Did you know? There are many exciting companies and industries in emerging markets.

A common misconception is that investors in emerging markets are limited to traditional old-world industries. This could not be further from the truth – in fact, there are many exciting, cutting-edge industries available to investors in EM.

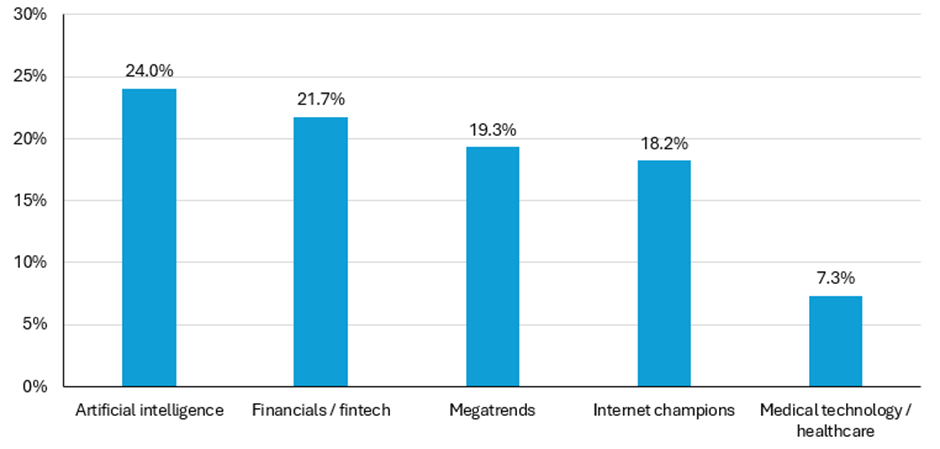

Our portfolio is currently exposed to five major thematics:

Chart 1: Exposure by thematic, Ox Capital Dynamic Emerging Markets Fund, as at July 2025.

Source: Ox Capital Management, as at July 2025.

- Artificial intelligence: the likes of TSMC, Samsung and Hynix are critical enablers of the AI revolution.

- Financials and fintech: young economies such as India, Indonesia, and Vietnam stand to double their GDP in the coming years. Strong domestic banks are great proxies to participate in the rising fortunes of these countries.

- Megatrends: the middle-class population in emerging markets is set to double over the next decade.

- Internet champions: there are many great internet-based businesses at the forefront of their respective industries available to investors.

- Medical technology and healthcare: aging populations and rising wealth will lead to insatiable demand for access to better healthcare in the coming years.

