The Spigot is Set to Open

The “5 Measures” to Support the Hong Kong Stock Market

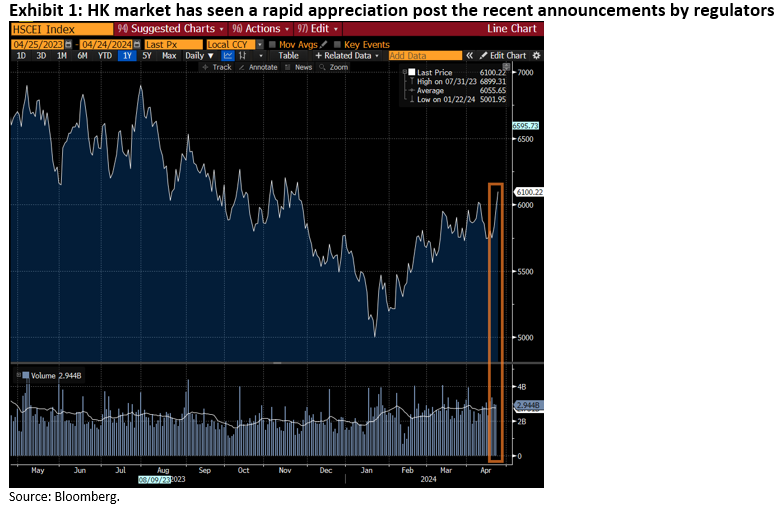

The Hong Kong stock market has seen a rapid appreciation following the announcement by the Chinese Securities Regulator (CSRC) on 19 April 2024, which essentially promised “5 measures” 1 to support the Hong Kong stock market by providing Mainland liquidity and encouraging Mainland IPOs in the Hong Kong market. This is particularly noteworthy, because, at the same time, equity markets in other parts of the world have generally weakened due in part to heightened fears of further interest rate hikes in the US.

While the specifics of the measures are still unclear, the announcement demonstrated a strong commitment from the Chinese regulators to booster the Hong Kong market. The fact the Hong Kong stock market was considered of strategic importance, and thus was to be protected, is undoubtedly reassuring to investors.

The measures highlighted a firm understanding of what needs to be done, that is, to improve liquidity to offset the outflow by the foreign investors who are perturbed by the now obvious geopolitical competition between the two great powers of the world. The vicious cycle was the outflows led to a sagging Hong Kong market, which further discouraged foreign investor participation. Three years of almost unrelenting and significant market decline experienced in the Hong Kong market was almost unprecedented in history of markets. This obviously led to dramatic undervaluation that was unexplainable by fundamentals alone.

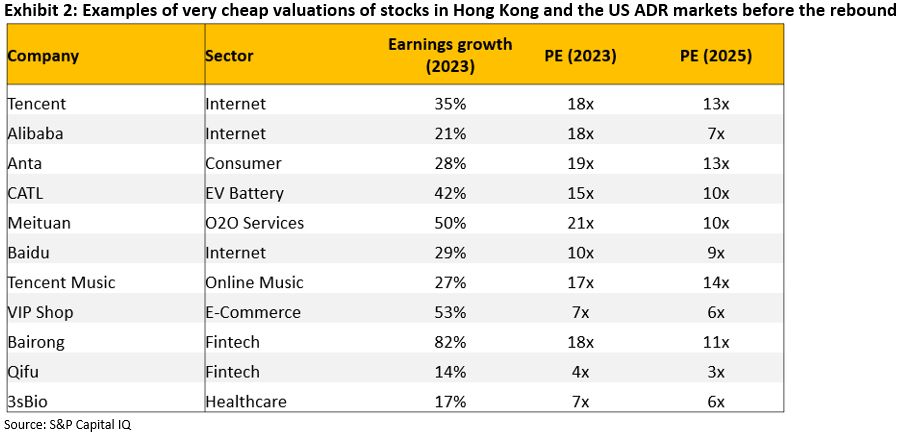

We are positioned in the champion companies with rock-solid economic moats and enviable growth rates. They are available on either single digit or low double-digit price to earnings multiples. Many of these companies have net cash on the balance sheet and are actively buying back a significant portion of their shares outstanding.

