Investing in China

We believe deciphering the Chinese economy is the single most important question for investors, be it for the purpose of investing directly in China or to understand the impact of the Chinese economy on a broad range of investment assets outside of China.

Ox Capital is in an advantaged position as we have the historic experience in China and framework to understand the nuances of the Chinese economy, through years of involvement and bottom-up fundamental analysis of investment opportunities.

Investing in China is not straightforward, in particular one has to appreciate the regulatory risks as well as having a firm understanding of the fundamentals of the industries and companies. Having said that, enormous opportunities are available as the better businesses will become national or even global champions in the years to come.

Our solution to investing in China is to be selective: to only invest when exceptional opportunities arise. We buy the quality entrepreneurial businesses that enjoys regulatory tailwinds and buy them when they are extremely attractively valued. As these businesses grow, the upside will be big, as we have seen recently in the Covid re-opening when the Hong Kong market shot up 60% in two months.

Our observation is that China is not interested growth for growth’s sake anymore. Quality growth is the new marker of success. China is already a mature economy. Building an ever-greater stock of infrastructure, property and factories simply does not make sense, particularly due to the various restrictions to technologies, such as in the advance semiconductor manufacturing space. Growth can only be more sustainable if the private enterprises within China invest in research and development.

Given its difficult relationship with the US, we are seeing a greater push from the Chinese Government to encourage domestic consumption and a further diversification of exports towards countries that it has a more stable relationship with. This means that growth coming out of China will be slower going forward, thus impacting the companies that will be prospective to the Fund going forward.

Further, as China’s economic growth has been a key driver of global growth over the last two decades, this diminishing growth momentum will mean slower growth for the entire global economy.

The reversal of property, internet and COVID-19 policies have led to meaningful improvement in economic activities. Economic adjustment in China over the prior 18 months was painful but necessary in order to reorientate the Chinese economy for more steady growth.

- Property transactions were down 40% from the peak, with extremely tight funding policies in mortgages and developer funding.

- Numerous indebted property developers went bankrupt.

- Internet companies saw dramatic curtailment of business activities led by regulatory change.

- Omicron lock downs in 2022 were especially difficult for the small to medium businesses in the service (such as dining and tourism) and entertainment industries)

- Lockdowns also reduced tourism activities, business planning and investment, hampering business confidence.

These adjustments occurred over an extremely short time frame and the banking system was resilient. The upside is that, going forward, the Chinese economy is more balanced, less reliant on property construction, and less speculative as property prices have adjusted back down to a more reasonable level. The dysfunctional sectors of the economy have been removed.

This change was not without costs. Business and consumer confidence weakened, and equity prices declined. We were able to avoid the full extent of these adjustments, through strong on-the-ground insights. Just as the market initially underestimated the authorities’ resolve to reform the economy, and the subsequent slowdown in activities, it could now be underestimating consumer confidence and growth in coming years.

The fact is, China’s income per capita is still a fraction of that of developed Asian economies. Entrepreneurial private enterprises continue to invest big in research and development and are making significant strides in climbing the technology ladder. Indeed, many domestic companies are already world leaders in a range of industries. The impetus for economic growth is still strong despite the difficult external environment as a result of intensified geopolitical competition.

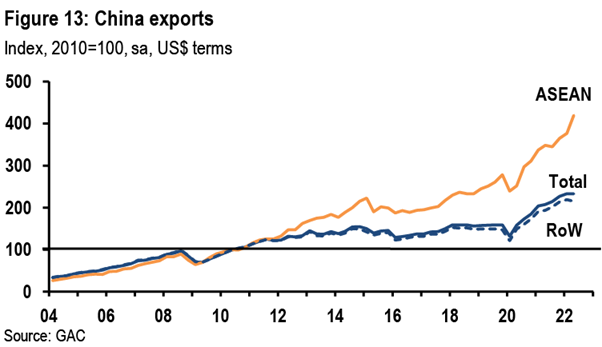

In response to the external environment the authorities have started building longer term partnerships with many economies including those in ASEAN, the Middle East and most recently with some European countries. Many of these economies remain interested in diversifying their reliance on their traditional developed market trading partners and the USD. While all these partnerships are in their early innings, in trade demonstrated major changes with ASEAN region gaining in share and US falling significantly.

Source: JP Morgan, GAC

Further, from the middle of 2023 some stocks in Hong Kong will start to be quoted in the Chinese Yuan (CNY). We view this as a major event, with significant long-term implications for Hong Kong equities. The extremely cheap Hong Kong valuations were a result of a liquidity issue, that will be resolved if Mainland investors can participate more directly with the local currency, CNY.

At Ox capital, with respect to Chinese exposures, we are selective. Given the attractive valuations, we have chosen to own quality stocks that are leveraged to long-term growth themes, through exposure to domestic consumption and future technological giants as the authorities focus on these two factors as key drivers for the economy going forward.

During times of volatility, we will not hesitate to adjust our exposure to China to reduce downside risk. Given the focus of the Chinese authorities on economic growth and COVID-19 reopening, the Chinese market looks highly prospective at this current time.

Past performance is not a reliable indicator of future performance. For Performance of the Fund please see our performance page.

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914) (Oxcap). Oxcap is the holder of an Australian Financial Services Licence AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe for interests, and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness or completeness. Neither nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.