China Property: Reality vs. Noise

The impact of the property market slowdown on the economy will be limited

The economic impact of the Chinese property market adjustment is mainly through significant volume contraction rather than price decline. Sales volumes and new property development starts slowdown has certainly been a major drag to the economy. Property price adjustments, however, have been relatively moderate, hence the banking system is still very resilient. Given sales volumes and new starts have adjusted so much already, the incremental impact of the property market slowdown on the economy will be rather limited.

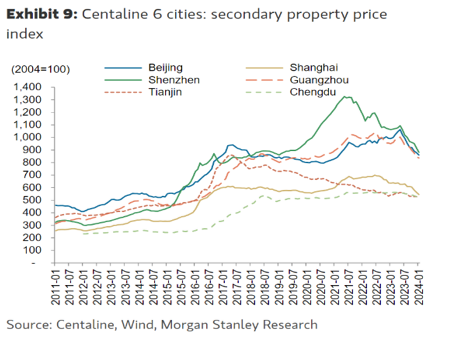

Thus far, the property price decline has been moderate because the property price bubble is not as sizable as popularly perceived. For example, in the economically vibrant top six cities, prices only roughly doubled over 12 years, a 6% per annum growth relative to a generally much faster nominal GDP growth of around 10% per annum during the same period. Property price increase has been rather lacklustre compared to many other economies with much slower income and GDP growth.

Shenzhen was one of few cities that saw a greater level of exuberance. The city is home to a number of leading EV (BYD), major internet (Tencent), financial companies (Ping An, China Merchant’s Bank) and property developers (China Vanke) in China, and property prices did appreciate rapidly. In most other cities in China, the regulator’s efforts to contain prices through macro-prudential measures (interest rates, strictly controlling mortgage approvals, limiting second property purchases, etc…) arguably had an impact on prices. Moreover, the down-payment ratio for properties is high, in many cases above 30%.

The implication is that given the amount of the equity households have in their apartments and the limited price decline in the major cities, property price weakness has had a limited impact on the banking system through mortgage defaults, etc.

The impact of the property price decline is the volume of new properties sold

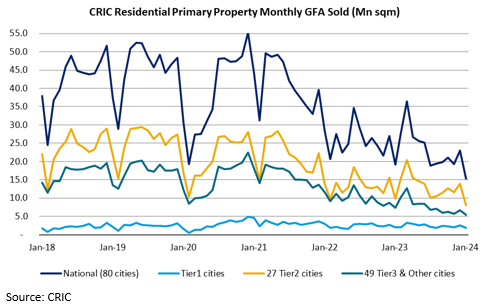

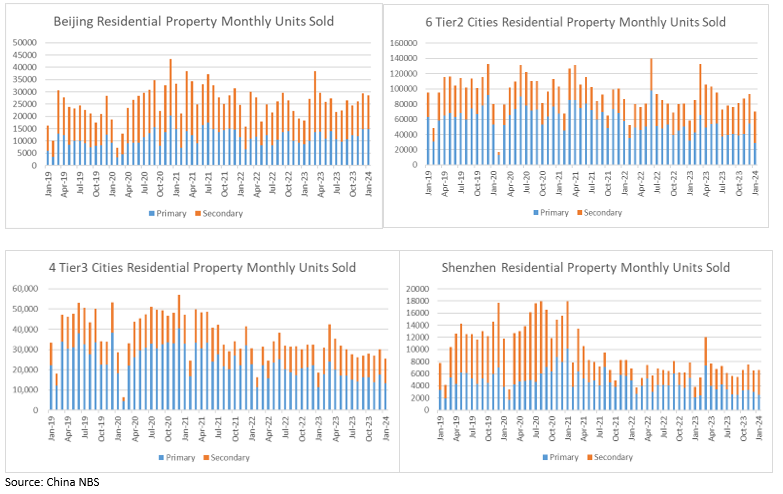

Numbers from various databases and top developers’ contracted sales suggests new property floor space sold declined by 50-60% from peak. Specifically, Tier1 cities’ new property sales have been more resilient compared to lower tier cities. Tier 1, 2, and 3 sold over 2021-2023 were -26%, -39%, -52% respectively.

