Uncovering Opportunities Amidst Volatility: Ox Capital’s Approach to Asian and Emerging Markets

The Team

The Ox team has a remarkable track record, having ran the Platinum Asia Fund that managed more than $5 billion dollars and generated double digit returns over the long term.

We have assembled the finest talent from Australia and around the world, with combined experience exceeding 50 years in investing in Asian and Emerging Markets.

The Ox Process

The Ox approach to investing revolves around two fundamental strategies aimed at achieving robust returns with reduced volatility:

- Owning leading companies in growing industries when valuation is attractive

- Using a dynamic method to reduce volatility when needed

The China Question

All the bad news we hear out of China is simply a result of a structural transformation from investment to consumption. The banking system is resilient despite the falling property prices and defaults. The economy is going to grow slower than before, but the reality is not as worrying as portrayed by the media. Car sales in China continue to show stability, with projections indicating around 25 million units sold this year.

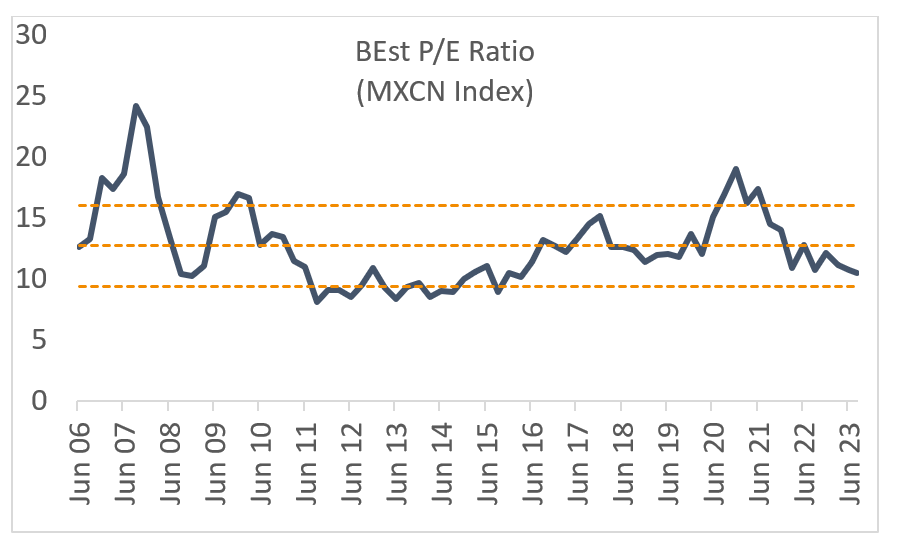

Due to the overwhelming negativity, Chinese markets are trading at extremely attractive valuations, at a significant discount compared to all major global markets.

Source: Bloomberg

The base case for China is that of continual policy easing. We have seen this playbook post the GFC in USA and Europe in the past decade. In hindsight, it was a great time to own the quality growth businesses like Google and Amazon when the US market was valued at mouth-wateringly cheap valuations in 2009. We believe similar amazing opportunities are available in China right now!

In the portfolio, we are focussed on structural growers that will prosper even in a property market slowdown. Contemporary Amperex Technology (CATL) is the biggest and arguably the best EV battery maker in the world, with a dominant market share. Its customers include Tesla, BMW, Mercedes and many others. It developed a battery that can travel 400km with a 10 min charge which effectively takes range anxiety out of the equation! It is on a 12x price earnings multiple, half the valuation of the smaller competitor of LG which is behind in technological knowhow.

Bright Spots in Emerging Markets

Emerging countries make up the bulk of global growth, contributing to 60% of global GDP, but is under appreciated by global investors. Clearly, emerging markets are much more than just China, as it includes markets like India, South East Asia, South America etc.

We are predominantly focussed on the bright spots in emerging markets such as India, Indonesia and Vietnam. These economies are undergoing a gargantuan economic transformation that drove China’s rise 15 years ago.

India:

India has gone through a decade of economic reforms and is finally bearing fruit. It is a huge economy with 1.4B people and income levels are low (around USD2000 per person) so it has substantial upside potential.

In India, we own IDFC Bank. Currently, the better run private sector banks are taking market share from the stale state sector banks. After obtaining its banking license just 5 years ago, IDFC set up the best in class online banking, risk management and cost effective operations. This is the fastest growing bank in India, and offers a fantastic opportunity to participate in the Indian economic growth. Importantly, our entry into this investment preceded the market’s realisation of the quality of the franchise and the enormity of its potential.

Indonesia:

Indonesia, with a population of around 280M, income is low. Nickel production has been growing at 30% a year making up 39% of global output. The nickel ore is on the surface, so the miners scoop it up, and using new processes, turn it into battery grade nickel that is 20% below current nickel prices. Indonesia is fast becoming the EV battery capital of the world. People driving Tesla or BMW Electric Vehicles may eventually all be using nickel from Indonesia, with batteries produced by CATL. Indonesian islands are turning into refining plants, this is the prime beneficiary of the EV boom!

In Indonesia, we own the best retailer called Mitra Adiperkasa (MAPI). It operates the largest network of stores and partners with more than 150 brands like Zara, Adidas, etc. Indonesia is an archipelago, which makes it very difficult for foreign brands to distribute their products. As a dominant local operator with local experience, MAPI can help and as a result, MAPI is practically taking a clip off every pair of branded sneakers sold in Indonesia! People have taken their eyes off Indonesia. This is a company in exactly the right place to ride on this massive economic wave and is only on 14x2023PE.

Vietnam:

Vietnam has a population of 100M and is very well positioned to become the manufacturing hub of the world. Factories are springing up like mushrooms, factory workers are moving in, and Vietnamese income will continue to flourish.

In Vietnam, we own the best quality property developer, Nam Long, as demand for apartments is insatiable in rapidly growing economies. Last year, there were only 15,000 new apartments sold in Ho Chi Minh City (HCMC) for a population of over 9 million people. The market is grossly undersupplied. Nam Long’s valuation suffered because of rate hikes. It is trading close to book value compared to the actual value of its land bank, which is worth multiples more. As interest rates decline, and land value continues to appreciate, valuation will revert.

The Dynamic Process

We manage the portfolio dynamically to protect against downside risks. In 2022 the team successfully reduced exposure, yielding positive returns when the market was down by 14%. Our proprietary process informed us that global demand for semi-conductors was weakening against a general market perception that the semiconductor sector was the place to be due to a shortage in chips for cars! One notable success was shorting the Taiwan index and it worked beautifully.

Conclusion

Ox is well-positioned to continue its track record of delivering robust returns in the ever-evolving Asian and Emerging Markets landscape. The valuations of the markets are extremely attractive, and we believe the time is now, and the dynamic process will protect capital during volatile periods.

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap), the investment manager of Ox Capital Dynamic Emerging Markets Fund and Ox Capital Emerging Markets Fund (Funds). Fidante Partners (ABN 94 002 835 592) (AFSL 234668) (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion.

Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon.

Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.