Why Emerging Markets Part 1: China

We believe the fundamentals are in place for emerging markets to outperform. In this three part series, we outline why we’re bullish on emerging markets for the next decade.

Domestic consumption is fuelling the growth of China

China has driven global economic growth but is not just the ‘manufacturer of the world’. Domestic consumption is fuelling the growth of China.

China is the world’s second largest economy and undoubtedly the world’s biggest manufacturing economy. However, the majority of the manufacturing sector in China is used to serve to its domestic market, with exports to the US remaining in the low single digits as a percentage of its GDP.

Chinese factories complement factories in the other Asian countries, such as Vietnam, to manufacture for the majority of the world. Irrespective of the noise over the US and China trade dispute, the global supply chain is going to remain firmly entrenched in the Asian region for years to come, with factories moving mostly within Asia to take advantage of changing and differing labour costs.

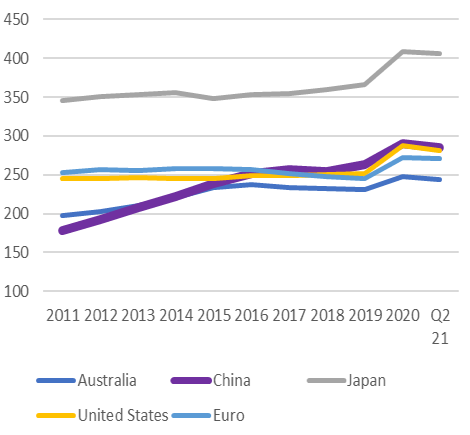

China has been deleveraging over the past decade

Economic growth has been led in emerging markets by the locomotive of the huge Chinese economy. China has spent the last 10 years cleaning up its balance sheet. Further, it continues to undertake the necessary reforms of its private and public sectors.

Multiple rounds of deleveraging in China has been painful for companies and investors alike. China had to wean itself off huge stimulus post the GFC, then clamp down on speculation which existed across the housing market and lending space. The level of indebtedness has stabilised as a result of many rounds of reforms and crackdowns. China’s total debt is now not that different to that of many of its developed country peers.

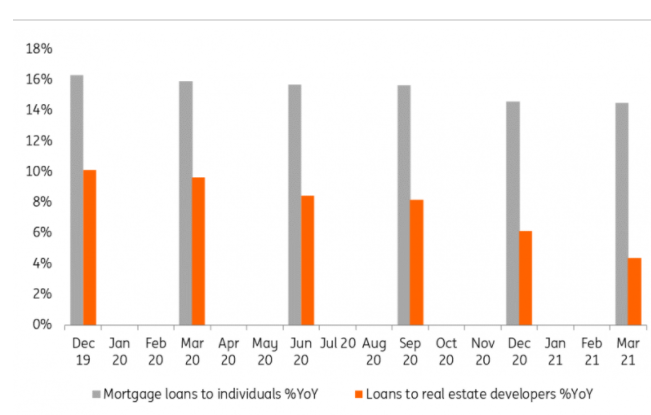

Figure 1: Total Debt to GDP

Source: BIS

Figure 2: Corporate Credit to GDP

Source: BIS

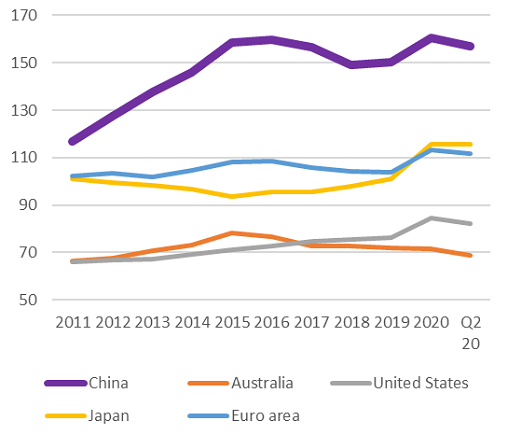

The one segment of debt that China leads against developed market peers, is its high level of indebtedness to corporates. However, it is important to unpack where this debt is being placed. In China, the majority of corporate debt is related to state-owned enterprise (SOE) lending. These loans are used to build infrastructure projects for the public such as bridges and tunnels, or upstream plants for say the aluminium or cement industry.

