The Vietnamese Economic Miracle

A poor country undergoing an exciting metamorphosis into a wealthy developed economy is not only inspirational for those privileged enough to witness it, but offers once in a generation investment opportunities, especially when the nation is under-appreciated by investors. The opportunities available in the Vietnamese stock market are tantalisingly attractive, with valuations recently experiencing a pullback as concerns of a global economic slowdown are front of mind for most investors.

The Vietnamese economic miracle is reminiscent of the Chinese miracle two decades ago. Vietnam, like China, was run as a command-economy. This obviously did not lead to the productivity improvements needed to lift the country and its peoples out of poverty. Economic reforms towards marketisation of the economy has been the answer to economic development, similar to what China went through from 1979.

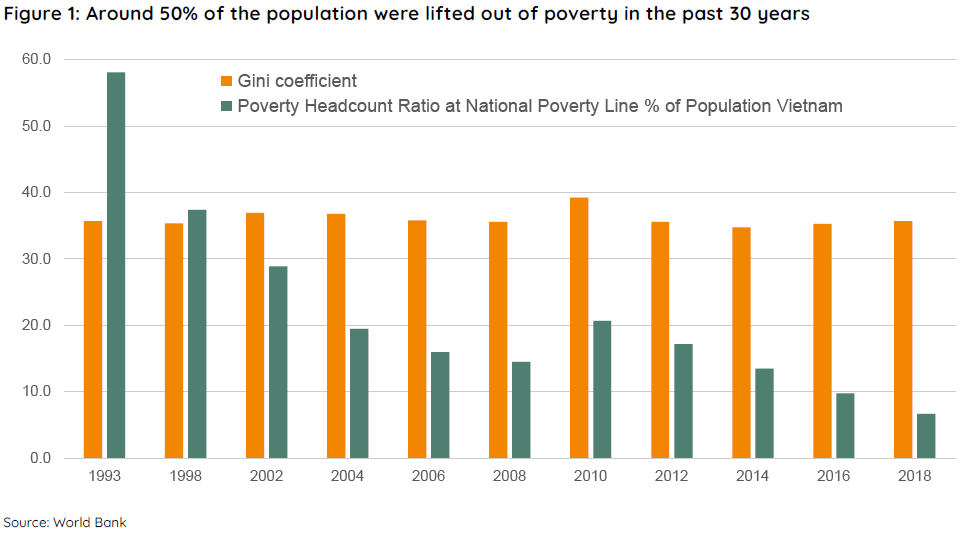

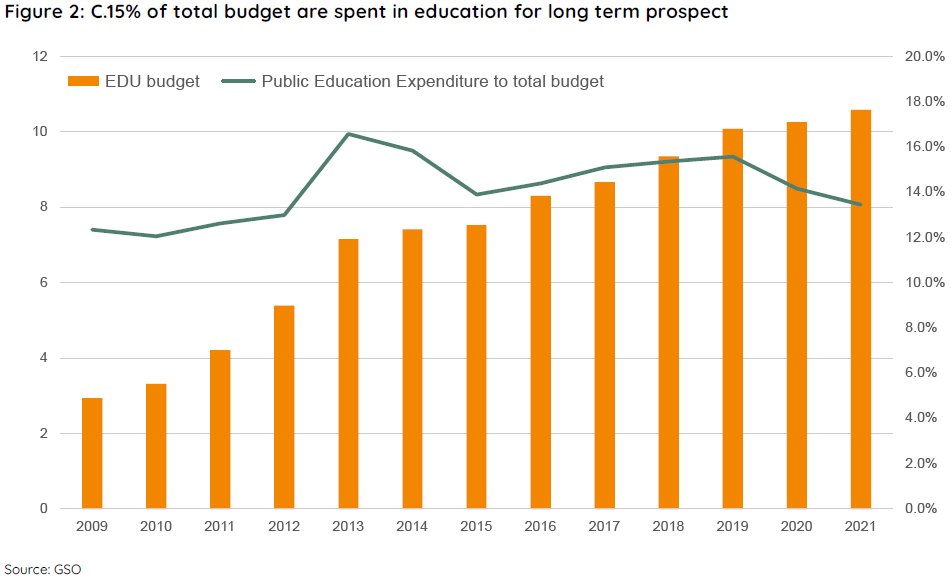

Reforms in Vietnam took place under a policy called “Doi Moi” or rejuvenation from 1986, which has seen poverty reduce and productivity improve. Agricultural land was given to the farmers to improve their incentive structure to optimise investment and output. Wide-ranging reforms of state-run institutions took place to encourage investment and governance. Locals were allowed to start businesses. Foreign investors were invited in with tax and land incentives. Education provision was socialised to enlarge the productivity of the labour force.

