Revisiting the GFC playbook

Why buying China equities now is like buying US equities during the GFC

Chinese equities are trading at mouth-watering attractive levels. In our view, the outlook is highly prospective for long term investors. As highlighted in our early January 2024 insights, we believe the issues facing the Chinese economy are well known and manageable! Many new policies and initiatives are being introduced to support and stimulate the economy. The economy will find its footing in 2024. Contrary to numerous pessimistic headlines, the Chinese economy is set to expand between 4.5% to low 5% range in 2024.

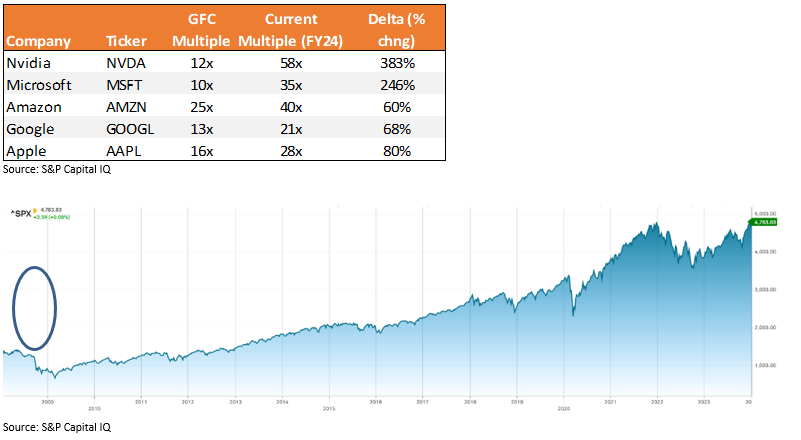

Déjà vu of the GFC playbook…The current set- up in China reminds us of the Global Financial Crisis (GFC) in 2008/2009 when the US financial markets were under tremendous pressure. As seen in the exhibit below, many quality companies, such as Microsoft, Amazon, Google were trading at depressed levels. Despite an almost catastrophic outlook in the GFC (remember the sudden demise of AIG, Lehman Brothers, Bear Stearns & the subprime mortgage crisis), it was, in hindsight, a great time to buy US shares and position for the long term. Quality businesses with sustainable growth benefited from multiple expansion and strong share price appreciation since that period.

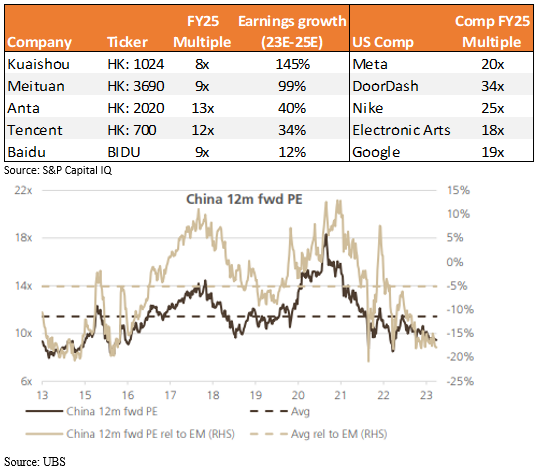

…a similar amazing long term opportunity is opening up in China right now! Valuations for Chinese equities are at depressed levels, and at a time when government authorities are dedicated to restoring confidence and reinvigorating the economy. As seen in the exhibit below, stocks like, Kuaishou, Anta, and Tencent are at multi-year low multiples with sustainable earnings growth outlooks. Quality businesses will continue to grow and become champion businesses in coming years. Now is the time to invest and take advantage of the very attractive valuations.

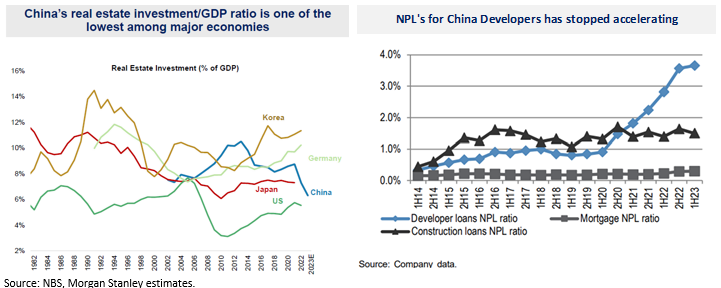

China property is not the US property crisis in the GFC. While we can point to multiple underlying causes leading up to 2007 (cheap debt, capital and credit availability, poor lending practices, financial engineering, deregulation, etc.…), the financial crisis resulted in gargantuan losses. Excess supply in housing, rapid house price declines, restrictive lending, and foreclosures of homes reduced cash flows to financial institutions. Ultimately, these developments led to financial contagion in the banking system. Even after three years of property market downturn in the Chinese property sector and property developer defaults, we have not seen significant stress in the Chinese banking system.

