Emerging markets outlook (and drinking tea) in 2026

Investing is like boiling a kettle. When the kettle is hot, one can get burnt. In the investing world, it doesn’t always pay to chase what is hot. When an economy is running hot, central banks will need to hike interest rates to ensure inflation stays under control. When an investment theme is “hot”, its future potential is rapidly priced in by investors. In comparison, when the kettle is warming up, one has time to set up the tea set, watch the kettle boil, take a moment to brew the tea to hit its full flavour, and finally sit back and enjoy.

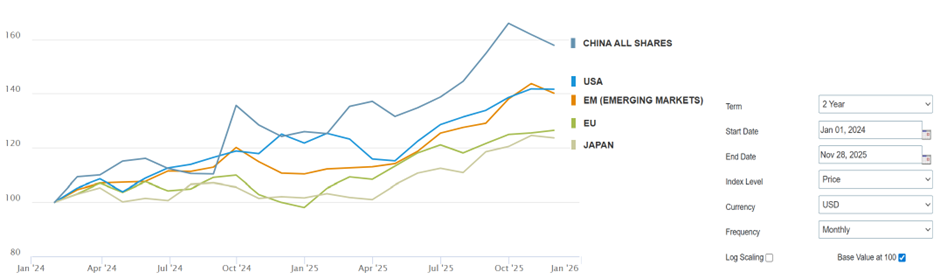

EM equities have been “cold” for over a decade, but the kettle is finally warming up. Between Jan-24 and Nov-25, EM equities performed just as well as US equities. In particular, the Chinese equity market, which was considered “uninvestible” by some funds, has outperformed the US, Europe, and Japan markets over the same period.

Figure 1: Chinese equity performance overtook key DMs in 2025

Source: MSCI.

Developed markets have been running too “hot”

In 2026, the “hot” developed markets (DMs) will have their share of challenges. Many developed economies have been running “hot” for some years propelled mostly by debt accumulation and rising asset prices. Since the pandemic, most developed economies have added debt to fund deficit spending for the maintenance of living standards. Politicians have often picked the easy option of further spending rather than reining in budget deficits.

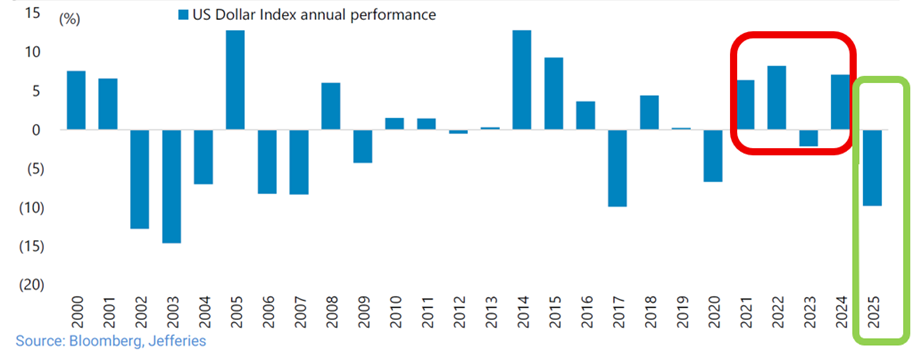

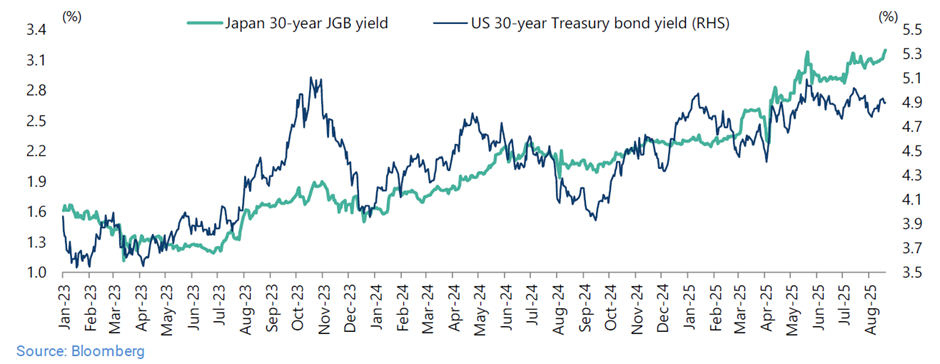

Global markets are starting to contemplate these latent risks. The weakening US dollar (USD), surging gold prices, and rising bond yields in the US and Japan (now over 3% for 30-year Japanese Government Bonds) are perhaps foretelling the problems ahead.