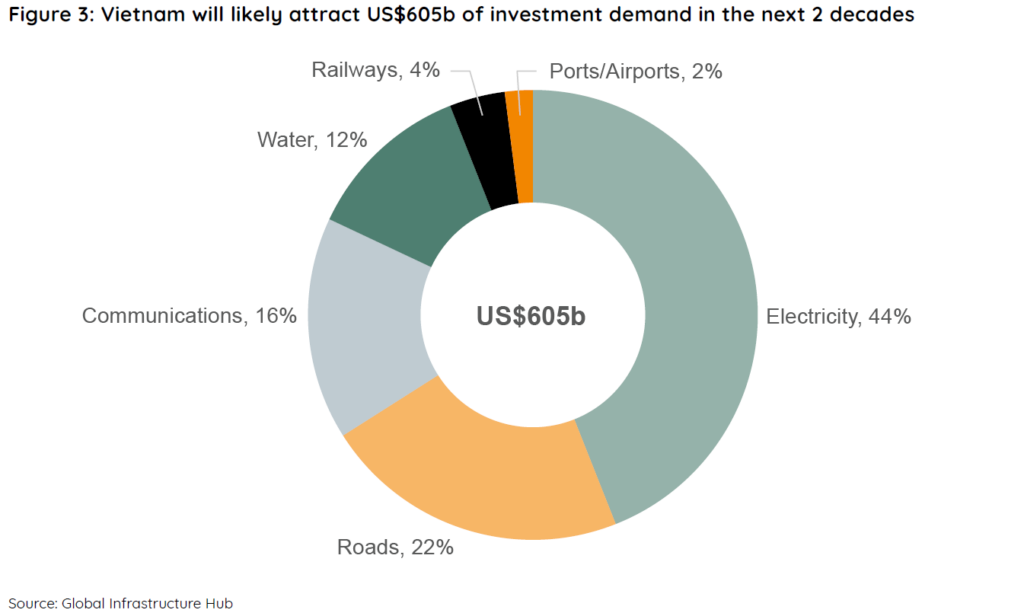

The government in Vietnam is capable and pro-growth. It has undertaken fixed asset investment, like building basic infrastructure such as power supply, which is now close to developed world standards in terms of power losses and stability, roads, railways, and ports. Reforms are continuing on multiple fronts to further lift productivity in the economy following the pandemic. The aim is for Vietnam to become a developed economy by 2040.

Vietnam joined the World Trade Organisation in 2007, which effectively integrated it into the global economy. However, the pace of reforms is not slowing down anytime soon, and it recently joined the Regional Comprehensive Economic Partnership (RCEP), the world’s biggest trade bloc encompassing most Asian economies (China, Japan, South Korean, ASEAN countries) and Oceania (Australia and New Zealand).

