Did you know? For investors seeking opportunities less correlated to US equity markets, it may be time to revisit Brazil.

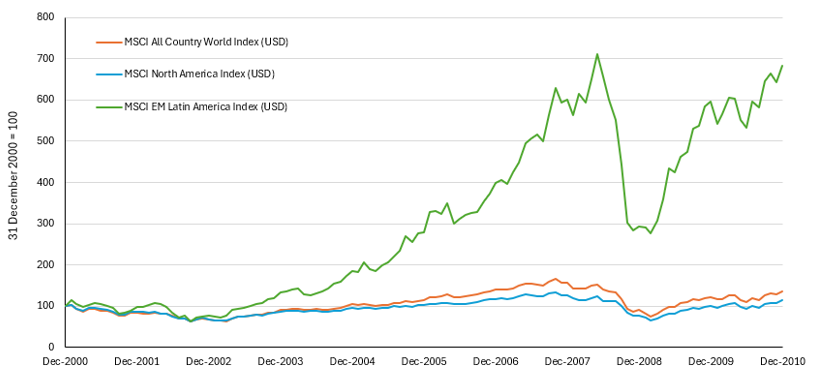

As the US bull market continues, it is prudent for investors to consider opportunities that are less correlated. Latin America (LatAm) has historically offered one such opportunity. From 2001 to 2010, for example, supported by rising inflation and strong commodity prices, LatAm equities significantly outperformed global markets.

Chart 1: Performance of MSCI ACWI, MSCI North America and MSCI EM LatAm indices, in US dollar terms, Dec-2000 to Dec-2010

Within the region today, Brazil stands out as the most compelling opportunity. As the largest equity market in LatAm, its performance is likely to be driven by two key catalysts:

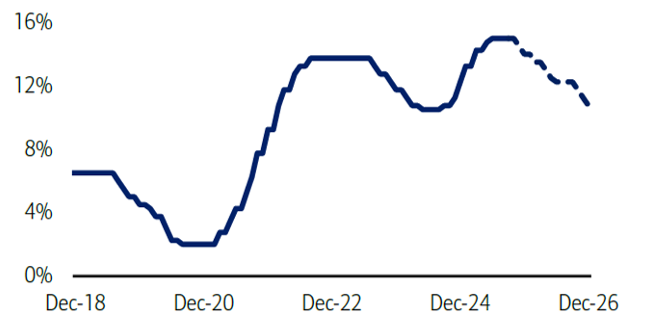

1. Monetary policy easing – Brazil currently has the highest real interest rate in the region (~10%). With policy rates at 15% and inflation running near 5%, we expect a meaningful rate-cutting cycle beginning in late 2025 and continuing through 2026.

Chart 2: Actual and projected Brazilian benchmark (Selic) interest rates

2. Potential for political change – Brazil faces a pivotal election in October 2026. Disapproval ratings for President Lula remain high as economic momentum slows. The leading opposition candidate, Tarcísio de Freitas, Governor of São Paulo, is regarded as pro-business and could help restore investor confidence. A political shift, coupled with monetary easing, could unlock significant upside for Brazilian equities.

Valuations further enhance the case for Brazilian equities, which have meaningfully de-rated relative both to history and other emerging markets.

Chart 3: 1-year forward P/E for Brazilian equities, 2016-2025, and current LatAm equity market valuation summary

The fund is investing in leading Brazilian companies at highly attractive valuations. With macro, political, and valuation catalysts aligning, Brazil offers a rare and compelling investment opportunity that investors should not overlook.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.