Driving the way forward

Autos going global with accelerating speed

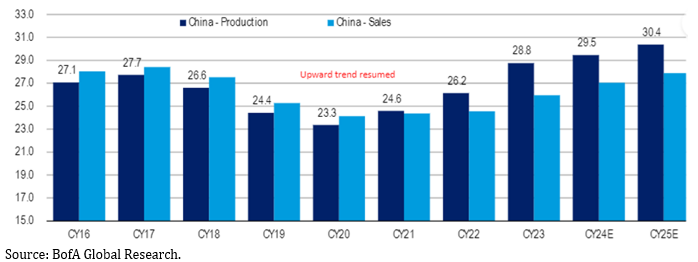

The Chinese economy is sizeable and dynamic. As the property sector experienced a major adjustment, its automotive sector, amongst others, continues to be develop in volume and sophistication, accelerating in the fast lane. The country is now the world’s largest automotive manufacturer and exporter. While sentiment towards this economy remains negative, it may be surprising to know its automotive sector is performing strongly, both domestically and competitive overseas.

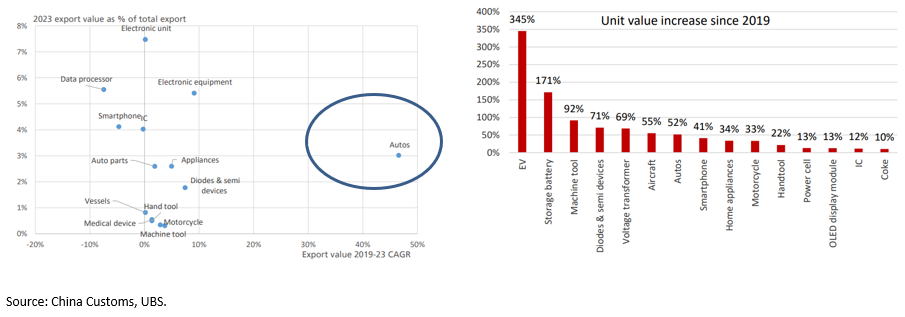

China’s export value has taken off to almost a 50% per annum growth rate from 2019 to 2023. The growth reflects the cost competitiveness and capability of the automotive supply chain, from simple auto components to EV batteries and engines. Given the growth rate and the value of cars compared to other products such as smartphones and appliances, the auto sector is likely to become a much bigger proportion of China’s export mix going forward.

Given the competitiveness of their products, Chinese car manufacturers and brands like BYD, SAIC, GW and the like have carefully invested in their own distribution network in recent years and it is starting to bear fruit. For example, BYD Co built its own cargo ships for its export.

Another astonishing fact is China is the world’s biggest EV market and is home to more than half of the world’s EVs. The car industry inside China is intensely competitive, offering hundreds of EV models to the consumers. This has driven rapid improvement in quality and cost. The lesser competitors are falling behind and this is leading to industry consolidation through which a handful of leaders are emerging.

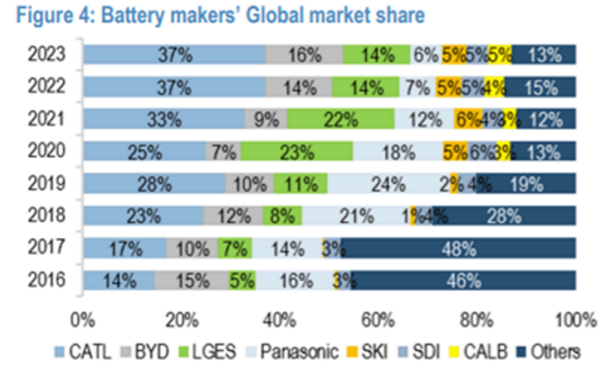

Notably, China’s EV batteries manufacturing leadership is underpinned by self-sufficiency and quality of battery components, such as battery grade lithium, separators, anodes, cathodes, as examples. While capacity outside of China is ramping up, the cost and quality advantage will likely mean that China will continue to play a dominate role in battery materials production.

At OxCap, our portfolio owns companies that benefit from the positive EV thematics. One such company is Contemporary Amperex Technology (CATL), the largest manufacturer of Lithium-ion batteries. The company is a leader in EV and grid storage battery technologies with over 37% global market share. In our view, CATL is well positioned to sustain its market leadership in the battery supply chain.

We note:

- With a significantly higher R&D spend to competitors, CATL has already commercialised wide range of leading products (e.g. fast charging EV batteries in which a 10 min charge converts to 500km range, more efficiency storage density lifting maximum range, battery designs leading to superior safety profile, etc).

- In the high-end, CATL has 80% domestic share in >RMB300k (~AUD60k) EVs, it will continue to benefit as consumers acceptance of luxury EVs continues.

- CATL is expected to further strengthen its presence in Europe with its LFP battery which global competitors don’t offer until 2026/2027, by which time the competitors are not likely to be cost competitive given their lack of volume and experience.

- We believe CATL is at an attractive entry point given it is trading at a 14x earnings multiple, well below its historical average despite its double-digit earnings growth outlook.

At Ox Capital, we are focussed on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.