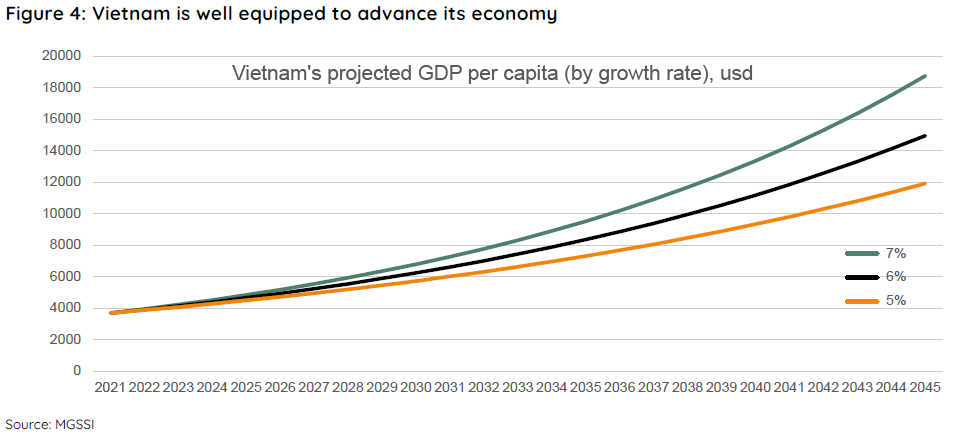

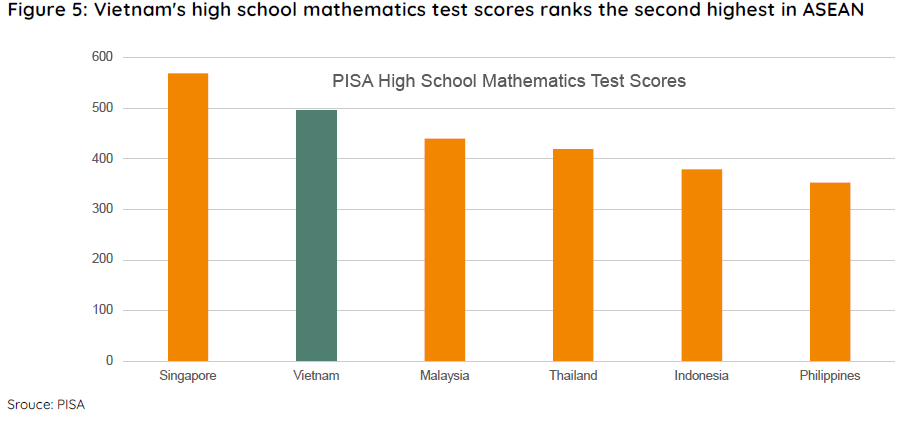

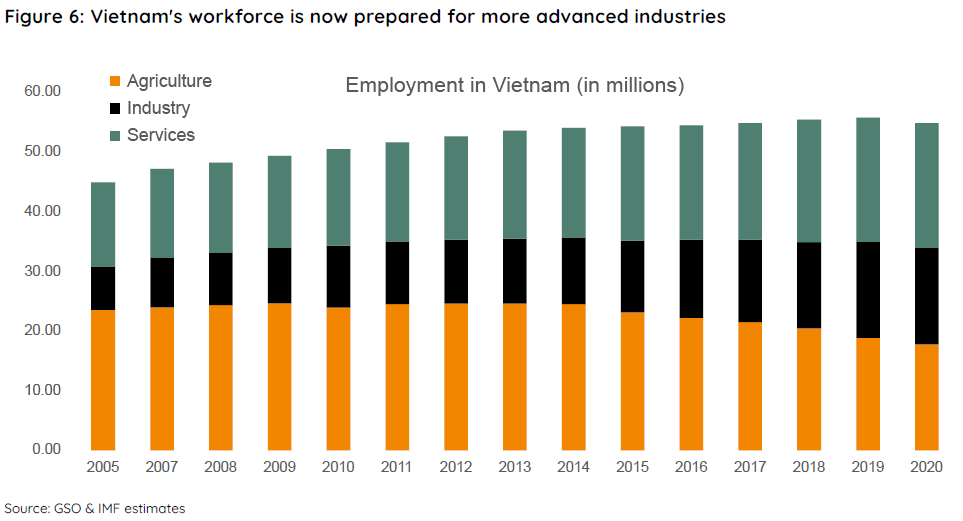

The result of reforms has been nothing short of breathtaking, with GDP growth of ~7% a year for more than three decades, improvement in education and strong health outcomes. GDP per capita is still low, at around USD3,700 per person (Current USD, World Bank 2021), and has a lot of room to grow. The simple act of providing the infrastructure and investment needed to enable the Vietnamese people to join the global supply chain and taking advantage of its cheap cost of labour, has been and will continue to be a key driver for growth as it takes a greater share of manufacturing output for the world. In a time when the world appears to be deglobalising, Vietnamese exports are growing at 15-20% a year, assisting its economic advance!