However, if we consider both new and existing properties (secondary) sold in the more economically vibrant cities, the numbers look less alarming. The strong cities saw almost no change in total properties sold in this downturn if we include secondary properties. The less vibrant lower tier cities, however, did see a meaningful downturn in total sales. Shenzhen, as mentioned previously, was the exception amongst the top tier cities. Both price and volume went up significantly as a result and has since come back down.

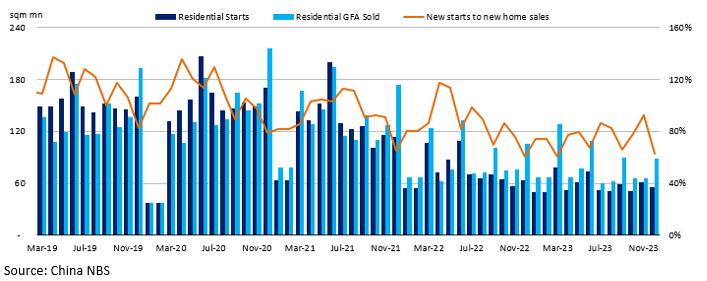

Slower sales volume is impacting construction activities and property developers

Given sluggish demand, property new starts across the country have declined around 65-70% from peak. New starts are annualising around a 5-6M apartments, a small number relative to more than the 300M households in urban China based on our estimates. Replacement and upgrade demand from old buildings ranging in quality built years ago should average a higher number than this. There is a chance of an undersupply in the more economically vibrant Tier1 cities as the cycle turns in a few years.

Property developers have suffered a great deal from mainly sales volume decline. Overleveraged developers have defaulted, and their corporate bonds were marked down significantly almost a year ago. A significant amount of bad news has been factored in the asset prices. Our assessment is the banking system has built up considerable buffers to withstand the fallout from property developer lending and can absorb significant losses.

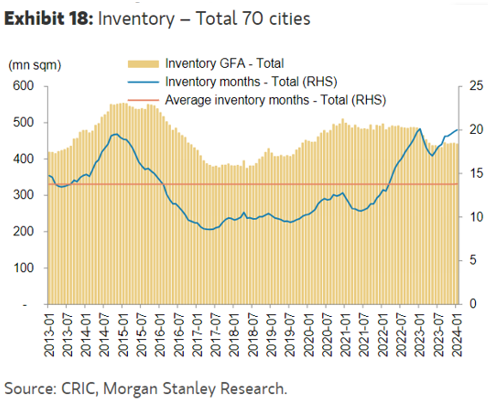

Inventory will take time to digest

A significant range exists for unsold inventory outstanding. According to CRIC (local properties research house), in the top 70 cities, there is 500M sqm or roughly 5M apartment. Some estimates are higher. If demand does not pick up, it will take some time for the inventory to be absorbed. However, the actual number of apartments appears to have been adjusting down over recent years, and the absolute level does not look excessive relative to history.

Anecdotally, the reality is that the higher tier cities probably still have relatively healthy inventory and demand dynamics, while lower tier cities will continue to see a glut of unsold inventories in the foreseeable future.

Conclusion

Volume contraction rather than price decline has been impacting economic activities. The banking system is resilient and continues to provide credit to the broader and dynamic industries ex-properties. Volume contraction continues to depress construction activities and confidence. This is likely a multi-year adjustment process. Government policies (of purchasing old properties for redevelopment) are already in place to help in absorbing some of the inventory, and conceivably can be accelerated if required. Notably, given so much adjustment has already taken place, the incremental economic impact of weak property sector will be much more limited.

At Ox Capital, we are focussed on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.