The OxCap MOAT

How our top-down approach helps us win!

At Ox Capital, our investment framework is rooted in identifying quality businesses with long-term sustainable growth thematics to drive outperformance. We also use macro-economic data to help us reduce risks in our portfolio. Our top-down approach involves two parts 1) fundamental and 2) quantitative. We will focus on the latter, our proprietary quantitative model called the Macro Overlay Aggregate Tracker, otherwise called by the acronym the MOAT. The model feeds in more than a million data points, a wide range of credit data, earnings per share (EPS) revisions from sectors around the globe, and market level data to provide a quantitative roadmap of the economy and actionable outputs. Combined with experience and discipline, we can take actions to protect and grow capital using this tool. Our quantitative framework has proven to be a useful tool to reduce downside risk during volatile times.

In short, the MOAT is a quantitative tool to help us navigate the type and level of risks to be taken. For context, we provide a few notable examples.

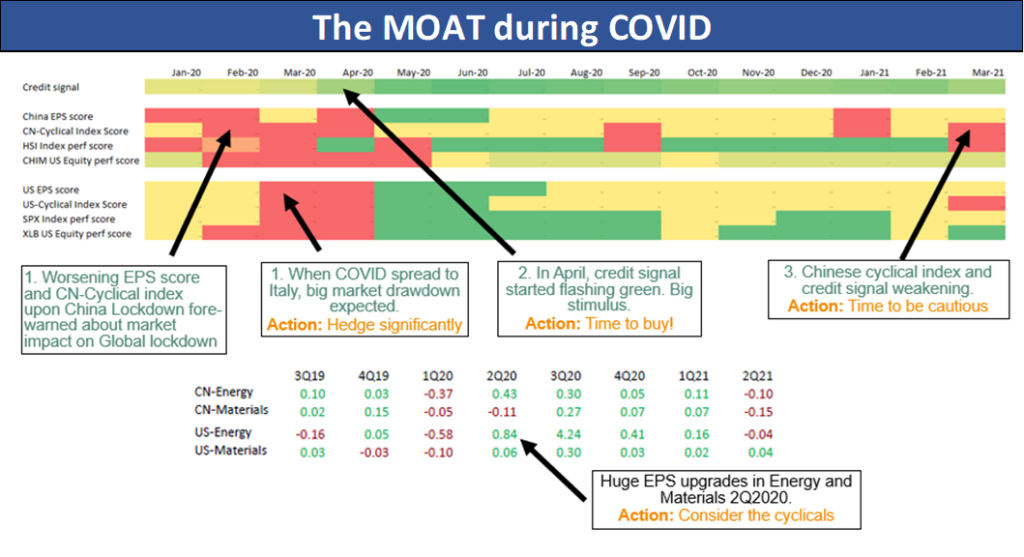

- The MOAT helped us navigate COVID. Our on the ground channel checks in early 2020 convinced us that COVID was not just another variation of the seasonal Flu, but rather a severe “Black Swan” event.

- a) Earnings per share was worsening as a result of strict lockdowns in China, a warning for the rest of the world on the impact to the market from global lockdowns. The early signs helped us hedge our portfolio

- b) In early April, the credit impulse fed into the MOAT started to point to a positive signal, but the market was not recognizing it. As a result, market sentiment was extremely bearish, but we expected stimulus money would be spent even during lockdowns and vaccines were being developed quickly. Notably this favoured sectors such as e-commerce, exercise apparel brands, life insurance, EV-related businesses.

- c) EPS upward revisions for cyclical sectors since 2Q2020 were significant while the market was still very concerned about the recessionary and deflationary forces. Our MOAT helped us identify changes in the severely beaten down cyclical sectors which became prospective areas for investments. We believed there was potential for inflation to come through, but this was considered unlikely by the market consensus as inflation had been benign for decades. We watched for tightening!

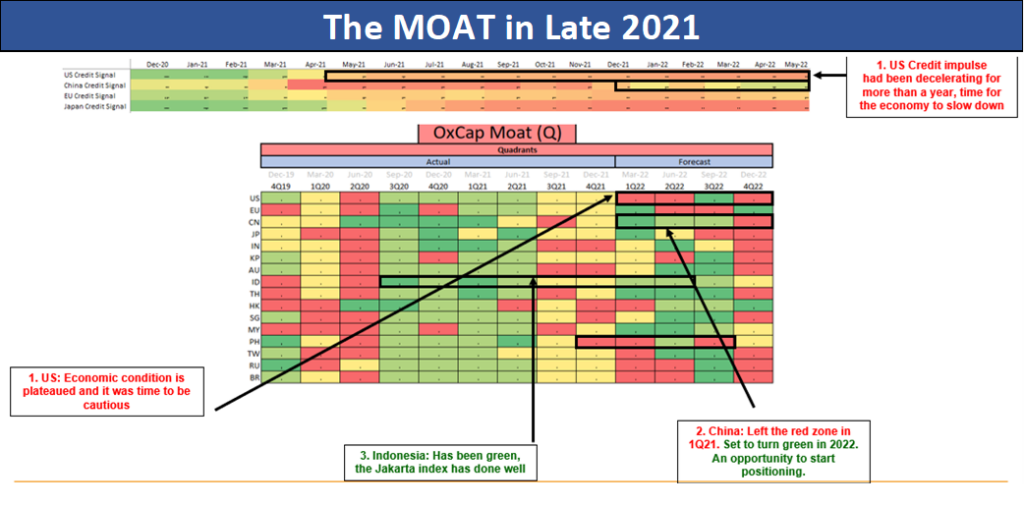

2. Weakening developed economies in 2022. Our MOAT helped us identify this trend in 2021. For example, our MOAT model showed developed market economies were likely to weaken throughout the year. Fundamentally we observed that smartphones and PC sales, over-indexed during the Covid period thanks to lockdown and stimulus support, but momentum was slowing down at a rapid pace. At the same time, because of shortage of semiconductor for autos, the valuations for the chips sector were highly elevated and as a result was not a safe place to hide. We took the opposite action of reducing and hedging our exposures in this sector which yielded great results.

