Brazil’s Bountiful Harvest: A Wealth of Promising Opportunities in 2024

Exploring Alpha Opportunities and Our Strategic Positioning

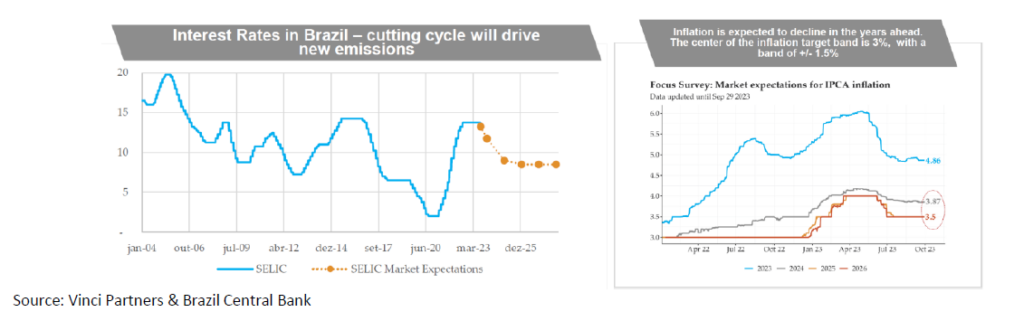

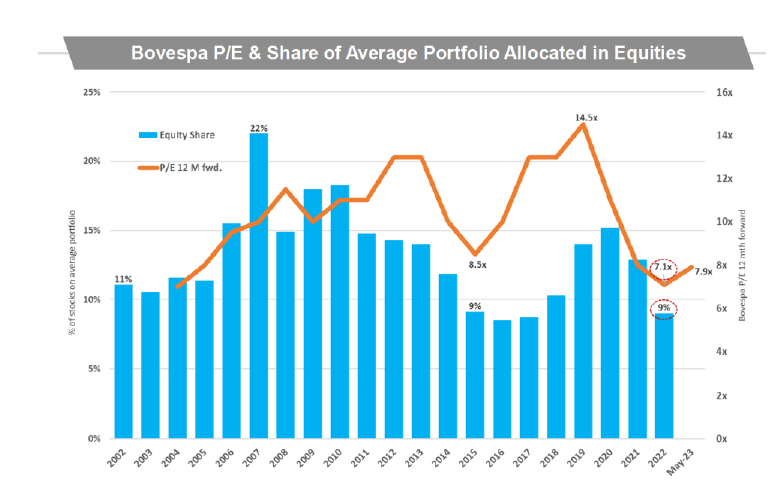

In our view, there are plenty of exciting money-making ideas in Brazil. The country has experienced a super high 14% interest rate until the recent cut. As interest rate starts to decline, the Brazilian economy benefits from a recovery of commodities, as Brazil is a major exporter including soybean, oil, iron ore, and meat. Further, a rapid decline in interest rates from a sky-high level will drive revaluation of equities which are trading on mouth-watering, inexpensive valuations.

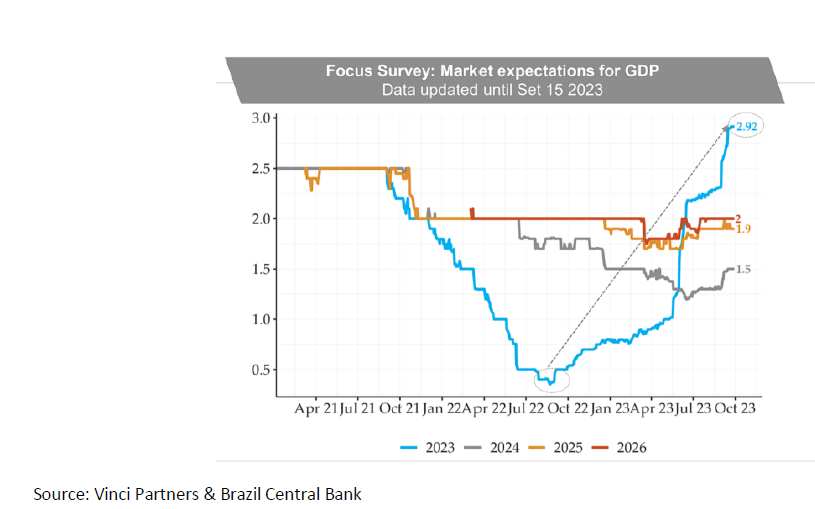

The longer-term fundamentals of the Brazilian economy are robust.