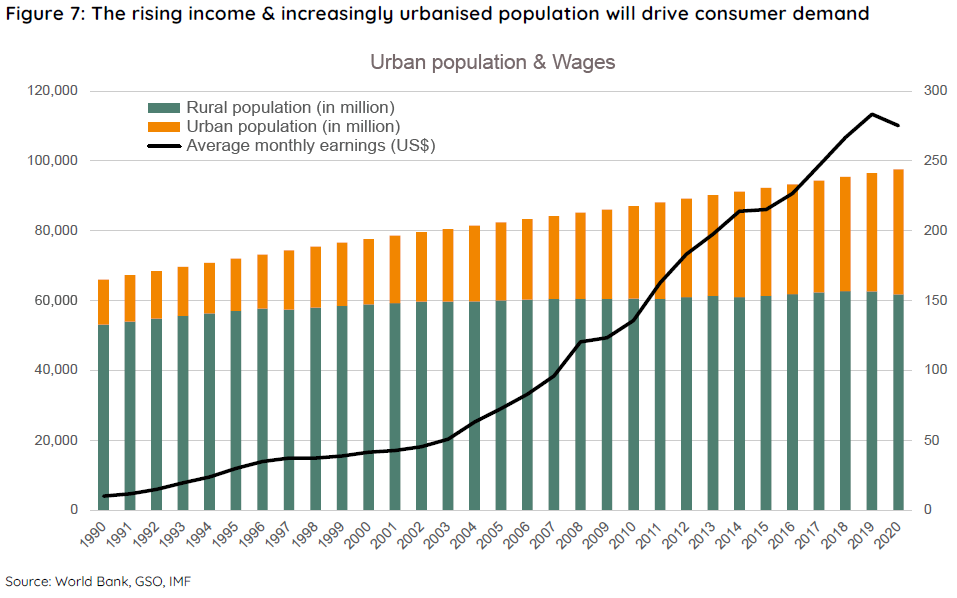

With GDP per capita of ~USD3,700 per annum, Vietnam has entered the middle-income class. However, wages are still obviously low compared to those in a developed economy. As local wages pick up, domestic consumption will continue to take off, fuelling demand for all sorts of goods and services domestically, which previously were non-existent in Vietnam. This then provides the impetus for domestic fixed asset investment as new businesses are created to satisfy these needs.

This dynamic of improving wages feeding domestic consumption was rocket fuel to China’s lightning speed economic development and the same is set to happen in Vietnam. Going forward, the prospective areas are linked to consumption, as urbanisation and rising wages are rocket fuel to consumer demand! Infrastructure spending will continue to be strong. In an economy with rapid growth and limited infrastructure, the return to society from infrastructure spending is immense. Exports will continue to grow, benefiting from the low domestic wages available in Vietnam, especially relative to the higher wages of the Chinese and most other ASEAN workers. Continued economic competition between China and the US, spurring the “China-plus-one” strategy of business investment diversification away from only China to other emerging economies, will also boost the Vietnamese economy.