Demand for investment in such infrastructure has been much less enthusiastic recently due to dampened economic activity. In fact, the regulators have put in very strict rules over new investments in this area. The level of corporate debt in China has largely held steady for the last five years. This is a promising sign!

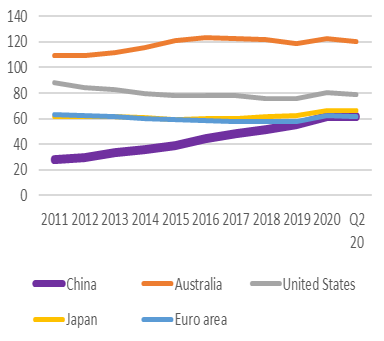

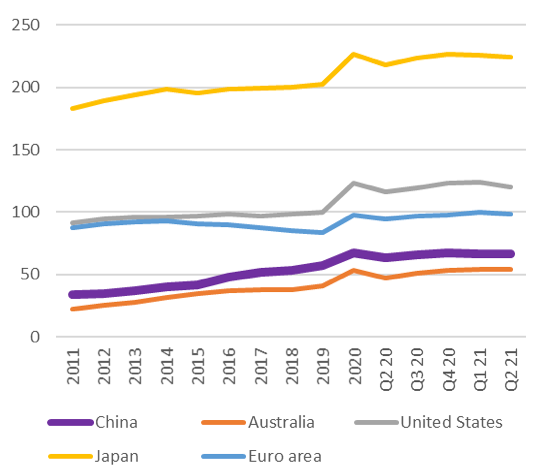

There has been persistent concern over China’s property market. However, the level of mortgage loans, as reflected in household credit to GDP, is not high compared to that of many developed markets.

Figure 3: Household Credit to GDP

Source: BIS

Figure 4: Mortgage Loans to Individuals and Loans to Real Estate Developers in China YoY Growth

Source: Think.ing

Loans to property developers have also been growing at a slower rate. No doubt this will slow even more after recent regulatory crackdown on property developers.

Some would be surprised to learn that government debt to GDP is also significantly lower in China compared to the US, Europe, and Japan.

Figure 5: Government Debt to GDP

Source: BIS

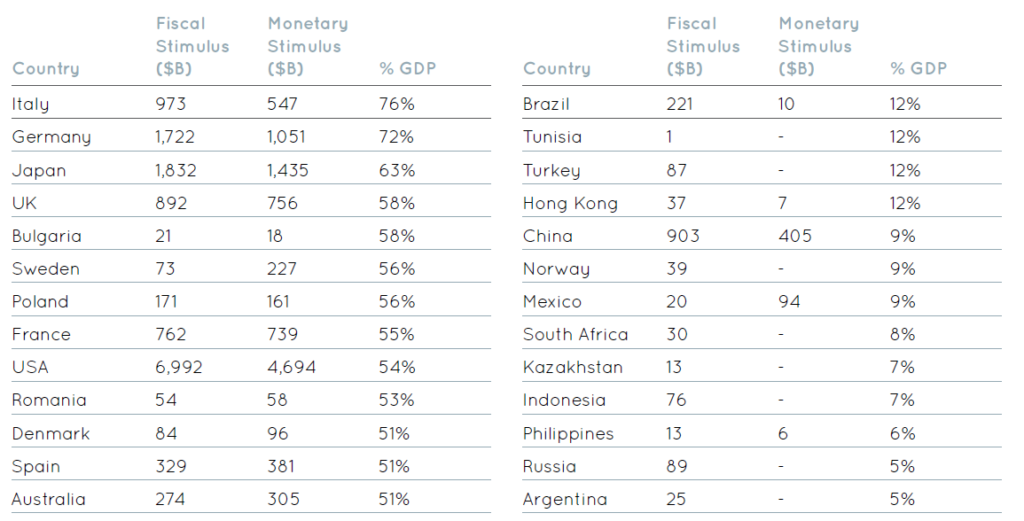

Emerging markets have not stimulated as much as developed markets during the pandemic

