Quarterly Note: December 2021

In this inaugural Quarterly Note, we would like to provide context as to why we are excited about the prospects for emerging markets and address some obvious concerns.

Negativity towards China, and emerging markets in general, reminds us of the negativity towards the US post the global financial crisis. It was wrong to avoid the US market more than a decade ago, and we believe it is a mistake not to invest in emerging markets today.

Economic prospects are improving for emerging markets and can sustain for the coming decade. China has spent the last decade cleaning up its debt load and structurally higher energy and commodities prices are a positive for emerging markets in general.

These markets provide the rare combination of growth and attractive valuations. Valuations of emerging markets are close to multi-decade lows as investors have focussed on the developed markets in the last ten years. Low growth, low inflation and low interest rate environments favoured developed markets; this is unlikely to persist in the years ahead. Further, starting valuation is one of the best predictors of long-term returns, and we are decidedly positive on the longer-term performance of these markets.

In the near term, emerging countries’ growth is set to improve with the Chinese authorities relaxing policies. Thanks to their quick tapering of stimulus when it was clear that the pandemic was well controlled domestically, they are ready to relax just when the rest of the world is tightening. There is very little inflationary pressure in China and a lot of air which existed in asset bubbles was squeezed out. Their capacity to further relax policies is significant, benefiting Chinese and emerging market equities.

In contrast, many developed countries spent aggressively during the pandemic. This felt good as it artificially stabilised the economy, but at the cost of assets and goods inflation, and debt load to the economy. To fight rising inflation, the US Federal Reserve is expected to raise rates multiple times this year, and an economic slowdown in the US is likely. Valuation of the equity market in the US is still expensive despite the recent sell-off!

Another feature of this coming decade is high energy prices. We believe high prices will prove structural in nature. Decarbonisation permanently adds cost to energy projects and is getting factored in by energy companies in their investment decisions. Even at today’s high energy prices, and with the prospect of more economic opening post pandemic, energy companies are reluctant to invest in new capacity. In the meantime, demand for gas – and to a lesser extent, oil – will continue to grow for many years even as the world transitions to carbon zero.

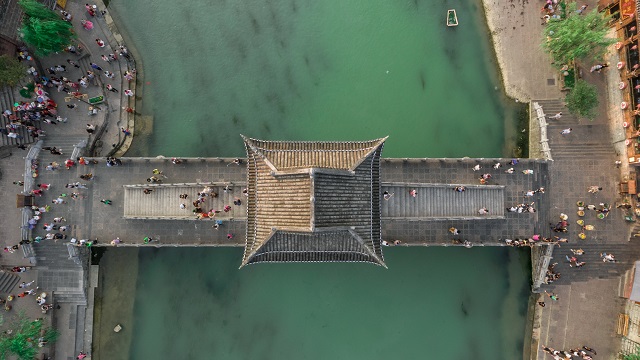

Emerging market countries such as Indonesia will benefit from this dynamic through favourable export prices. Domestic consumption tends to benefit from a trickling down effect. The Indonesian market has been largely overlooked the past five years, with foreign ownership of equities in Indonesian currently at a 10-year low and good companies on extremely attractive valuations.

Brazil will also benefit from higher energy prices going forward. It has lifted interest rates significantly in 2021 as inflation took off. They have slowed the economy, but equities valuation has corrected. We can identify many longer-term secular growth opportunities available at a fraction of the price available in developed markets.

Debt and regulatory risks are front of mind for the potential emerging markets investor. The reality is that debt levels of emerging countries are much lower than that of developed countries. In particular, China is one of few big countries that has spent the last five years reducing debt load. Crackdown is not new but is a recurrent feature of China as the authorities catch up with the breakneck pace of change and growth. We believe the intensity of this cycle of crackdown has also peaked at the end of 2021. In the past, this has marked the bottom of equity markets.

The Ox Capital investment process involves deep fundamental and bottom-up research. We adopt a long-term view on our investments and look for companies aligned to strong secular trends. As a result of this process, we can look past transitory fear in the market and take advantage of attractive valuations for quality businesses. Emerging markets are currently prospective using our process. We believe the time to look for opportunities that can double in next three to five years’ time is now.

In the full report, we provide a detailed comparison of developing and emerging markets and discuss why we’re bullish on emerging markets for the coming decade.

Read more: Why We’re Bullish on Emerging Markets

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.