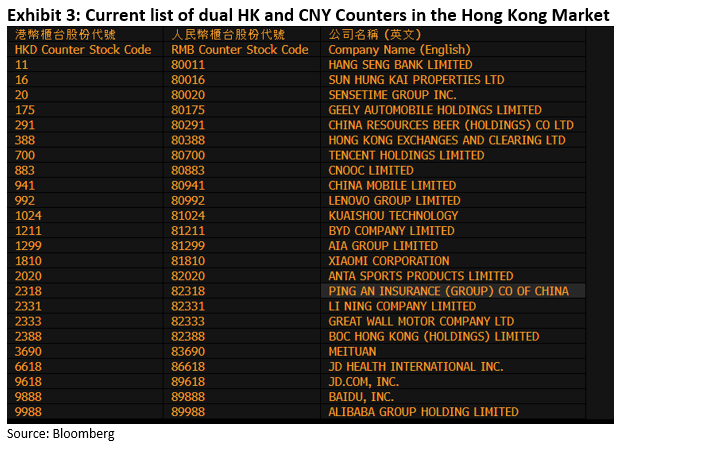

The rebound in share prices thus far has been concentrated primarily in a certain group of stocks, internet stocks and the ones with CNY quotes. Both these groups of stocks will benefit disproportionately as liquidity improves in Hong Kong.

Last year, the Hong Kong stock exchanged started to quote some of the stocks in both HK Dollar and the Chinese currency (CNY counters). These stocks are fungible and should theoretically trade at the same prices. To purchase these stocks in Hong Kong, investors can use their HKD or Chinese RMB in Hong Kong. Because of the closed capital account, Mainland investors cannot directly purchase the CNY counters.

Within the 5 measures contained a proposal that will enable Mainland investors to directly invest in the CNY counter in Hong Kong in the near future. Historically, Mainland investors have been allowed to invest in the HK Dollar counters via what is known as the “Southbound” program, but not the CNY counters. The crux of the matter is, if CNY Southbound can be opened up, this can effectively solve the Hong Kong market’s key problem – i.e. funds flow and illiquidity. Apart from this, a greater linkage in the way of ETFs between the Mainland and Hong Kong markets can alleviate the liquidity issue.

Given the extremely attractive valuations, the rebound was to be expected and indeed has much further to run if the policies are indeed implemented. Hong Kong listed stocks of the same business trade at a significant discount to its Mainland listed counters.

Apart from the 5 measures, efforts have been made generally across the Chinese stock market universe to boost the long-term health of the stock markets and to provide steady return for the long-term investors.

The Chinese authorities are improving minority shareholder rights, limiting supply of new IPOs to control supply, and has vowed to intervene directly by buying equities in the event of extreme volatility. Many Chinese companies have indeed announced and executed substantial share repurchases, effectively removing supply in the market, supporting share prices.

At Ox Capital, we have been positioned for an improvement of liquidity in the Hong Kong market, as a dysfunctional equity market hampered market-driven asset allocation and drains confidence which is already fragile thanks to the property market adjustment. The health of the stock market is of strategic significance!

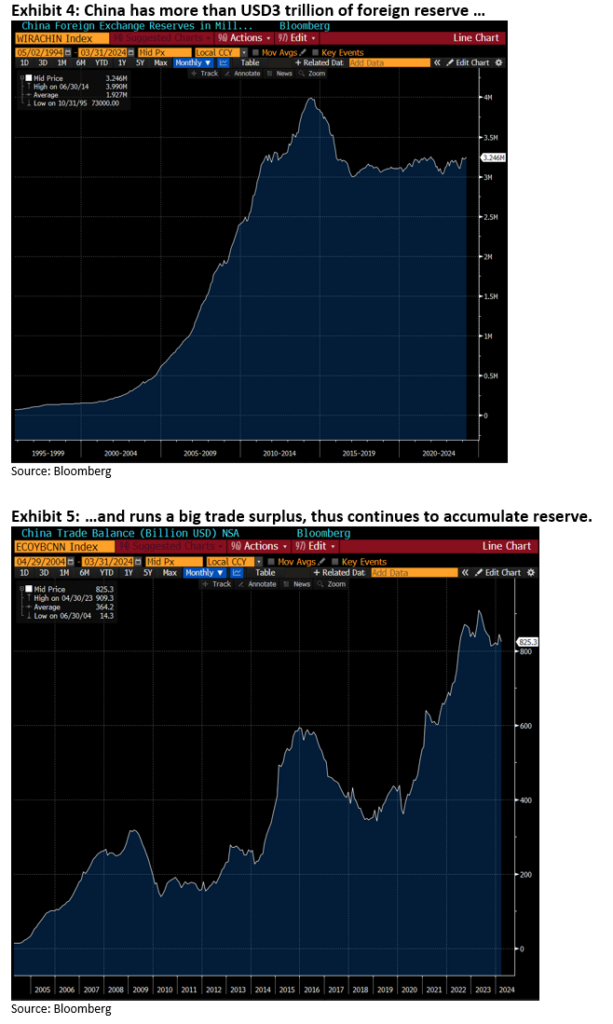

Further, the economic fundamentals of China are not as bad as commonly perceived. While the property sector has shrunk significantly, the overall economy is still growing at 5% and car sales is growing at ~10% (close to 30 million cars sold a year)!