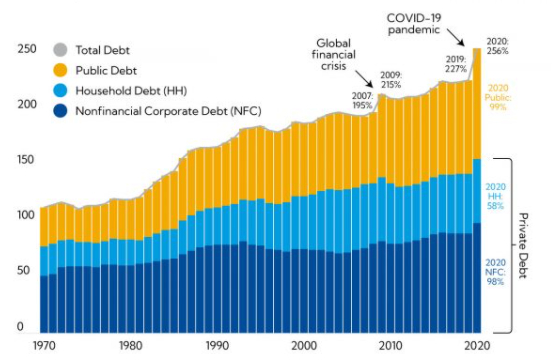

During the pandemic, global debt surged to a record high. The use of debt during the pandemic has been particularly aggressive in developed markets, who borrowed heavily to stimulate their economies and support their ageing populations.

Emerging markets as a whole have been more fiscally responsible during the COVID-19 pandemic than developed markets. We can see this through in lower levels of fiscal and monetary stimulus as a percentage of GDP. Emerging markets are coming out of strict lockdowns with a small portion of the stimulus compared to developed markets.

Figure 6: Global debt as a percentage of GDP

Source: IMF. Note: Estimated ratios are weighted by each country’s GDP in USD

Table 1: Fiscal and monetary stimulus over the COVID-19 pandemic: 2020/2021

Source: BofA Securities. Note: Figures in USD

China has cracked down on bubbles in the economy in the past

Regulatory crackdown in China is nothing new. China has been cracking down on various sectors for over 15 years.

Across popular media, the crackdown in China has been largely attributed to a more assertive Chinese Government and leadership. We are not here to dispute this. However, we prefer to focus our efforts on the economic and investment question: what is the longer-term economic impact of these reforms?

We have written about the regulation crackdowns previously. Our firm belief is that while it is impossible to know the absolute outcome, reforms have been a recurrent – and will be an ongoing – feature of any economy in rapid transition and economic development.

The intention for the most part is to improve the economic prospects of the country, by putting in guard-rails and rules to reduce dysfunction. Firms negatively impacted by reform obviously suffer from the crackdowns. We have seen this in rock-bottom valuations across much of the Chinese internet sector in 2021.

These reforms also demonstrate the authority’s willingness to forgo the economic interests of a small proportion of people for the betterment of the masses. Our work suggests previous big crackdowns have led to better outcomes for the economy. In the years following the changes, weighty returns have been seen in the indexes which correspond to the sectors which saw large reform.

Table 2: Regulatory Research Summary

| Sector Impacted by Regulation | Railway | Alcohol | Healthcare |

| Beginning of regulation What happened | Feb 2011 Railway ministry head, Liu Zhijun, was dismissed from office for bribery. Railway capex was cut, and an investigation into the railway ministry followed. | Dec 2012 Anti-corruption drive. Central government released a series of standards on entertainment budgets and governance. | May 2018 Changsheng Biotech supplied faulty vaccines to the health department. Rounds of investigation into the vaccine supply chain and the tendering process. |

| Stock correction Duration | -50% 11 months | -51% 14 months | -35% 8 months |

| When it ended How it ended | Dec 2011 Investigation finished and the Central government improved operational process of the Railway Ministry. | Dec 2013 Anti-corruption campaign ended with significant improvement in government departments governance. | Dec 2018 Improved manufacturer vaccine certification and tendering process. |

| Subsequent return Time taken | 600%+ 2.5 years | 400%+ 4 years | 200%+ 1.5 years |

| Policy goal | Improve quality of and safety of railways. | Better governance and fairness in the system combined with better incentive structure for government officials. | Improve security and safety. |

Source: Ox Capital Research

The numerous crackdowns over the last decade have also acted to reduce risk in the Chinese banking system. The last and most recent crackdown on the property market was famously seen through the case of Evergrande and other less publicised but highly indebted developers. Developers that are cavalier users of debt have lost their businesses. Property prices had gone up during the COVID-19 period in 2020, like most other countries, but this round of credit crackdown squeezed a lot of air out prices. These obviously have short-term implications on consumption and equity prices, but longer-term we see this as positive.