1. Like other emerging markets, many of its sectors are young and the growing economy has needs for its vast population (~214mn) that are fairly well off from an economic perspective.

2. The Lula government is fiscally responsible. The Lula government came into power in October 22. Contrary to initial fear, the new government has been sensible, and it is looking to balance the budget in 2024. Going forward, the government aims to restrict real growth in government expenditures to 70% of growth in tax revenues. In addition, the government is working on multiple tax reform plans to simplify the current complicated tax regime.

3. The sensible fiscal and monetary policies meant that the Brazilian Real has been stable. Inflation has peaked and is expected to fall continuously through 2025.

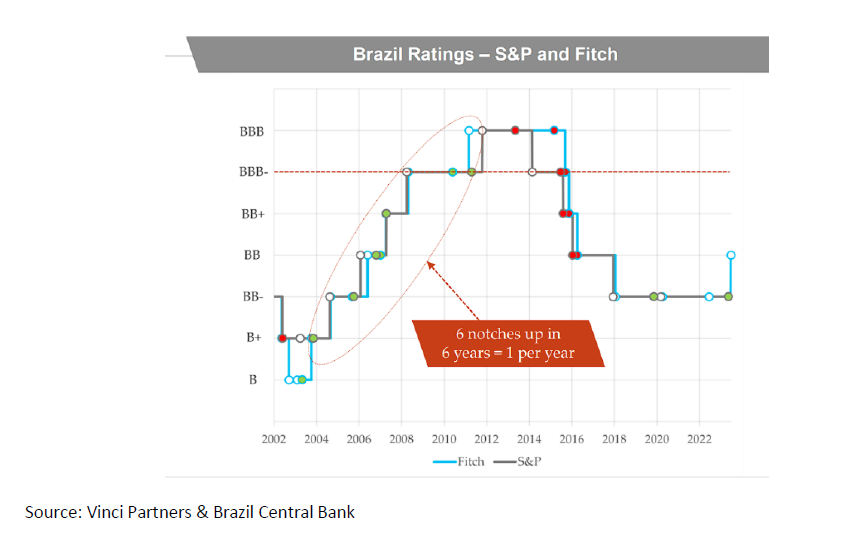

4. In time, if the government maintains its fiscal focus, Brazil may be upgraded back to investment grade. It is currently two notches below.

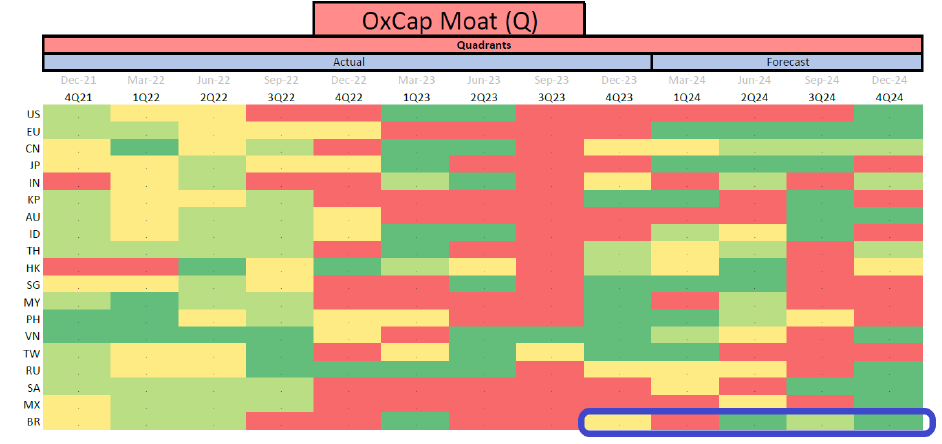

The MOAT and attractive entry point

Valuation of the Brazilian market (Bovespa) has sharply contracted. We are looking at a great entry point with forward price to earnings multiples at depressed levels. Moreover, our proprietary quant model (The MOAT) is pointing to a promising opportunity through 2024, with a clear runway after the first quarter. Time to be on the hunt for quality growth companies in Brazil at attractive valuations.