Figure 2: USD weakening of 2025

Source: Bloomberg, Jefferies.

Figure 3: The gold price has rallied nearly 60% YTD at time of writing

Source: Goldprice.org.

Figure 4: Rising 30-year bond yields in the US and Japan

Source: Bloomberg.

A changing geopolitical landscape and global alliances deepen the challenge ahead, as countries are also compelled to fund new defence spending. To fund this ever-growing government debt, it is likely that major DM central banks will loosen monetary policy (i.e. cut rates or even pursue QE in some form) in the face of moderately high inflation rates.

Emerging markets are only “warming up” in 2025

EM countries have better economic and demographic foundations than most of the developed world. Most EM governments have managed their finances responsibly. Consider Malaysia, which is actively pursuing fiscal reform, and Indonesia, which under President Joko Widodo has improved in leaps and bounds. Meanwhile, the Chinese and Vietnamese governments have both made tough decisions to keep their property markets in check. Having learnt their lessons from previous debt crisis, EM governments have worked hard to keep fiscal deficits under control, while still pursuing effective pro-development agendas.

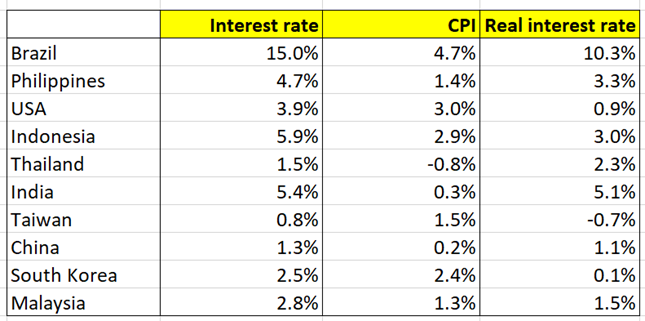

Even through COVID, they refrained from large government handouts. EM central banks broadly have no hesitation pushing interest rates higher to support domestic currencies and keep inflation in check where needed, even as many of the DM central banks’ have begun new easing cycles. Case in point in monetary policy responsibility is Brazil, where the central bank has kept interest rates at 15% despite inflation running at a much lower 4-5%!

As governments remain sensible in EM, many countries in EM have reasonable real interest rates (>3%). That is, there can be more monetary policy easing to come, supporting economic growth and equity markets in many EMs.

Figure 5: Brazil, Indonesia, Philippines and India have high real rates of over 3%

Source: Trading Economics.

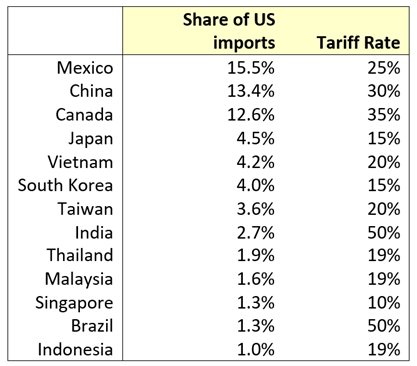

2025 can be best characterised as a year of “de-risking” across EM. By and large, EM economies have emerged unscathed from US tariff negotiations. The final tariffs were largely between 10-20% in Asia, much lower than the initial “targets”. This left the relative competitiveness of these Asian EM export nations unscathed. Two EM countries which were singled out by the US were Brazil and India. However, exports to the US from India and Brazil only account for a small percentage of GDP (≈2%), and likely any loss in volumes from the US can be taken up by other trading partners. Finally, China and the US agreed to a trade truce in November 2025, meaning trade and key external risks are settled for now, and we expect this to remain at least through 2026.