Chinese ADRs are a very attractive opportunity

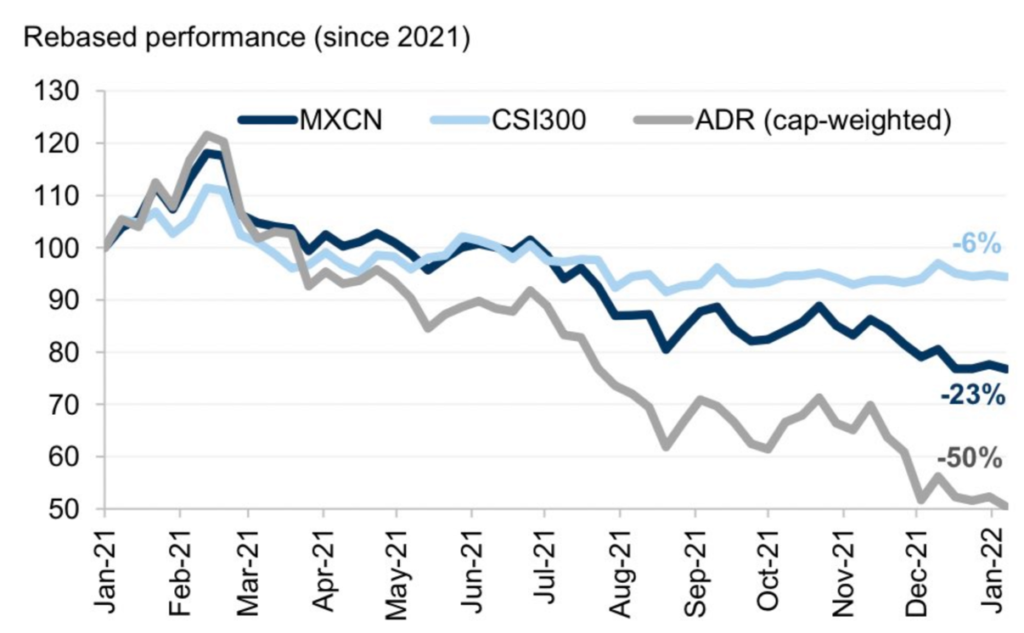

Domestic investors are much less concerned about China’s economic prospects than the press would have its readers believe. Share market performance in 2021 of China’s domestic markets, which are mostly made up of local investors, held up much better than Chinese stocks listed internationally. This is clearly evidenced below, where we see a significant divergence among Chinese equity markets. Domestic Chinese-listed A-shares stayed resilient in 2021, however, US-listed ADRs halved in market value.

Our thought piece on Chinese ADRs evaluates the risks of Chinese stocks de-listing in the US, the opportunity for Chinese technology companies listed in the US, and the huge financial market dislocation which exists between these companies and the rest of the world.

Figure 7: Chinese Equity Market Performance in 2021

Source: Jefferies

China is going through a slowdown due to pre-emptive monetary policy tightening

Chinese authorities tightened monetary policy early in 2021. The pandemic was well contained, and they were able to cut off stimulus early. The cost of cutting off stimulus was weak asset prices; however, the benefit came in reduced inflationary pressures, which are inherent when printing money.

Tightening of Chinese monetary policy has meant that real interest rates in China are closer to neutral compared to that of developed countries like the US, which are still way below zero.

