Ox on the Ground: India’s Growth Story

A transformation driven by rising incomes, digitalisation and an infrastructure boom

India’s exciting growth momentum is underpinned by strong fundamentals: a young and large population, increasing infrastructure investment, and supportive policy reforms. During our recent visit, sentiment was optimistic as a reduction in the domestic GST and interest rate cuts are expected to support consumer purchasing power and fuel India’s economic growth.

Private consumption is the main contributor to growth

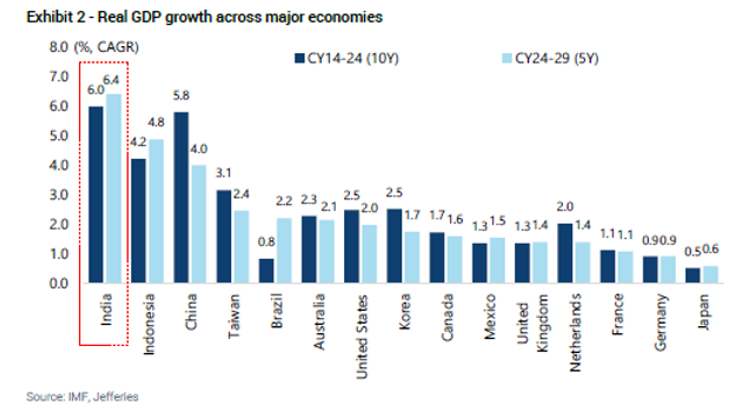

India is the world’s most populous country. Home to 1.46 billion people, India represents nearly 18% of the global population. Further, it has a young median age of just 29 years. Over the past decade, GDP has grown at a 6% CAGR, and is expected to continue to expand at similar pace over the next five years, keeping India among the world’s fastest-growing economies. Private consumption has and will continue to play a central role, contributing over 61% of India’s GDP.

India is projected to record the fastest GDP growth among major economies over the next five years

On the ground: A busy modern retail supermarket (left); traffic intersection in Jalandhar (Tier-2 City) (right)

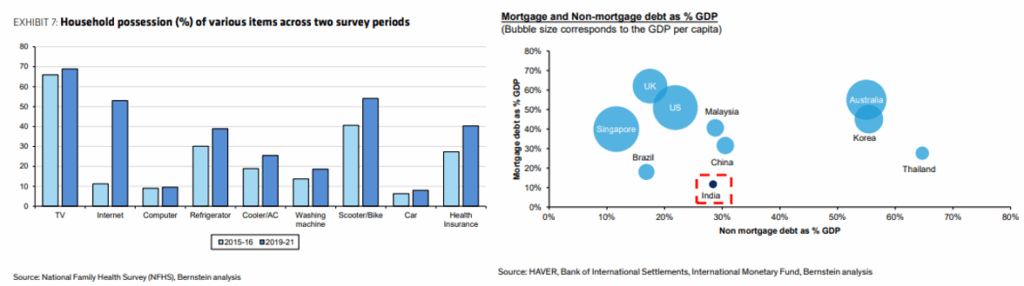

Low debt base with rising demand

India’s consumer debt levels as a percentage of GDP remain low compared to other countries, giving banks plenty of room to increase lending. Conversations with our portfolio companies in the financial sector, such as HDFC Bank, ICICI Bank, and Axis Bank, emphasise their key role in promoting financial inclusion and seizing growth opportunities in India. The other takeaway was that as income levels rise, the companies are seeing increased spending on discretionary items like automobiles, entertainment, and travel, which is continuing to boost demand for new loans. Overall, loan growth across the system is expected to stay healthy (~10% in 2025).

Household ownership of key items (left); debt levels as a share of GDP remain at a low level (right)

Retail shifting from unorganised to organised

India’s rising incomes are transforming the retail landscape as well. A visit to Ambience Mall in Gurugram showcased this shift, with offerings ranging from affordable retailers to luxury brands. A major trend in retail is the structural shift from unorganised retail, including local Kirana stores and small shops, towards modern retailers such as D-Mart, Reliance Retail, and quick-commerce players.

On the ground: Ambience Mall, Gurugram (left); various shopfronts at a busy road in Jalandhar (centre); traditional Kirana store (right)