Figure 6: Key Asian nations we invest in remain highly competitive exporters, despite new tariffs imposed by the US

Source : Ox Capital research.

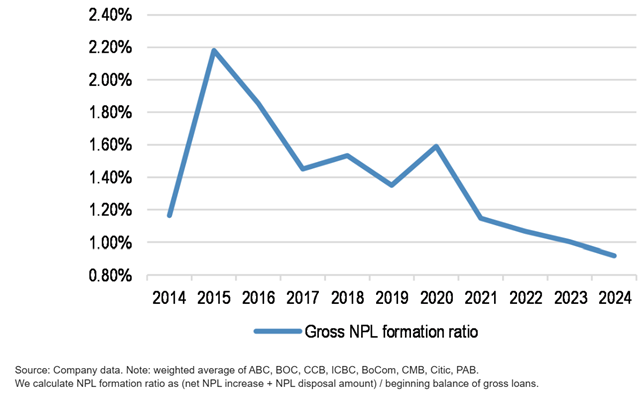

In China, it has been four years since the property market peaked. Property prices have declined as much as 30 to 40% in most cities. Several large private property developers have defaulted and been liquidated. Notably, the banking system has negotiated its way through the property market downturn well, with bad debt formation for Chinese banks trending down since 2021.

With the banking system intact, China is NOT Japan. The country is only working through a cyclical property market downturn, and it is at the later stage of this adjustment. We expect property prices to bottom in late 2026 / early 2027.

Figure 7: NPL formation in China is showing a healthy decline and banks’ balance sheets are resilient

Source: JPMorgan.

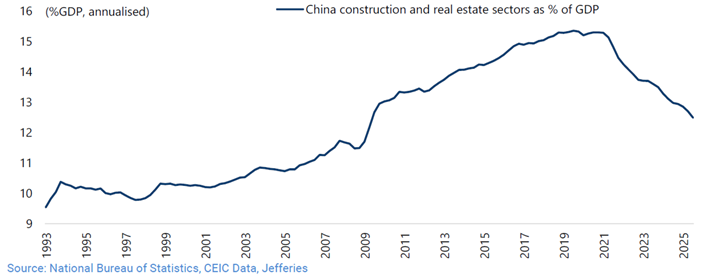

What is often less mentioned is the transformation of the Chinese economy. The construction and real estate sectors have shrunk as percentage of GDP.

Figure 8: The construction and real estate sectors peaked at just over 15% of Chinese GDP in 2019, and are now around 12% of GDP

Source: Jefferies.

Despite this, the Chinese economy still managed to grow ~5% p.a. between 2021 to 2025. The shortfall in growth coming from the slowing real estate and construction sectors was made up by the export and industrial sectors. Since the first Trump administration, China has been developing other export markets. Between 2021 to 2025, we can see the rise of Chinese exports to the Global South (ASEAN, Latin America, Africa, India, Pakistan, Saudi Arabia, UAE and Turkey), which have been able to offset falling exports to G7 nations.

Figure 9: G7 nations are no longer the top end markets for Chinese exports

Source: Jefferies, CEIC Data, General Administration of Customs.

Its growth potential is further bolstered by the rise of new and innovative industries. These days, China is the leading producer of solar and wind energy equipment. In 2023, it overtook Japan as the largest auto exporting country, and it is today leading the world in the transition to electric vehicles (EVs).

While China is now having success in various industrial and manufacturing end markets, for a time there was a fear that US sanctions could hold back China in the technology race by restricting access to semiconductor technology. Instead of becoming stifled, China has made it a national priority to develop domestic semiconductor know-how. In some product segments, the domestic suppliers are finally good enough to be considered as replacements for foreign imports. After semiconductors, the next front was AI. Again, China has shown that it is firmly in the race after the unveiling of DeepSeek in January 2025. Chinese AI companies, along with the open source community, can innovate and are often much more cost effective than the well-known hyperscalers.

In summary, EM economies are resilient and capable of withstanding external pressures.