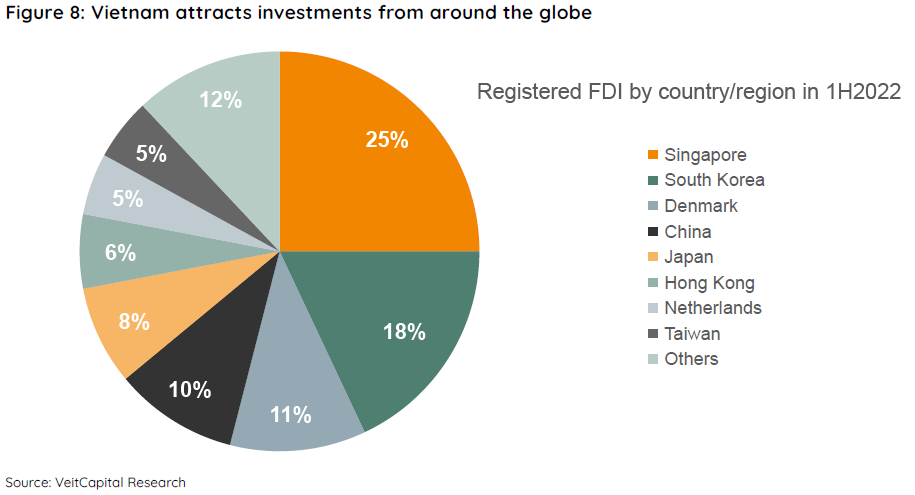

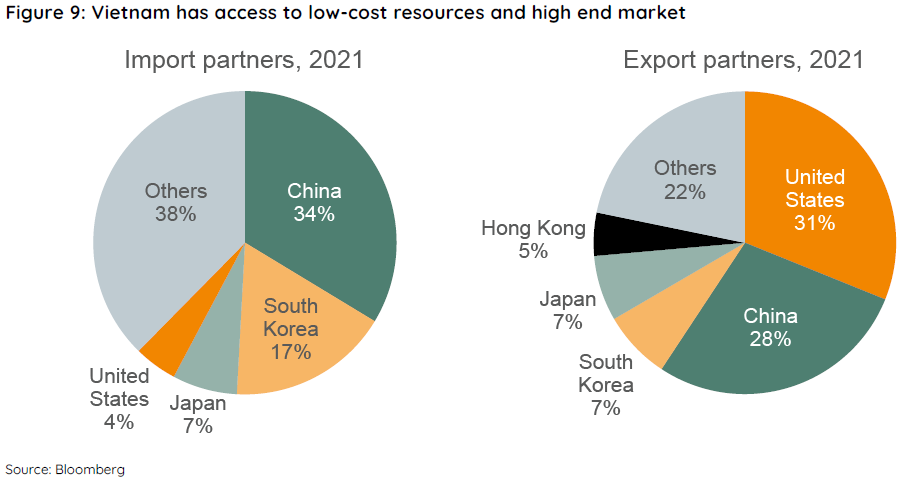

As a reasonably neutral country to both the US and China, Vietnam has the unique benefit of being able to take advantage of cheap low-cost Chinese equipment while receiving foreign direct investment from a wide range of mostly Asian countries. Key FDI partners include Singapore and South Korea, who help to propel its export engine which is largely dominated by the US and China.

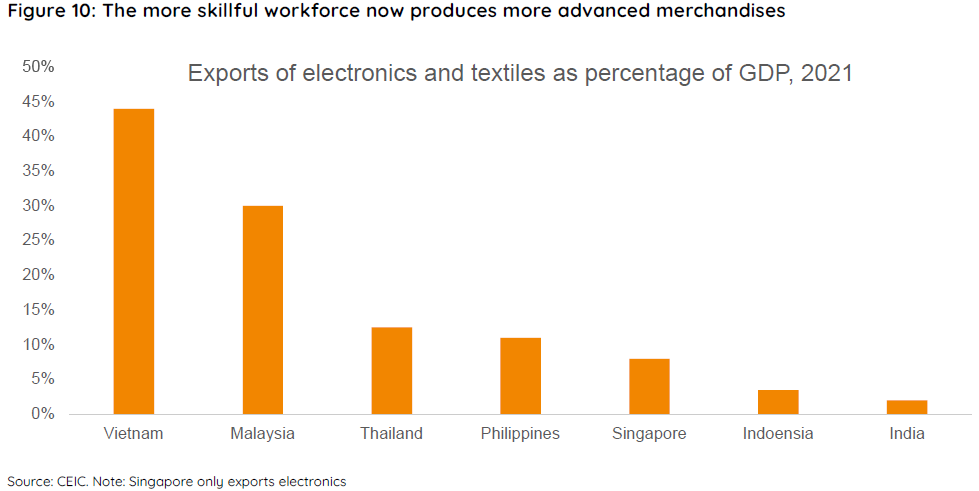

Vietnam’s export performance has been going from strength to strength and is evidently moving from just producing textile products to the more complex electronics goods!

The potential for Vietnamese equities is immense. The recent pullback is a perfect opportunity to get set. It is an economy that will benefit from powerful tailwinds and its economic transformation is interestingly only in its early innings! At Ox Capital, we focus on strong businesses in growing regions of the world and invest with stringent price discipline. We are extremely excited by the strong and attractively priced businesses on offer in Vietnam.

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.