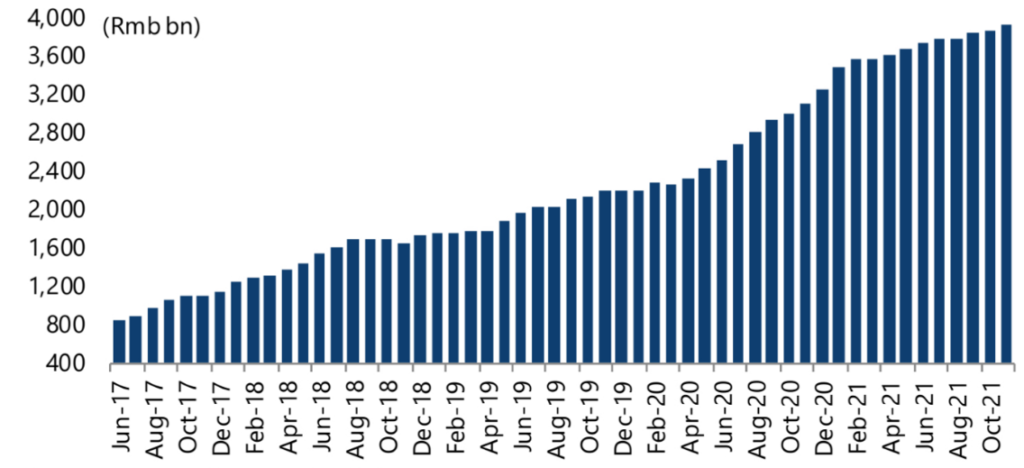

As a result of China’s prudent policies, foreign money has continued to pile into Chinese Government bonds.

Figure 8: Foreign holdings of Chinese Government Bonds

Source: Jefferies, China Bond Connect, CEIC Data

Savings abundance in China

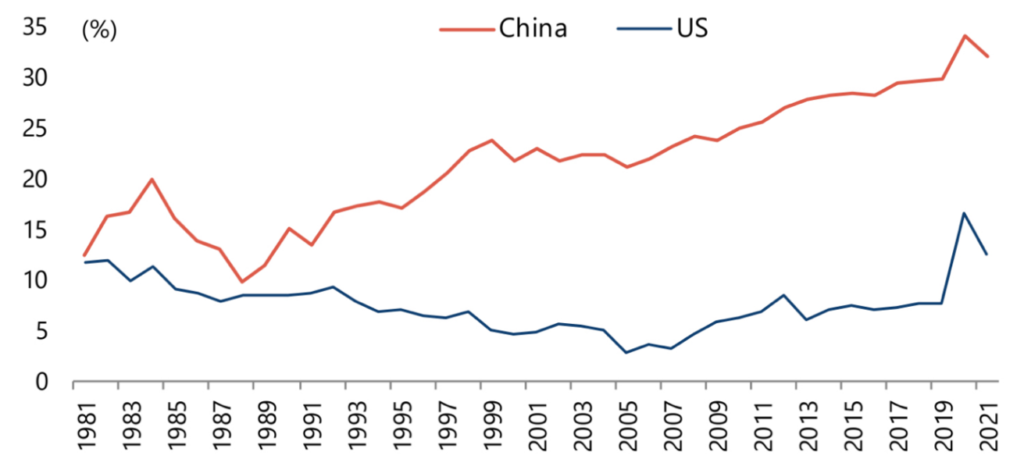

Much has been said about the savings levels of US consumers, particularly changes as the result of COVID-19 related transfer payments. If we compare personal savings as a percentage of disposable income between the US and China over the past 40 years, we see a clear savings differential. Chinese personal savings accounting for over 30% of disposable income in 2021, whereas in the US this figure was below 15%, or less than half.

Figure 9: China and US personal savings as a percentage of disposable income

Source: Jefferies, China National Bureau of Statistics, CEIC Data, US Bureau of Economic Analysis

Commodity prices and their relationship to EMs

The other part of the emerging market story historically is commodities, and more specifically their prices. Many emerging market countries are commodity producers. While China is transitioning from being a construction-led to a consumption-led economy, demand for certain commodities will persist. Although, demand growth for commodities will be less rosy than it has been in the past. The good news is this slowed growth has not been missed by commodity producers and supply discipline is in place. Investment project approvals for commodity producers is few and far between these days. Further, the ESG movement has introduced reputational risks for these producers, further limiting supply.

A smoother but slower Chinese economic growth rate, and a less supplied commodities sector, in a less globalised world, will likely lead to a higher level of inflation. This is a breath of fresh air in emerging markets, who have suffered the go-stop Chinese economic engine and oversupplied commodities over the past decade or more.

To summarise, emerging market economies are very much less indebted compared to the developed world, valuations in stock markets much more attractive, and interest rates have already been adjusted up, making investment in emerging market more prospective going forward.

Read more from the series:

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.