Emerging markets are “heating up” in 2026

There are multiple catalysts on the horizon. We are optimistic on EM in 2026:

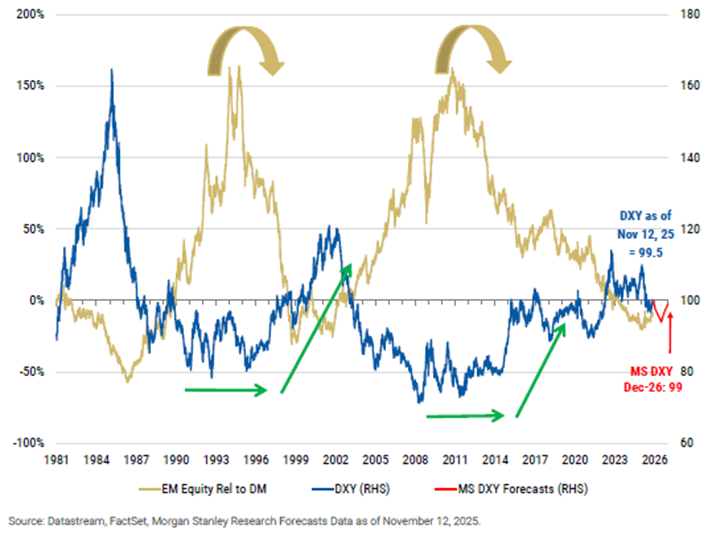

- The weak USD:

As a rule of thumb, a weak USD is a tailwind for EM. Central banks in EM economies need to consider the impact on their currencies in their rate cut decisions. Hence, a weak USD affords EM economies greater flexibility, with inflation largely under control. A key event to watch next year is the appointment of the new US Federal Reserve Chairman, as Jerome Powell’s term will expire in May 2026. If the new Federal Reserve looks to quickly cut rates to support the economy, there will be greater downwards pressure on the USD.

Figure 10: EM versus DM equity relative performance versus the USD index (DXY)

Source: Morgan Stanley.

- Anything-but-AI:

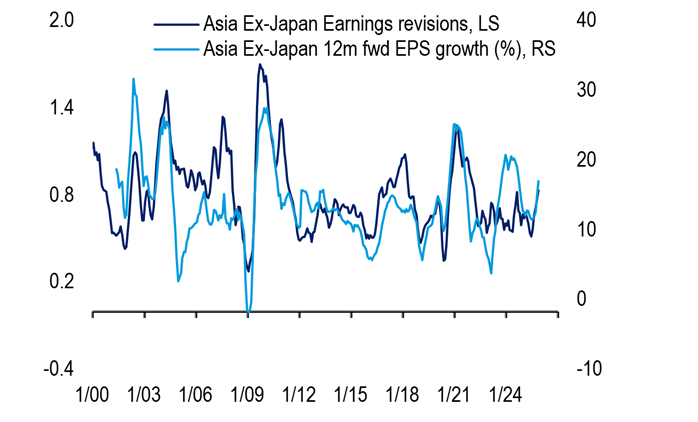

AI has been the focus of investors for over two years now. Many traditional non-technology stocks have been left behind and de-rated. At some point in the future, momentum behind AI spending will inevitably slow. Hence, investors will need to look for the “anything-but-AI” investment. EM, in particular Asian equities, can be a fertile hunting ground for new ideas. Earnings are expected to grow strongly (17% YoY) in 2026 in Asia ex-Japan.

Figure 11: Asia ex-Japan forward earnings growth forecasts are strong and expected to stay high in 2026

Source: BofA, MSCI, FactSet.

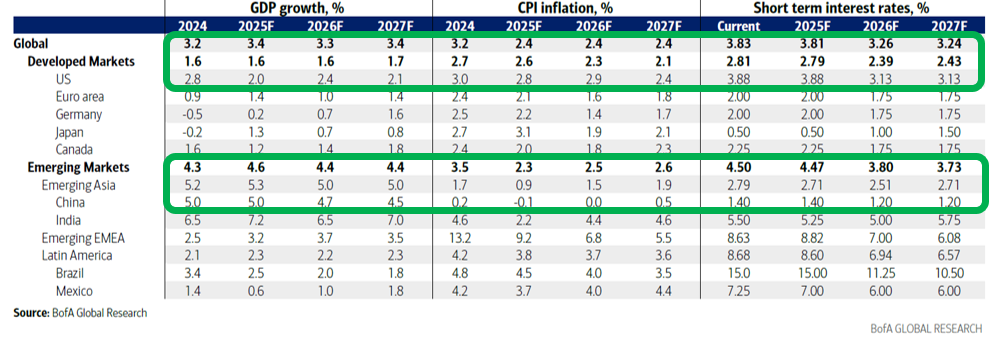

- EM macro is better:

