Did you know? Hidden EM ‘gems’ can outperform gold

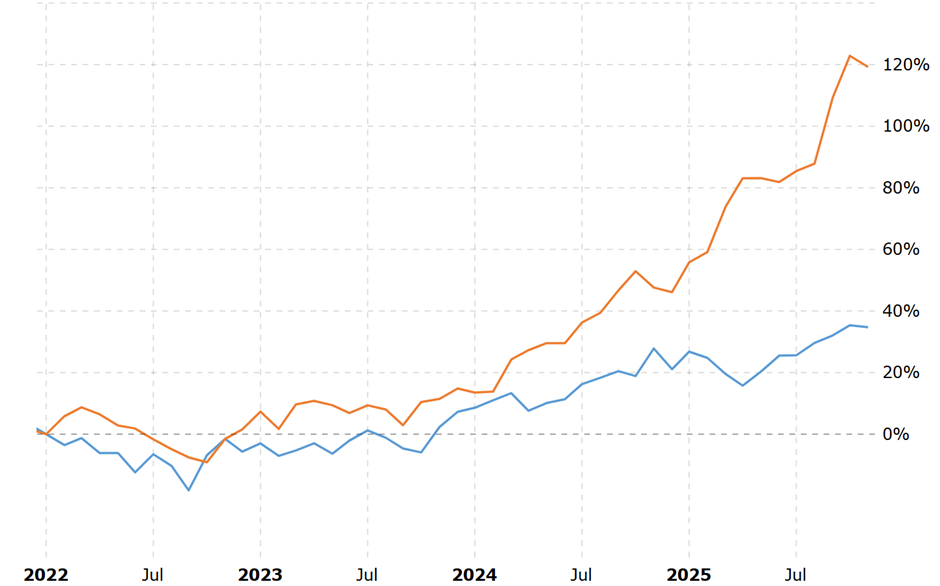

Gold has undeniably been a great investment in recent years. In fact, since 2022, gold has handily outperformed the US-based Dow Jones Index (returning a cumulative 119% versus 35%, respectively).

Chart 1: Dow Jones Index (in blue) performance versus spot gold (in orange), 2022-2025

Source: Ox Capital Management.

In our view, there are two factors behind rising investor interest in gold.

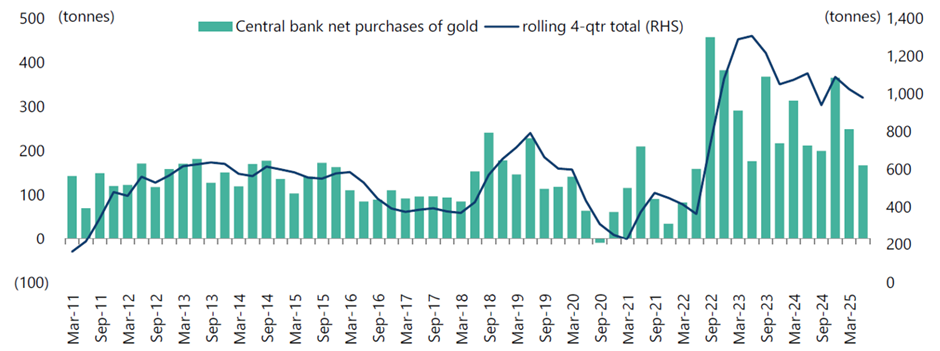

1. Central banks around the world have bought over 1,000 tonnes of gold annually since 2022

The first is that in 2022, as part of sanctions imposed upon Russia following the invasion of Ukraine, the assets of the Central Bank of Russia held in Europe (worth as much as €210bn) were frozen. This drove central banks – especially in non-G7 countries – to ramp up their purchases of gold to diversify and protect their sovereign assets. Central banks have subsequently bought over 1,000 tonnes of gold annually over the past 3 years.

Chart 2: Central banks’ quarterly net purchases of gold

Source: World Gold Council, as at 30 June 2025.

