Chinese Listings in the US: Risky or Prospective?

2021 was a volatile year for Chinese listed companies in the US. We saw increased regulatory scrutiny in China across multiple sectors, political tensions between China and the US escalate, and ambiguity surrounding the possible future delisting of US-listed Chinese securities. Despite the volatility, earnings growth has not significantly slowed down and valuations at all-time lows. With all the noise in the market, this has led the investment team at Ox Capital to ask the question: are Chinese ADRs prospective at current prices?

What are ADRs and how do they work?

An American Depository Receipt (ADR) is a certificate issued by a US bank which represents a specific number of shares in a foreign company. ADR’s allow foreign companies direct access to US investors and, in turn, capital markets. Further, US-based investors are able to buy shares in foreign companies without the complexities of entering foreign markets as an investor.

Specific to US-listed Chinese stocks, investors who hold an ADR technically own shares in an offshore holding company called a Variable Interest Entity (VIE), not the actual entity which is not allowed to be owned by the Chinese authorities. Under this structure, the VIE has a contractual relationship with the operating company and owns the majority of the operating entity acceptable by Chinese regulations. This allows them to circumvent Chinese rules around foreign investment, while still having access to US capital.

VIEs have been around for over two decades. As the relationship between the US and China deteriorated in 2021, scrutiny has increased over their listing requirements. In early 2021, the US Securities and Exchange Commission (SEC) Chair Gary Gensler expressed his concern that investors did not understand how these companies work and pushed for more oversight and transparency. The Chinese authorities appear open to reaching an agreement with the SEC, but the outcome is not clear. If no agreement is reached, Chinese ADRs may have to be delisted from US exchanges.

Sector concentration of ADRs in the TMT space

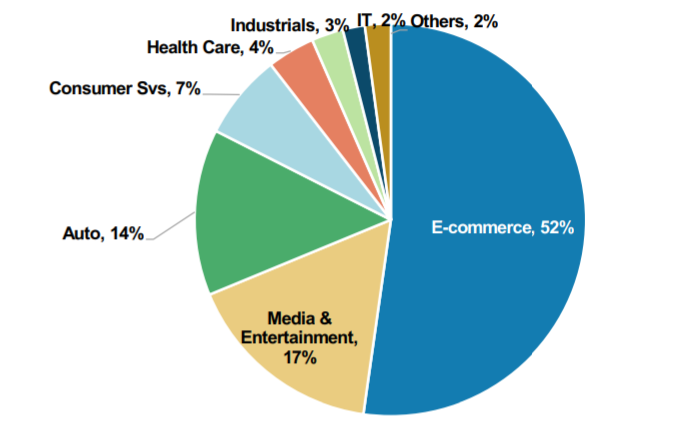

The ADR space is highly populated with e-commerce, and media and entertainment companies. Key companies which access the US markets through ADRs include Alibaba, Baidu, Pinduoduo, JD and NetEase, to name a few. Importantly, Tencent (listed in Hong Kong) is also a VIE structure.

Figure 1: Industry breakdown of Chinese ADRs

Source: FactSet, DataStream, Morgan Stanley Research. Data as at end of November 2021

Behind the noise in the market and recent volatility, it is poignant to highlight that many of the underlying companies remain high-quality with long growth runways and are now available at highly attractive valuations. Although the VIE structure introduces ambiguity, from a fundamental bottom-up perspective, many of them are good businesses.

The SEC tightening disclosure requirements for Chinese ADRs

In December 2021, the SEC adopted amendments to finalise new submission and disclosure requirements for ADR issuers. The amended rules significantly enhance the amount of information a US-listed Chinese company must provide each year in order to remain compliant with listing requirements. Key changes include stricter audit requirements, disclosure of percentage of shares owned by government entities and whether they have a controlling financial interest in the company, and disclosure of names of any official Chinese Communist Party members who are on the company’s board of directors. These requirements will apply to submissions going forward from December 2021 year-end results, which will come out in April/May of this year. The Holding Foreign Companies Accountable Act (HFCAA), under which these amendments sit, outlines that if a company does not meet these requirements for three consecutive years, they will be required to delist from US exchanges after a grace period of a few years.

What could happen if Chinese ADRs are required to de-list?

The HK Stock Exchange is welcoming Chinese ADRs to dual list in Hong Kong. A few companies have already done so, including Alibaba and JD.COM, amongst many others. Needless to say, the conversation about dual listing is front of mind for many CFOs of these companies.

With the dual listing, investors can convert their ownership of their ADRs to Hong Kong shares, thus allowing their shares to be traded in either market. In other words, these shares are fungible.

It is important to note that 69% of the market value of all Chinese ADRs currently have a secondary listing which they could fall back on should they be required to de-list from US exchanges. Further, less than 2% of the market value of all Chinese ADR listings in the US do not qualify for a dual listing in Hong Kong. Whether or not these submission and disclosure requirements are here to stay, the event of Chinese ADRs de-listing from the US is not likely to result in mass public equity disarray for Chinese companies. Rather, it’s likely to result in a share transfer to existing Asian exchange listings. Despite this likely outcome, we saw Chinese ADRs sell off in the share market indiscriminately amid these announcements in December 2021.