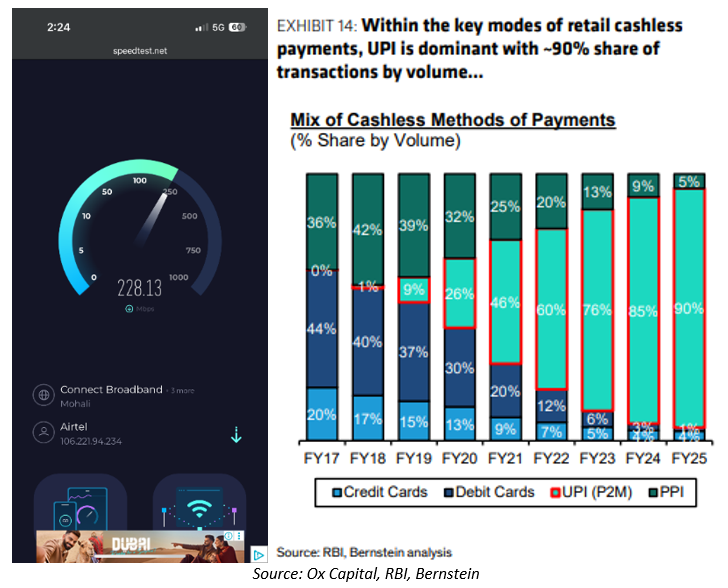

Digitalisation: 5G and UPI Powering Change

Internet connectivity, even in rural locations, stood out to us this time during our visit. Internet speeds were impressive even in rural locations. 5G coverage is widespread, with rural areas generally supported by 4G networks. Easy access to high-speed connectivity, combined with the government’s Unified Payments Interface (UPI) initiative promoting digital payments, is driving rapid adoption of online payment platforms. Our exposure to the sector comes through Reliance, whose telecom subsidiary Jio holds a leading 41% market share in the mobile telecom space.

On the ground: Mobile internet speed check conducted in a rural location

Infrastructure boom driven by public infrastructure and housing

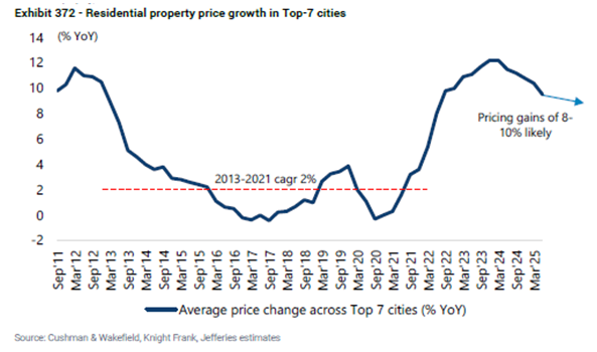

On the ground, India’s infrastructure transformation is progressing. Roads, rail, energy, and public assets are being supported by strong demand in housing, commercial real estate, logistics, and office space. In cities such as Gurugram and Mumbai, demand for both residential and commercial properties is rising, partly driven by multinational companies setting up Global Capability Centres (GCCs). Real estate has emerged as a key theme after a decade of subdued growth and real estate prices have been rising steadily since 2021.

On the ground: Residential site under construction (left); DLF Cybercity (right)

Residential property price growth across top 7 cities in India

Policy reforms supporting local production

The Production-Linked Incentive (PLI) scheme launched in 2020 provides manufacturers with direct financial rewards for increasing production of goods made in India. Since its launch, the PLI has significantly boosted production in sectors such as electronics, automobiles, pharmaceuticals, and solar modules.

Another major reform that took effect on September 22 this year was cuts to the GST. The government lowered GST rates on consumption goods to simplify the tax structure and promote consumption. Essential items like personal care products and packaged foods were moved to a 5% GST bracket, while goods like air conditioners, affordable cars, and bikes were shifted from 18% to 12% GST bracket. GST was also reduced for health and life insurance plans. These cuts make products more affordable, increase demand and help households to save more. The impact of these GST reductions is expected to be greater than recent income tax changes because less than 7% of the population files tax returns, and only 3% pay income tax in India. The GST cuts introduced to counter short-term challenges from US tariffs are a step in the right direction.

Change in GST rates

Social progress with challenges ahead

India’s transformation will continue to be driven by rising incomes across all sections of the population. Over the past decade, extreme poverty fell from 16% in 2011–12 to 2% in 2022–23, lifting 171 million people above the poverty line. Employment growth has outpaced the working-age population since 2021–22, with urban unemployment rate falling to 6.6% in Q1 2025, the lowest level since 2017–18.

However, challenges remain. Youth unemployment is at 13.3%. The agriculture sector remains the main employer, engaging about 45% of the workforce, but wages in this sector remain low. One thing that is clear from our recent trip is overall economic development continues to lift people out of poverty. Digital connectivity has also given people in rural areas access to financial services, awareness of government programs, and opportunities to seek jobs elsewhere. Therefore, sustained reforms and inclusive policies will be crucial to maintaining progress and ensuring that the benefits of growth reach all parts of society.

On the ground: A scene outside a premium hotel in Gurugram, where a religious NGO was distributing free meals

On the Ground at Jefferies India Forum

At the Jefferies India Forum in Gurugram, where 100+ companies met global and domestic investors, confidence was high. Management teams highlighted resilient consumer demand and supportive policies, even as tariffs create near-term headwinds.

Valuations: premium market with strong domestic inflows

From a top-down perspective, Indian equities appear expensive relative to EM peers. However, India’s growth story is clearly supported by optimistic local sentiment and robust domestic participation. Inflows through SIPs (monthly investments into mutual funds) reached US$3.2 billion in August 2025. Moreover, equities account for just 7% of household assets in India, compared with 26% in the US, highlighting significant room for further growth.

SIP and domestic fund flows have continued to support the market, even as net FII outflows have persisted since October 2024

High valuations in India are supported by impressive earnings outlook. India ranks second globally in earnings growth, just behind Taiwan. When viewed through the PEG ratio, the market remains attractive in terms of valuation. We remain optimistic on the prospects of our investments in India.

With the second-highest projected EPS growth, Indian equities offer an attractive PEG ratio

India’s transformation is happening steadily and sustainably. With strong structural drivers and many promising growth opportunities, India remains an exciting and attractive market for investors.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.