Another great example in late 2021 was we bought into the best quality Indonesian stocks as a result of our MOAT model flashing green (a positive signal) and overlayed with our qualitative work showing improving fundamentals in the economy. The Indonesian market was one of the best performing markets in the world, and the sentiment was starting to warm up to the idea that Indonesian stocks may be prospective, long-term investments!

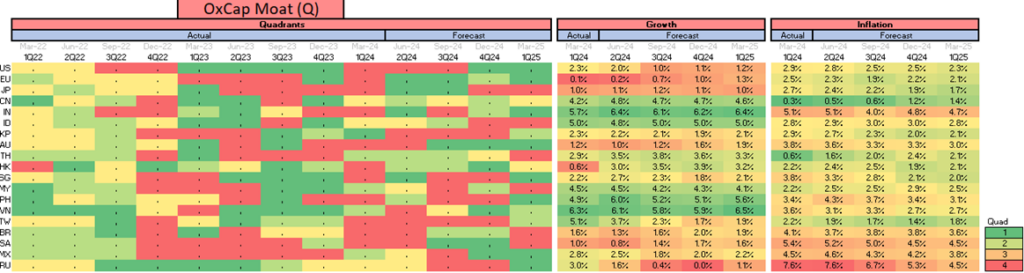

The hunt for Alpha in 2024: Our MOAT is pointing to a promising environment for Asia growth as inflation in many markets is stable to declining. Analysing the MOAT, we note:

- Many parts of Asia continue to grow rapidly with minimal inflationary pressure:

- In China, inflation is already the lowest in the world. The government has entered a fiscal loosening cycle, which will fuel growth through credit expansion. Notably the PSL has restarted with upticks in December and January which should assist in improving confidence and boost economic growth. The sum is likely to be spent on urban renewal projects and affordable housing programs and infrastructure across the nation. In prior periods, when the PBoC intervened via PSL, it successfully restored confidence and revigorated the property market. PSL was gradually curtailed post 2017 during China’s deleveraging campaign. Moreover, the National Team (China’s Sovereign Fund) has stepped in to support the equity market and has committed to continue as needed. This is positive to Chinese equities, as it signifies a willingness of the authorities to support economic growth if needed.

- Vietnam, the outlook looks promising. The country had been able to cut its key policy rate 150bps in 2023, with room for one more 50 bps cut if needed in 2024 as inflation is manageable, provided currency stability remains. GDP growth is expected to accelerate above 6% growth in 2024.

- Finally, Indonesia, inflation rate remains under control at sub 3% while government subsidies has mitigated some concerns. Combined with a more stable currency and FX reserves, we expect its central bank can start to cut rates in 2H24. moreover, loan growth 10-12% y/y in 2024, supporting consumption and domestic growth.

- In contrast, the overall credit withdrawal in the United States has slowed the economy and lowered inflation.

- If we examine the US more closely, the only significant inflation contributor remains is core services which are mostly shelter costs. Other factors such as food, core goods (mostly auto prices) and energy are no longer inflationary pressures. Energy has even become a detractor.

- We believe this is a result of the US credit tightening since Jan 2021. Besides slowing down the economy, the tightening caused some minor stresses in the banking system (I.E. Signature Valley Bank “SVB” & NY community banks), but nothing systemic thus far to the system, especially with the Fed’s aid since March 2023.

- EPS revisions show earnings for most financial institutions are in the US are resilient, but we do note higher for longer rates puts stress on regional banks. As mentioned in our November 2023 insights, unrealized losses on bank balance sheets due to the loss of value of its holding of government bonds with rising bond yields. (Bonds tend to lose capital value when interest rate goes up.) While the Federal Reserve has backstopped the stress arising from this issue (utilising the Fed’s emergency lending program called BTFP amongst others), the unrecognised losses on the balance sheet have likely impacted desire of banks concerned to extend lending. Moreover, commercial real estate (CRE) loans are another area of concern and the BTFP program is planned to finish by the end of 1Q24.

- Notably, the US will enter a rate cut cycle regardless of the pace and timing thanks to the gradual slowdown and milder inflation. This scenario is an ideal risk-on setup and will benefit Asia equities, especially when the starting valuation is relatively low.

In summary, the leading quality companies within the Ox Capital portfolio are taking market share domestically and globally while valuations remain attractive and do not reflect the earnings growth prospect, in our view. Our top-down approach complements the core of our investment philosophy which is to own quality stocks with long term sustainable growth at attractive valuations and the MOAT helps us effectively reduce the volatilities experienced by our investors.

At Ox Capital, we are focussed on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.