Where to from here?

Despite all the noise, the worst of the property sector adjustment is behind us. While structural issues may still require time to perhaps “find a bottom”, the issues will not lead to systemic risk, in our view. The likely outcome is an economic slowdown and further easing of policies the strength of which will determine the duration of the downturn.

A more forceful application of PSL to deal with the property market inventory situation can stabilise activities quite quickly. In the meantime, new drivers of growth can offset the slack to GDP due to the deflated property sector. Further, if relaxation measures can lead to return of some degree of inflation in the economy, then the property prices decline in nominal terms will be milder and less painful also.

As investors, we are excited about the amazing businesses with little direct linkage to the property market, many with cash on the balance sheet and are buying back shares. Many are trading on extremely attractive valuations. As confidence returns, consumer and advanced manufacturing will contribute more to economic growth overtime. The breakneck pace of development and technological advance at the company level will build many new champion businesses. Quality companies such as Mindray, Kuaishou, Anta, & Tencent Music will become champion businesses rivalling global competitors. We believe long term investment opportunities for China are under appreciated and we believe the market is underestimating the changes and transformation happening across the Chinese economy. The outlook is further supported by the rise of new industries and other EM regions.

Top of mind issues

The key economic issue around the Chinese economy is the structural adjustment away from the property sector as a contributor to growth.

The good news is that the bulk of adjustment with respect to properties have already taken place after sales and new starts have adjusted down more than 40% from peak levels. According to Morgan Stanley Research, China’s real estate investment to GDP has declined to a relatively low level of the overall economy already as a result.

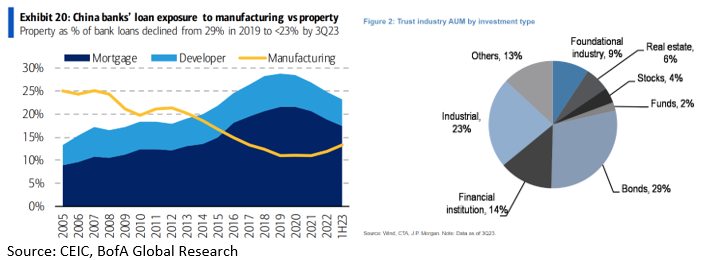

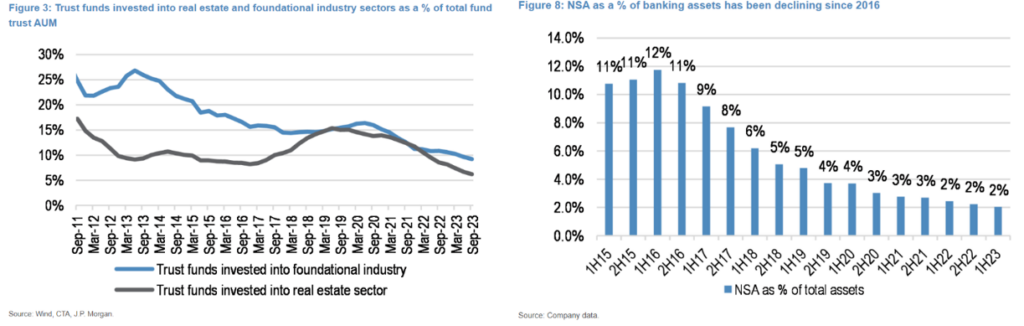

The resilience of the banking sector means it is unlikely we will see a banking system crisis that is typically associated with big declines in the property sector. Our assessment is that Chinese banks are resilient after years of cleaning up and building buffers. While there are headlines of defaults from big developers, there is little evidence of systemic financial crisis that is typical of property busts. Chinese banks’ real estate related exposures are now back to around 2015 level, allowing room for further relaxation of policies. New bad debts in the loans and bonds have peaked already.