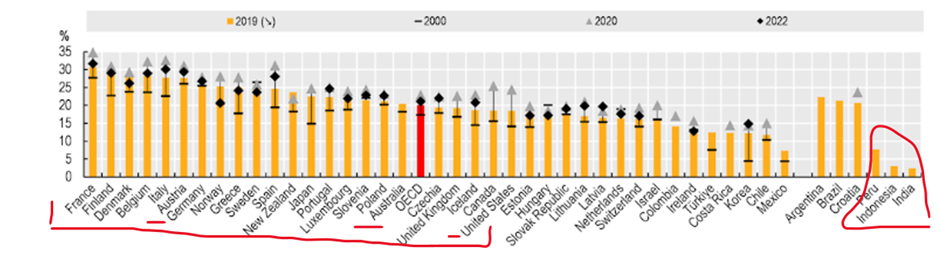

2. Gold as a “debasement” trade

The second factor supporting gold is the so-called “debasement trade”. During the Covid pandemic, developed market (DM) governments expanded their balance sheets through aggressive monetary stimulus and substantial fiscal deficits to support their populations. A notable Australian policy example was the federal government’s JobSeeker Payments. Today, many remain reluctant to implement austerity measures to rein in these deficits, opting instead to sustain fiscal spending – and by extension, living standards – through increased borrowing. Looking ahead, the path of least resistance may well be to debase currencies and inflate away growing debt burdens. As a result, an increasing number of capital pools, including central banks, are turning to gold as both a safe-haven asset and a hedge against major DM currencies such as the USD, JPY, and EUR.

In contrast, many emerging market (EM) countries, having paid a heavy price for past debt crises, have adopted far more disciplined fiscal management than their DM counterparts. During the Covid period, most refrained from excessive borrowing to finance direct handouts. Their central banks have also maintained relatively high real interest rates to contain inflation and support domestic currencies.

Chart 3: Public social expenditure as a percentage of GDP, in 2000, 2019, 2020 and 2022

Source: OECD, Ox Capital Management.

As global investors regain confidence in the stability of EM economies and currencies, or become more convinced of a sustained weakening of the US dollar, EM equities are likely to attract renewed attention from international capital.

Indeed, there are compelling reasons to invest in high-quality, fast-growing companies in emerging markets rather than in gold. The key distinction is that gold primarily serves as a store of value: an ounce of gold held for ten years remains just an ounce of gold. By contrast, ownership of strong companies in EM offers the potential for compounding through earnings growth, dividends, and share buybacks. The key to superior performance lies in identifying and investing in those companies poised to become the corporate behemoths of the future.

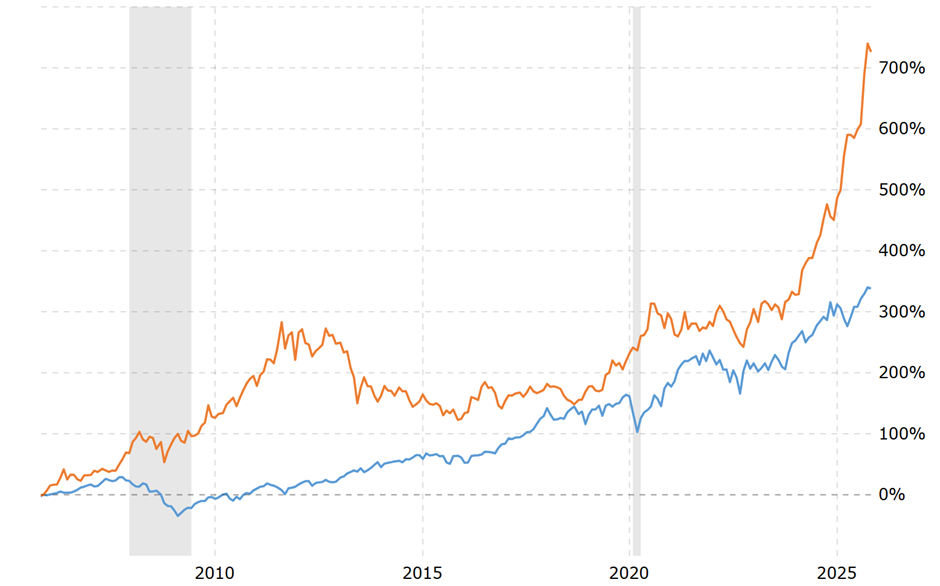

While gold outperformed the Dow Jones Index, for example, between 2005 and 2025, its performance paled in comparison to an investment in the likes of Tencent or TSMC. TSMC produced a 30x return over the same period; Tencent produced a 600x return.

Chart 4: Dow Jones Index (in blue) performance versus spot gold (in orange), 2005-2025

Source: Ox Capital Management.

Chart 5: Tencent share price performance (in white) versus spot gold (in blue), 2005-2025

Source: Bloomberg.

Chart 6: TSMC share price performance (in white) versus spot gold (in blue), 2005-2025

Source: Bloomberg.

At Ox Capital, we invest in leading companies in EM countries. We aim to uncover and invest in the corporate champions of the future and deliver attractive performance for our investors.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.