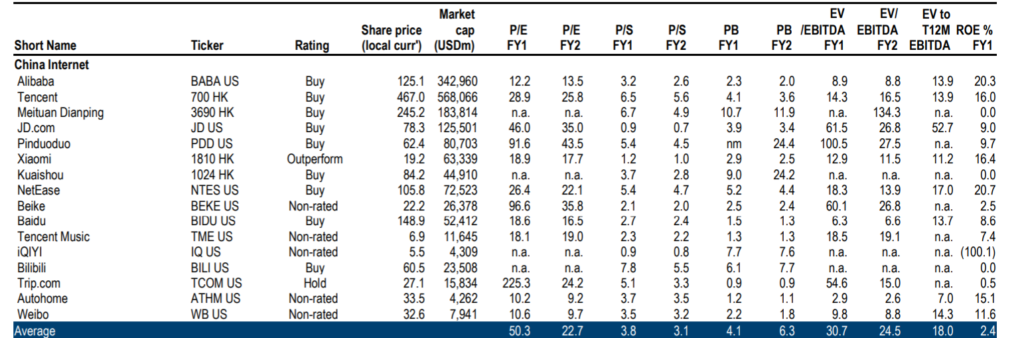

The table below shows some of the recent valuations of Chinese technology companies. The majority of these companies have seen large share price declines over 2021. We are picking through the best businesses to take advantage of these low valuations to establish positions in businesses with strong momentum and future growth runway.

Table 1: China Internet Valuations

Source: Daiwa Capital Markets. Data as of 8 December 2021

A China and US valuation comparison

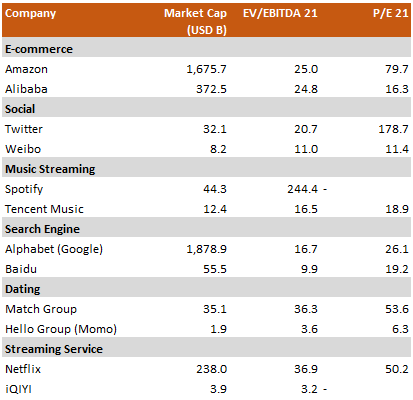

While it is not entirely accurate to compare companies across different countries, it is a fascinating exercise to look at some of the Chinese technology companies and compare them to similar businesses in the US from a valuation perspective. China-based technology companies are widely on lower valuations in this market.

Table 2: US and China Technology Company Valuation Comparison

Source: Capital IQ consensus estimate. Data as of 13 January 2022

Now let’s play around with this comparison and dub each of these companies as the Chinese equivalent for dramatic effect.

Weibo, the “Twitter of China”

Weibo is a platform similar to Twitter in China with 500 million monthly active users. Comparatively, Twitter had 400 million monthly active users globally in 2021. Weibo’s market capitalisation is USD8.2 billion, with over a quarter of its value in cash and investments, whereas Twitter is valued at USD32.1 billion. On an EV/EBITDA basis, Weibo is trading at nearly half the valuation of Twitter.

Tencent Music, the “Spotify of China”

Tencent Music is the dominant music streaming platform in China, with over 640 million monthly active users in 2021. Tencent Music has a market capitalisation of USD12.4 billion, with over 40% of its market value in cash and investments. Further, Tencent Music owns 2.5% of Spotify and 2% of Universal Music Group. By contrast, Spotify is valued at USD44.3 billion, with over 380 million monthly active users globally. While Spotify has to compete with the likes of Amazon and Apple Music, Tencent Music is the clear market leader in online music in China. Tencent Music is valued at 16.5x EV/EBITDA, while Spotify is valued at 244.4x EV/EBITDA.

Baidu, the “Google of China”

Baidu is the dominant search engine in China, with over 70% market share in 2021. Baidu is currently valued at 19.2x P/E, compared to Alphabet’s valuation at 26.1x P/E. Interesting to note, Baidu also has an investment in the “Netflix of China” called iQIYI. iQIYI is trading at 3.2x EV/EBITDA whereas Netflix is trading at 36.9x EV/EBITDA.

The above examples highlight the low valuations for leading technology companies currently available in China. The list is certainly not limited to these names.

This crackdown on Chinese ADRs reminds us of other policy crackdowns we have seen historically in China. A period of reform is marked by volatility in the market and then stabilisation once the operating environment is clearer. We encourage you to read our other recent thought piece on internet sector reform and historic rounds of sector specific policy changes, China is Self-Calibrating for Future Success.

Looking ahead

We are long-term investors at Ox Capital. Our thesis remains optimistic towards the long-term China growth story. While China has significant control over its capital markets and the crackdown of the government seems aggressive to Western eye, we believe the underlying motive is to make the Chinese society more equitable and hence sustainable over the long-term. We remain vigilant, noting that market ambiguity around Chinese ADRs may remain in the coming months. However, as it stands, we believe fear in the market is transitory, and fear is a fertile ground for great buying opportunities.

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.