There have been some failures of financial institutions (trusts and shadow banks) linked to the property sector. Given the pressure from the authorities to mitigate risks in the system, the non-bank financial system has been strictly regulated for almost a decade and have been shrinking. Such failures are not to be unexpected given the downturn, they represent a small part of the financial system. For example, the recent bankruptcy filing for Zhongzhi Group was well known and manageable, representing roughly 0.1% of total China credit, per JP Morgan.

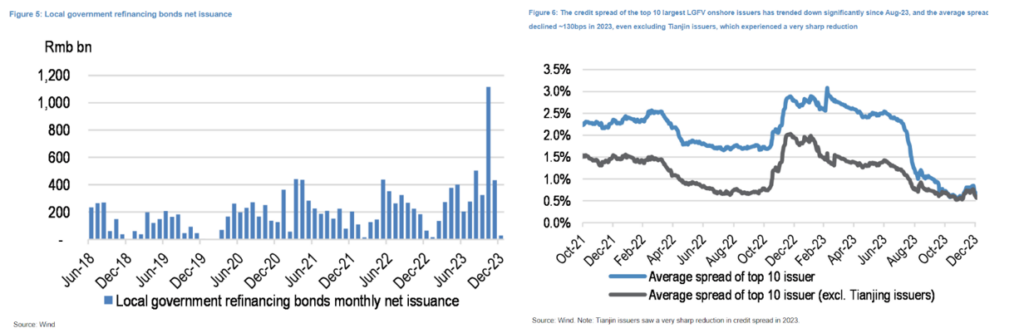

Another issue is the debt called Local Government Funding Vehicles (LGFV). The sum totalling USD7 trillion, so it is not small, but manageable, as the magnitude is well-understood by investors and regulators. Government actions stabilising the LGFV problems has already led to a decline in the LGFV bond credit spreads!

The issues of LGFV revolves around the less economically vibrant counties and provinces versus big cities have been piling up LGFV. LGFV is money borrowed to provide social services and infrastructure investment. The Central Government has been concerned about LGFV for a decade, and has been trying to suppress its growth, however, it nonetheless grew quite quickly, particularly during the Covid period. The problem is many of the LGFVs are backed by properties which have fallen in value. The solution is rather obvious. Spending from smaller local governments has to slowdown, outstanding LGFV loans can be swapped with Central Government debt, cash generating assets injected into it from the government of SOEs, and some LGFVs can potentially be restructured. The issue is not a big systemic problem, but rather a LGFV driven infrastructure drag to GDP is indeed likely.

The banking system is nevertheless going to remain robust. As sated previously, there is a lot of buffer in the banking system to absorb losses. The weakness in the system are property developer loans. There is circa RMB20T of developer loans. Roughly 75% of developers borrowing is from the banks, the rest are RMB bonds, USD Bonds, trusts etc. The good news is property debt is backed by land and properties. If the loss rate is 15%, the cost is RMB3T (default rate 50%, loss given default of 30%). The buffer available in the banking system is around RMB9T. That is, in the event of further defaults in the developers, the banking system will see mild level of stress, but it is not likely to be systemic in nature.

Solutions are coming, perhaps rather slowly:

The economic problem relates to structural growth resulting from a desire to move away from properties as a driver of growth. It makes no sense to either reboot the property market or infrastructure spending anymore to propel China’s economic growth. Furthermore, the debt level is already high.

As a result, the authorities’ reaction to this “crisis” is somewhat piecemeal in nature.

- Recap and restructure the LGFVs: Accept lower infrastructure spending, but ring-fence for financial contagion

- More relaxation of policies on the private sector: This will encourage new drivers of growth i.e. online games, tourism, sports, tuition, etc.

- PSL to policy banks to issue as equity for some infrastructure spending (selectively)

- PSL to policy banks to buy properties to stabilise the property market (yet to happen), but urban renovation is part of it.

In our view, if number three and four can be ramped up, we believe the market can quickly stabilise. Growth will still be sluggish, but at least the idea of “sleep-walking into the abyss” will cease.

As we have stated previously, it is important to consider the multiple catalysts and act now given 1) valuations are extremely cheap, 2) property market is stabilising, 3) China QE “PSL” is supporting the economy (and restoring confidence) at this juncture, 4) Chinese capital replacing international flows in Hong Kong equities market, 5) National Team providing stability, and 6) geopolitical stabilisation. In our view, the champion Chinese companies in the OxCap portfolio have the set-up for “hockey stick” growth.

At Ox Capital, we are focussed on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.