In 2026, EMs are expected to grow faster than DMs (4.4% vs. 1.6%, respectively). Low inflation and high real interest rates suggest further room for multiple rate cuts in many EM economies. An important catalyst to watch out for is new stimulus policies in China in 2026. Most investors are not expecting much on this front. There will be upside if and when the Chinese government delivers on these measures in 2026.

Figure 12: GDP growth for EMs in Asia is higher than DMs in 2026

Source: BofA.

- Value-up/shareholder return:

In 2025, we saw the rise of value-up programs emphasising minority rights in Asia. This is something we have not seen much of in our time investing in Asia. Korea, which drew attention from global investors with its value-up program, was one of the best performing markets in EM in 2025. Other countries are taking notice. Indonesia set up its sovereign wealth fund (Danantara) in February 2025. Danantara is pushing state-owned enterprises to improve return on equity, and provide better shareholder returns. Elsewhere, the Singaporean government is investing $5bn with fund managers under its market development program to improve the liquidity of small and mid-caps in Singapore. These initiatives can be rewarded more strongly as execution begins to come through.

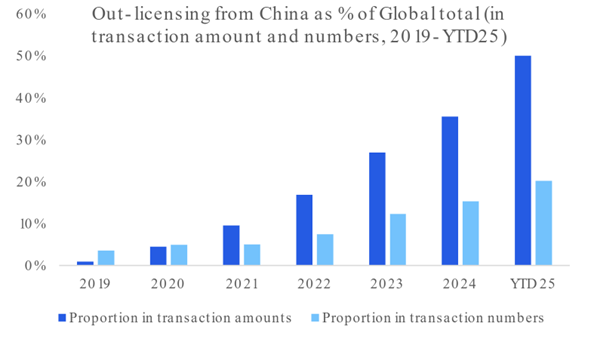

- Sunrise industries:

The US/China rivalry is leading to the rapid growth of many “sunrise” industries (and stocks) in China. China is looking to promote and create domestic champions to reduce its reliance on US suppliers. We are particularly encouraged by the strong returns seen in the Chinese biotech space in 2025 as investors have begun to wake up to their potential. Almost 50% of global drug licensing deals in 2025 were sourced from China. Outside of biotech companies, many of the emerging leaders in fields such as robotics, medical device, AI, SaaS, autonomous driving, LIDAR, semiconductor and fintech, for example, are listed and poised to deliver sharply accelerating growth in 2026 and beyond. Many of these companies are looking to expand globally. There are just as many exciting thematic ideas in EM as on the Nasdaq.

Figure 13: China is beginning to dominate global drug licensing with its innovative companies

Source: Citi Research.

- Stronger shareholders in EM:

EM equities are in stronger hands and better supported than in years past, making them less susceptible to global fund flows. While mainland capital used to only make up 10 to 15% of turnover in Hong Kong, Chinese investors have now displaced global funds as the key investor, regularly accounting for two to three times this volume today, at 25 to 30% of daily turnover. In addition, another nice surprise for us, compared to years past, is the fact that we are seeing Chinese companies buying back their stocks aggressively. Some companies have shareholder return targets of as much as 10 to 15% a year. Similarly, the Indian stock market is well supported by local investors (through their regular saving plans). The Indian market has been resilient despite foreigners reducing their positions throughout 2025.

