The Next Decade for Emerging Markets: Riding the USD Cycle

A weak US dollar is a boon for emerging markets

The prospect of US monetary easing and a declining USD represents a highly significant development for emerging market equities.

Historically, periods of USD weakness have coincided with strong performance across emerging markets, while a strengthening USD has generally produced the opposite effect. The below chart illustrates this relationship, with the orange arrows highlighting the direction of the USD and the green arrows the direction of the MSCI Emerging Markets Index. Notably, these cycles can persist for a decade or longer.

Source: Bloomberg, Ox Capital Management. As at 17th September 2025.

A strong USD poses challenges for emerging markets because it constrains the ability of central banks to pursue independent monetary policy and weighs on equity valuations. As the USD is the world’s reserve currency, emerging markets are often forced to defend their currencies against sharp depreciations by maintaining higher interest rates, even when domestic inflationary pressures are subdued. This both slows economic growth and depresses asset valuations.

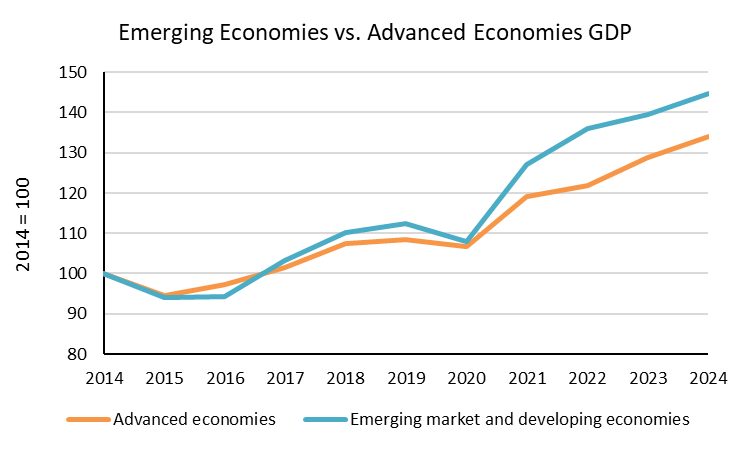

Over the past decade, this dynamic has clearly been a major headwind: from 2014 to February 2025, the USD Index appreciated 35% and the MSCI US Index rose 226%, while the MSCI Emerging Markets Index returned just 11%. The following charts illustrate the contrasting experiences of investors in the MSCI North America Index and the MSCI Emerging Markets Index over this period.

This divergence highlights a common misconception: stronger economic growth does not automatically translate into stronger equity market performance. According to IMF data, emerging economies have consistently outgrown developed markets, where much of the post-COVID growth has been fuelled by extraordinary fiscal and monetary stimulus. Meanwhile, many high-quality emerging market companies, despite having delivered solid earnings growth, have had their stock valuation compressed, thus becoming increasingly attractive.

The combination of US rate cuts and a weaker USD present an inflection point for emerging market equities. Like a coiled spring, when liquidity rotates out of the US into emerging markets, stock market valuations and economic activity will likely rebound significantly. At present, we continue to find compelling opportunities, particularly in China, Vietnam, Indonesia, and Brazil – markets where Ox is overweight and focused.

At Ox, our approach is to identify structural winners in emerging markets: high-quality companies, with durable competitive advantages, trading at attractive valuations. We believe these businesses are best positioned to benefit from the next cycle of USD weakness and renewed emerging market strength.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.