Why Emerging Markets Part 2: The ASEAN Opportunity

We believe the fundamentals are in place for emerging markets to outperform. In this three part series, we outline why we’re bullish on emerging markets for the next decade.

ASEAN (the Association of Southeast Asian Nations) is an attractive opportunity which is largely overlooked by global investors.

South East Asia has over 600 million people, or about 9% of the world’s population, and is growing fast. It encompasses countries in the South East Asian region which includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam. Over a quarter of the region’s population is between 15 to 29 years old. The size of the middle class is growing, and demand for consumer goods such as electronics, cars, education, leisure, healthcare is rapidly increasing.

ASEAN is a region of different markets and varying economic developments. Diversity leads investors to a wide range of opportunities and having an appreciation of the local cultures and nuances is important in making the right investment decisions.

The drivers for growth are an abundant and young labour force, endowment of natural resources and digitalisation.

Table 1: ASEAN market snapshot

| Indonesia | Singapore | Malaysia | Vietnam | Thailand | Philippines | |

| Total Population (mn) | 274.9 | 5.9 | 32.6 | 97.8 | 69.9 | 110.3 |

| Urbanisation (%) | 57% | 100% | 77% | 38% | 52% | 48% |

| Median Age | 29.9 | 42.5 | 30.5 | 32.7 | 40.3 | 25.8 |

| % Population (13+) | 78% | 89% | 80% | 80% | 86% | 74% |

| % Population (18+) | 69% | 85% | 72% | 73% | 80% | 65% |

| % Population (16 to 24) | 66% | 73% | 68% | 67% | 69% | 63% |

| GDP ($bn) – 2020 | 1,058 | 340 | 337 | 271 | 502 | 361 |

| GDP/Capita (US$) – 2020 | 3,870 | 59,798 | 10,402 | 2,786 | 7,189 | 3,299 |

| Mobile Connections (mn) | 345.3 | 8.5 | 40.0 | 154.4 | 90.7 | 152.4 |

| % of population | 126% | 146% | 123% | 158% | 130% | 138% |

| Internet Users (mn) | 202.6 | 5.3 | 27.4 | 68.7 | 48.6 | 73.9 |

| % of population | 74% | 90% | 84% | 70% | 70% | 67% |

| Active social media users (mn) | 170 | 4.9 | 28 | 72 | 55 | 89 |

Source: Hootsuite, We are Social, 2021. BofA Global Research.

Recently, the Regional Comprehensive Economic Partnership (RCEP) was developed to enhance trade cooperation between countries in Asia Pacific, including Australia, New Zealand, China, Japan, Korea and the 10 countries in ASEAN. RCEP is now the world’s largest trade block, accounting for a quarter of global trade.

At a time when Chinese labour costs are increasing due to rapid economic development, the young labour force in ASEAN countries will benefit from a migration of supply chains to the region. South East Asian countries have also been increasing their share in global exports recently. Tariff cuts through RCEP are likely to boost regional trade over the next decade.

Countries such as Indonesia, who are key commodity exporting nations, will benefit from a rise in energy prices. Indonesia is a major exporter of coal, still an essential fossil fuel required during the transition to clean energy, and of nickel, a key commodity required for electric vehicles. Such a rise would act to boost the Indonesian economy.

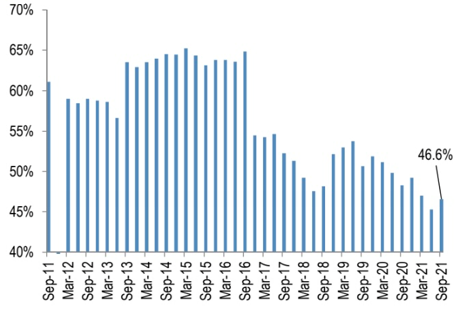

Despite favourable foreign investment laws in Indonesia, such as the Omnibus Law, foreign ownership of Indonesian equities is remarkably low and has contributed to the low valuations in the region. We think this could be on track to improve over the coming years, as market fundamentals improve.

Figure 1: Foreign ownership of equities in Indonesia

Source: J.P. Morgan

We are excited by the opportunity presented in the ASEAN region and continue to focus its on high-quality businesses for potential investment opportunities.

A detailed note on the opportunity in ASEAN is available below, as well as a closer look at the opportunities in Indonesia in our Country in Focus.

Read more from the series:

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.