Time to sit back and enjoy the tea

Since COVID and the Russian invasion of Ukraine, the world has been in a state of flux. The Trump administration has been working to re-cast the global order. Despite this, China has withstood and successfully countered challenges and a trade war with the US. Its local economy has proven sceptics wrong, and despite property prices being crunched in a bid by the Chinese government to reduce systematic risk, the banking system has hardly missed a beat. Outside of China, governments in EM are sticking to orthodox economics, by keeping budget deficits low, maintaining stable domestic currencies, with central banks fighting to keep inflation in check.

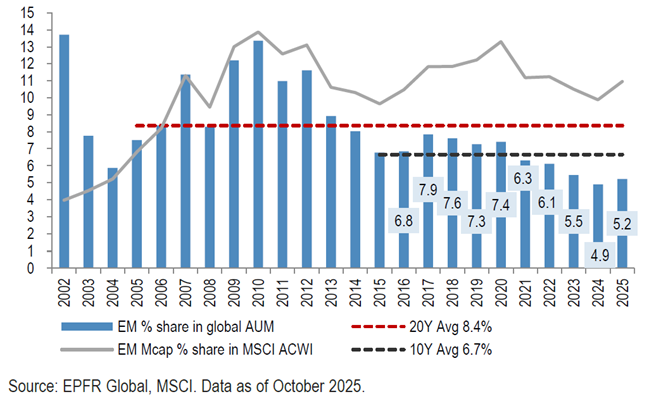

Just like any good tea, it will take time to brew. Despite a favourable macroeconomic backdrop, global investors are only lightly positioned in EM, well below the historical average.

Figure 14: EM positioning by global investors can pick up a long way from here

Source: JPM, EPFR Global, MSCI.

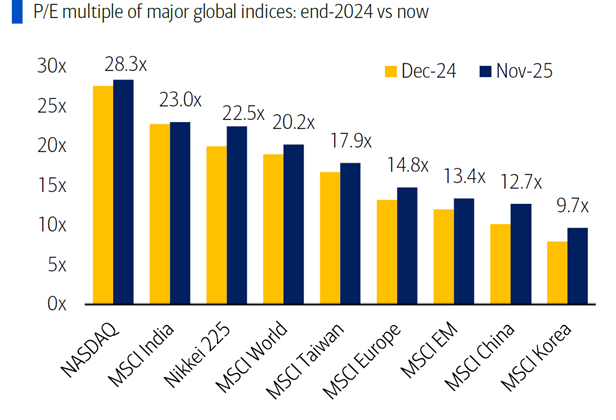

EM remains attractively valued relative to the rest of the world. It is encouraging to observe that valuations of emerging markets have increased in 2025; however, there remains room for further valuation uplift before these markets reach excessive valuation levels.

Figure 15: The MSCI EM Index is trading at only 13x P/E, less than half that of NASDAQ at 28x

Source: BofA, FactSet, MSCI.

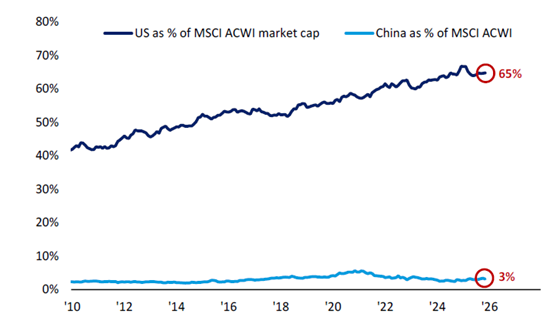

Investments in EM will offer attractive returns in the long run. For example, the value of the US stock market is 20x larger than China, even though US GDP is only ~1.5x higher.

Figure 16: China should make up much more than its current ~3% of MSCI All Country World Index in time

Source: BofA, GFD Finaeon.

In a world of uncertainties, EM economies can be the “safe pair of hands” investors need. EM equities offer strong:

- Thematics (many exciting sunrise (and non-AI) industries);

- Stocks (quality businesses and solid earnings growth); and,

- Macro (weak USD + low inflation = more rate cuts)

These positive factors are aligning in 2026. Our view is that EM equities are attractively valued and there are many exciting opportunities hidden in plain sight if investors pay attention!

At Ox Capital, we invest in leading companies in EM countries. We aim to uncover and invest in the corporate champions of the future and deliver attractive performance for our investors.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.