The reality is that longer term prospect for China is likely to be rather positive. China’s GDP per capita is still low, at USD12,500, the workforce is well educated, and reforms (sometimes painful) continues to be made, and it is evidently climbing the technological ladder.

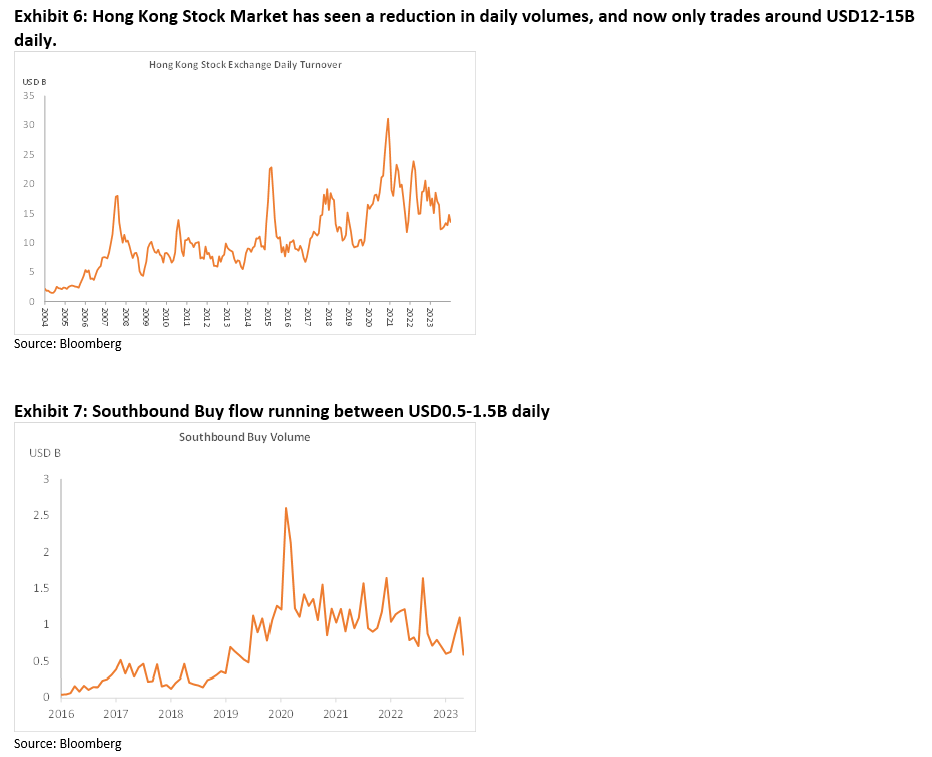

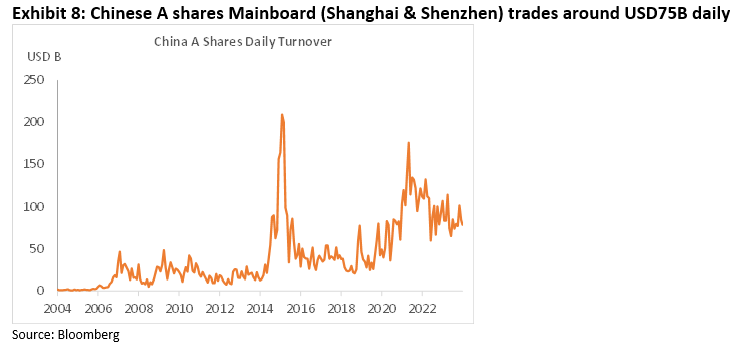

The fact is, the Hong Kong stock market (which trades USD15B a day) is much smaller than the Mainland markets in Shanghai and Shenzhen. While there is already Southbound money buying HKD stocks (USD0.5-1B a day), the volume is tiny relatively to the trading volume of the mainland markets (USD75B a day). Incremental Chinese flow via the CNY counters or ETFs can add substantial flow the market and valuation of HK stocks.

The spigot from the Mainland is set to open, the question now is, how big the spigot will be?

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

1 The 5 measures included greater linkage between HK and Mainland for ETFs, REITs, sales of investment funds, allowing Mainlanders to access CNY-denominated stocks in HK, encouraging leading businesses to IPO in HK.

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.