Did you know? Surgical robots are a new sunrise industry in China

Minimally invasive robotic surgery systems are becoming an increasingly common sight throughout the world’s hospitals, offering human surgeons greater precision and control, and human patients a lower risk of complications and faster recovery times. While the industry has historically been dominated by the US-based global market leader Intuitive Surgical, today surgical robots are a new sunrise industry in China. A landmark event for the surgical robot industry in China was the approval of the Toumai robot, produced by MicroPort Medbot, in 2022. In a head-to-head trial against Intuitive Surgical’s Da Vinci robot, the Toumai robot was found to perform as well, if not better, than the Da Vinci robot. In particular, patients operated on using the Toumai robot had a lower adverse event rate following surgery.

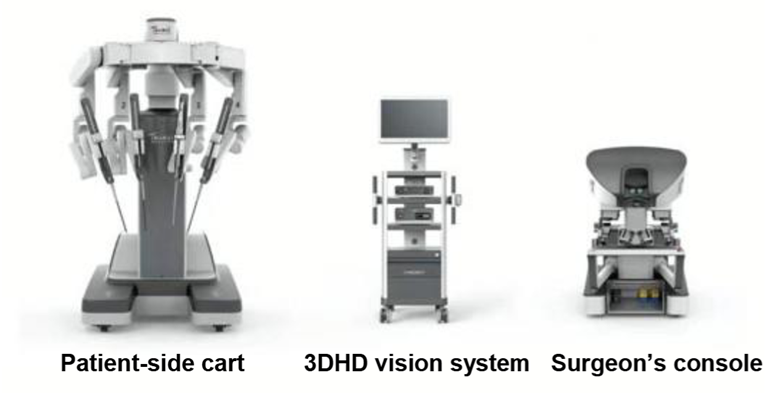

Exhibit 1: MicroPort Medbot robots

Source: MicroPort Medbot.

Exhibit 2: MicroPort Medbot’s Toumai robot in action

Toumai robot overview: https://www.youtube.com/watch?v=1XUskMAukWU

Toumai robot operates on an egg: https://www.youtube.com/shorts/pnW5koekSNY

Source: YouTube, MicroPort Medbot.

Before the approval of the Toumai robot, Da Vinci dominated the market in China. Historically, relatively few robot-assisted surgeries were performed in the country. Da Vinci robots were expensive, as Intuitive exercised its pricing power and charged an “arm and a leg”, figuratively speaking, for its ongoing consumable parts. A lack of insurance coverage for robotic surgeries made the cost prohibitive for ordinary patients.

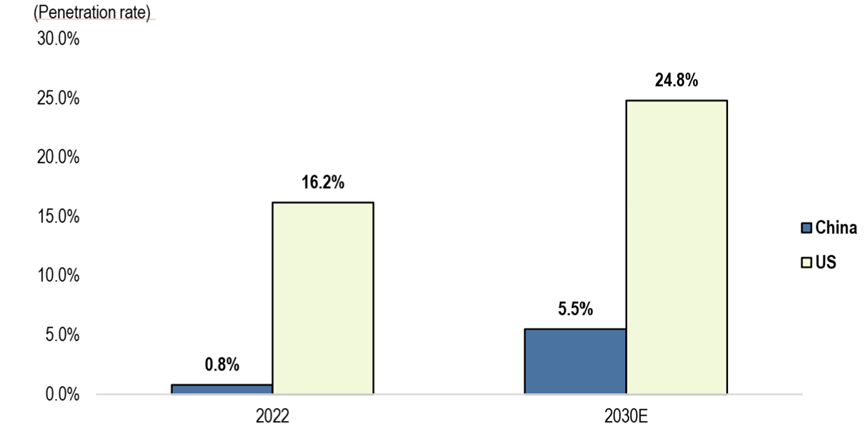

Exhibit 3: Penetration of robotic-assisted laparoscopic surgeries in China were under 1% in 2022, but are expected to grow over 5x in penetration by 2030

Source: Frost & Sullivan.

Now, the availability of cheaper and capable Chinese robots is driving the adoption of robotic surgeries. The approval of Toumai and other domestic robots is finally turning the tide. The consumable cost per surgery for Toumai is at least 25% lower than Da Vinci. We anticipate the volume of robot-assisted surgeries will boom in the years following 2026.

Toumai is part of the next wave of industrial evolution in China, becoming competitive in high-value and technology-heavy industries on the world stage. In certain aspects, Toumai is already even leading Da Vinci. For instance, Toumai has successfully been used to perform over 500 complex telesurgeries, in which human surgeons were as far as 5000km away from the patient, allowing for better patient outcomes outside of major cities.

MicroPort is gaining share where other competitors have struggled. Despite investing hundreds of millions of dollars in recent years, the Hugo robot of US firm Medtronic has not managed to make inroads against Da Vinci. Toumai, though, has already managed to win over 50 orders from hospitals outside of China, winning out over established US brands.

Exhibit 4: Global reach of MicroPort Medbot

Source: MicroPort Medbot.

After finding success in renewable energy, EVs, and batteries, China is continuing to develop new industries that will sustain its domestic economy, as well as benefiting the rest of the world. At Ox Capital, we invest in leading companies in EM countries, including MicroPort. We aim to uncover and invest in the corporate champions of the future and deliver attractive performance for our investors.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.