Source: Vinci Partners & Brazil Central Bank

Source: Ox Capital

How are we investing in Brazil? The bottom-up hunt for Alpha opportunities

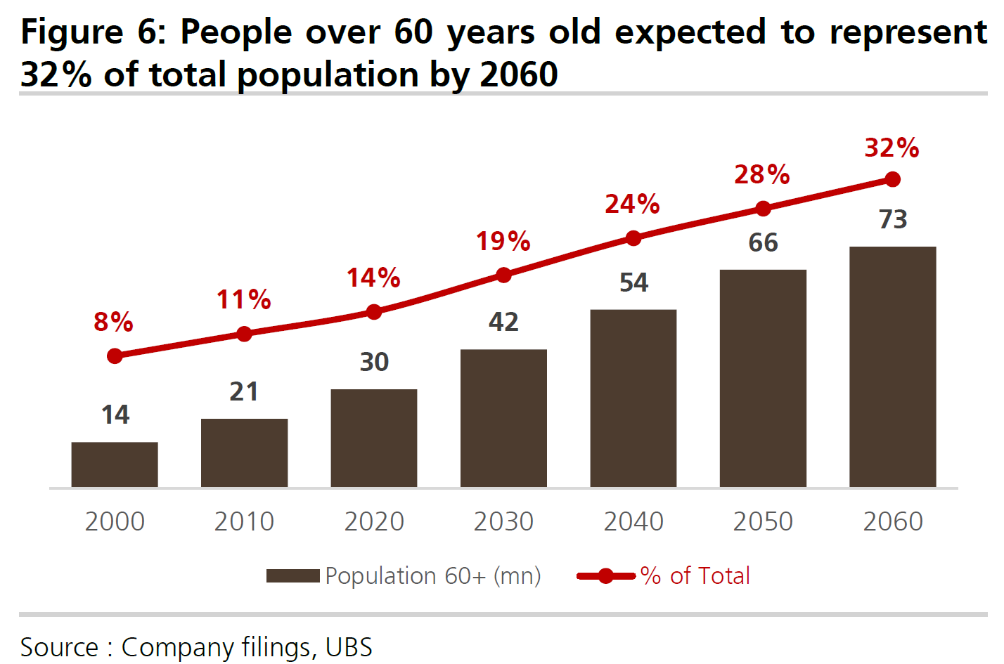

Right now, interest rates in Brazil remain high (12.25%) and the expectation is for rates to be cut to 9% by the end of 2024 as inflation is running at mid-single digits. We are looking for businesses with resilient growth in tough operating environments that will rebound significantly as interest rates come down. We like the healthcare sector (which is a resilient industry in all sorts of economic climates). What is lesser known, is the population in Brazil is rapidly aging (a secular trend).

Given the expectation of rate cuts, an interesting angle is to own names that benefit directly from falling interest rates. Brazil has a nascent equities “culture”, as there are only 5-6M retail investment accounts (out of population of ~214M). We believe the financial services sector in Brazil is prospective.

At OX Capital, across EMs, we look for companies that meet the “QGV” test:

That is, quality companies with a strong, sustainable long-term growth outlook at inexpensive, attractive valuations. For a stock to make it in our portfolio, there is a high bar to clear. We need to be comfortable and confident on the political landscape, macro environment, industry dynamics, company competitiveness, catalysts, and ESG considerations.

