China Property: The Adjustment is Mostly Done

The sluggish property sector will be less of a drag to economic activities!

A great deal of adjustment has already taken place in the Chinese property sector. So much so, that in the economically vibrant parts of China, properties are already somewhat undersupplied. At the same time, the Chinese authorities have turned much more supportive of the sector. Hence, the likelihood of property prices rebounding in key cities is increasing. Even if the recovery in the property market proves to be sporadic, given the much smaller scale of the property sector after the shrinkage in activities, the overall impact on economic growth will likely be rather limited going forward.

The property market adjustment was severe as the authorities wanted to successfully change the locals’ view on the property market. Many used to believe that property prices could only go up, now they believe they can only go down! It is understandable why the optimism in the early years transpired, decades of bustling economic growth and urbanisation meant that prices kept going up. What many may not have realised, is the Chinese authorities have been constraining demand for properties for almost a decade by implementing drastic tightening measures, limiting mortgage issuance, and keeping mortgage rates high.

Initial measures were not sufficient to break the prosperous “property culture” in China. More drastic measures were needed, including severely limiting funding from all channels to the developers and more tightening of mortgage issuance. It was a difficult decision to make, but the costs of a property market deflation was more or less expected. It appears to have been worthwhile given an ever-expanding property sector could pose an even bigger risk to the economy in three to five years time. The price to pay is insolvencies and a slower economy.

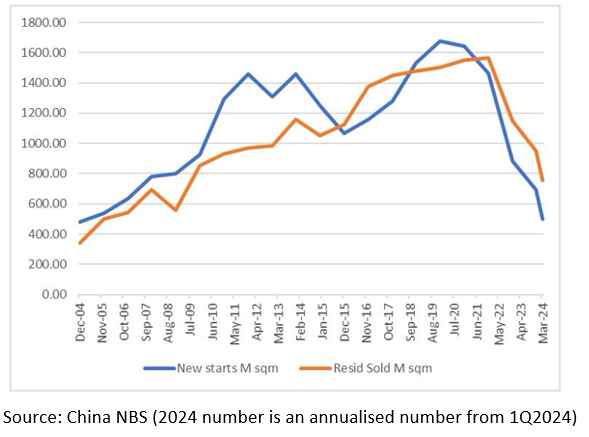

Many property developers have gone bankrupt, property prices have corrected 20-30%, property sales are down 60-70% from peak and new starts declined even more. The degree of adjustment in the property sector has been so significant that it is getting increasingly likely that the sector will stabilise at some point, albeit at a lower level. Property development is not likely to be as prominent of a sector for the Chinese economy as before, while other economic sectors like autos, renewables, semiconductors, and service sectors will take over the reins to drive economic growth.

The fact is, new property build volume has already declined to 2004 lows based on our estimates. Given limited new supply, well-located projects are selling out very quickly, some within a day of going for sale in vibrant cities like Shanghai. Such events in top tier cities highlights the fact that the property market is quickly and dynamically adjusting and there is potential for supply demand to tighten suddenly.

Exhibit 1: China property sales and new starts have decelerated to levels not seen in over a decade

Supply continues to tighten even as the Chinese authorities have turned more supportive of the property market. The meeting of senior Chinese Government officials held on April 30th focused on directly purchasing of unsold apartments (at bargain prices) to repurpose for social housing and limiting land sales. These measures reduce expectation of supply growth and aim to improve confidence in the market.

At the same time, the easing of purchase restrictions and lowering mortgage rates are set to continue to spur demand.

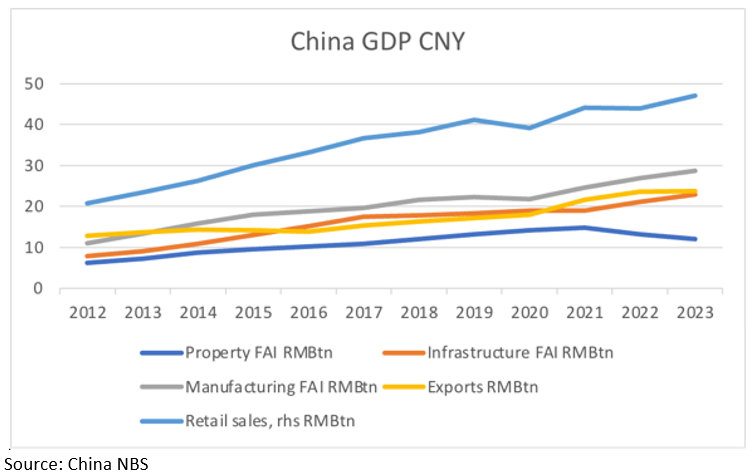

What is surprising perhaps, is the economy’s resilience to a rapid and significant property adjustment. This reflects the diversity and dynamism of the modern Chinese economy. Properties is not the only sector driving activities, other sectors are growing robustly, offsetting the weaknesses in the property sector.

Exhibit 2: The Chinese property sector is not insignificant, but the economy is diverse and robust

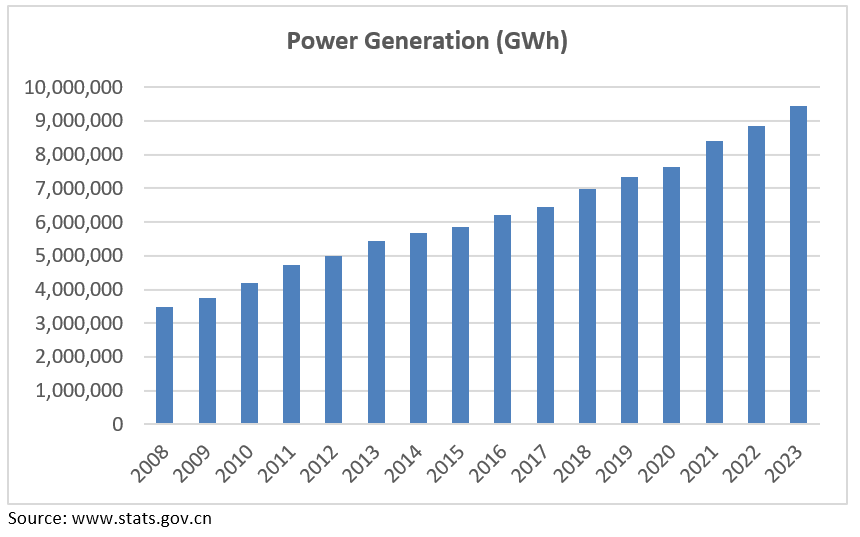

Economic growth will also be fuelled by technological development such as electric vehicles, solar panels, wind turbines, batteries, industrial equipment, robotics, high-speed rail, AI, semiconductors, and continual urbanisation, which is at ~65% only per the National Bureau of Statistics. As China’s GDP per capita is only USD12,500, significantly lower than that of all developed countries, a reasonable base case is that of a GDP per capita significantly higher in five to ten years. Power generation demand, which is highly correlated to economic growth, continues to expand.

Exhibit 3: China Power Generation Continues to Climb Through the Property Adjustment

As the overall economy continues to be resilient, and certainly better than most believe despite the negative sentiment, the supply of new properties has contracted significantly. The authorities are intervening by purchasing a portion of unsold inventory and limiting land sales. Demand is going to rebound as the authorities bolster demand by easing restrictions and mortgage rates. The economy will continue to grow, especially as the population continues to move into the major cities. Soon, we may see a widespread shortage in property supply in the economically vibrant cities. The bulk of the property adjustment pain is in the rearview mirror and property development will continue to be an important industry, albeit a less substantial one in China. The properties will be of higher quality and the sector more sustainable.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.