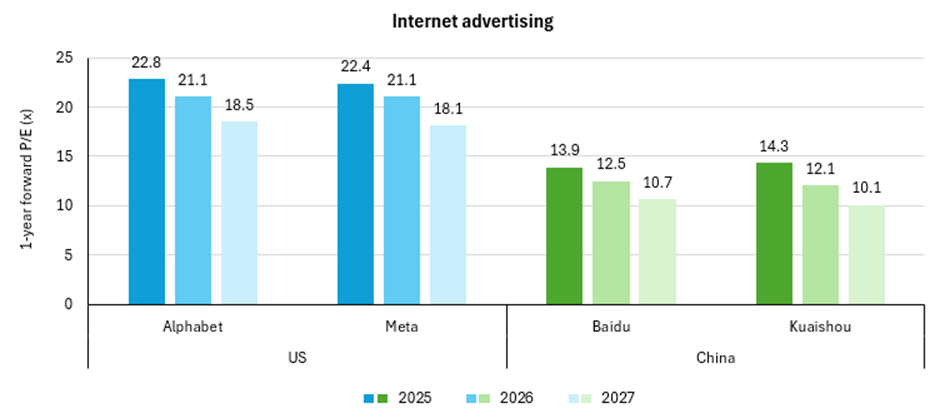

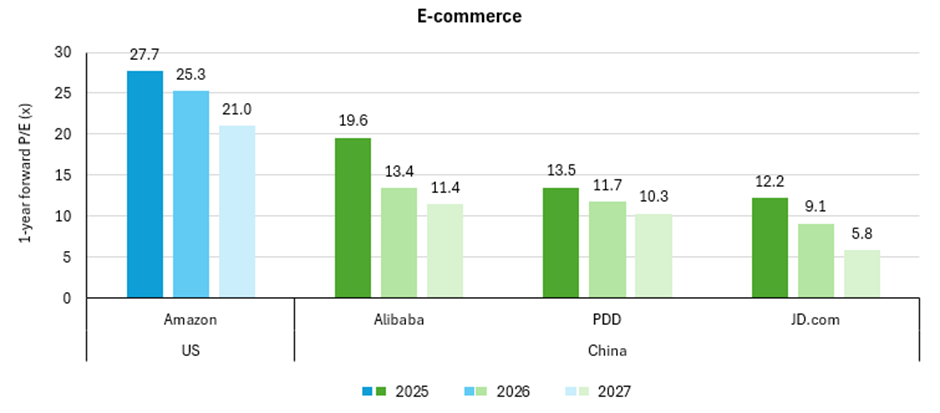

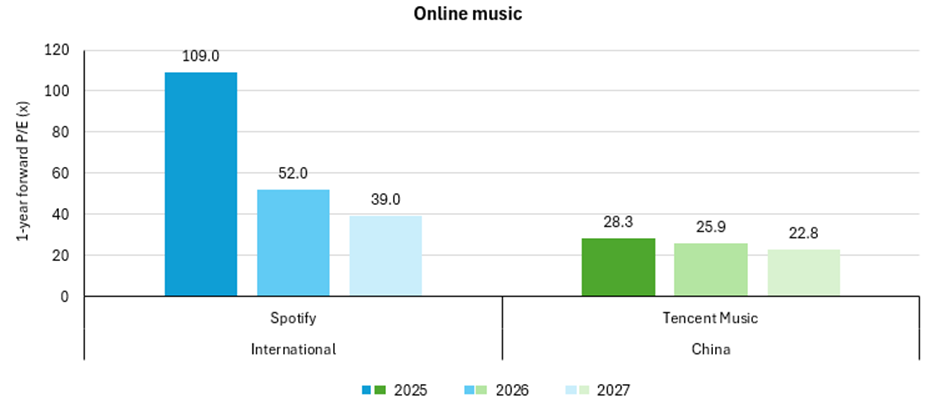

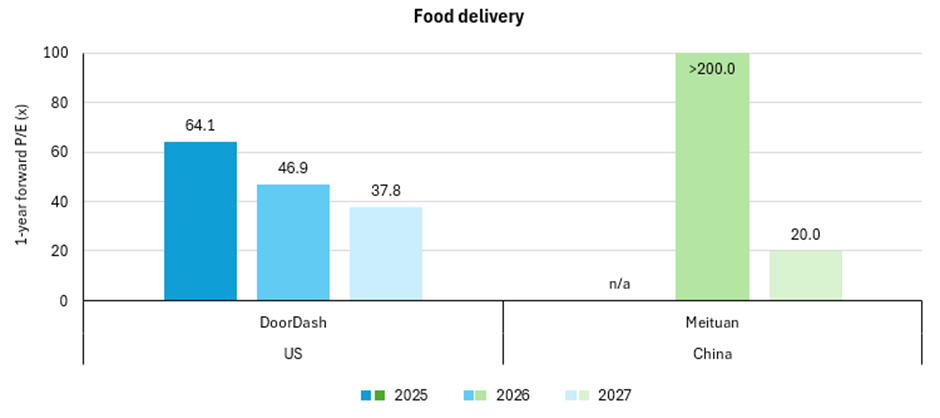

One particularly exciting opportunity for investors is the internet sector in China – despite being comparable in both business quality and long-term growth outlook, many of these internet champions are trading at a steep discount to their counterparts in the US.

Chart 2: 1-year forward P/E ratio estimates for selected internet companies, 2025-2027, as at August 2025.

Source: Bernstein, Ox Capital Management, as at August 2025. This is not a recommendation to buy, sell or hold any financial product, security or instrument.

At Ox Capital, we continue to believe that there are many exciting opportunities available in emerging markets – and that now is the time for investors to sharpen their pencils and consider the opportunities an EM exposure can bring to portfolios.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.