We own many names in Brazil, which represents ~7% of the portfolio (just slightly over the benchmark weight) at the end of October. Some examples of our stocks include:

1.Banco BTG is our largest holding at 1.6%. The remaining positions are roughly 0.5-1% each

2.In terms of falling interest rates thematic, outside of BTG, Vinci Partners (leading PE fund in Brazil), Inter & Co (Fintech), PagBank (Fintech).

3. We also own Hypera in Healthcare given positive secular trends.

We will provide a brief overview of a few names below:

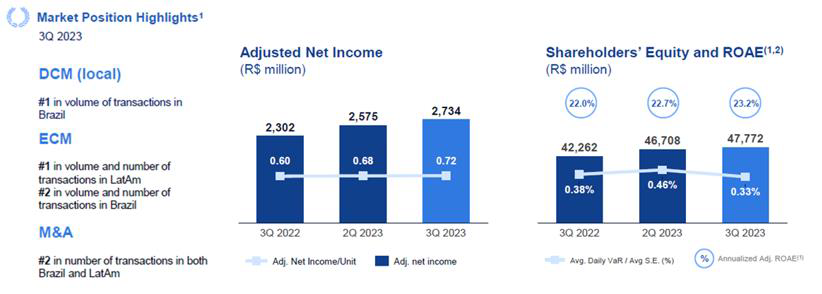

Banco BTG: (1.6% of portfolio weight as of October 31, 2023)

BTG is the number one investment bank in LATAM. The company earned over 20% ROE while net profit increased 27% y/y despite a tough interest rate environment in 2022. Moreover, it is transforming from a transaction driven investment bank to a diversified, resilient wealth manager / asset management business.

On Valuation, the stock was inexpensive relative to historical multiples when we bought the stock at 1.3x price to book versus its historical peak at 3.8x. BTG will continue to see its earnings pick up as interest rates continue to decline in Brazil.

Source: BTG company data

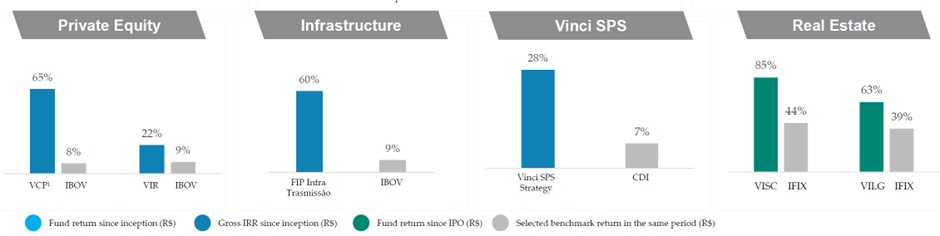

Vinci Partners:

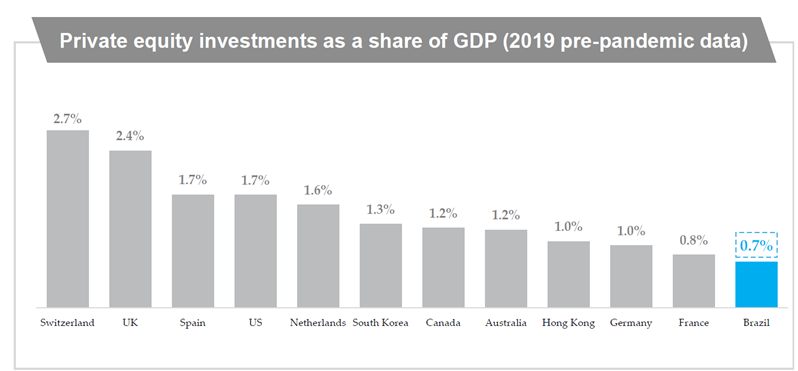

Vinci is one of the leading private equity funds in Brazil. It is set to benefit from 1) deepening financial services in Brazil, and 2) the declining interest rate environment will increase the demand for investing in financial products. Historically, Vinci has been a very strong performer with more than a 50% IRR for its PE/infra funds since inception. In addition, there is a secular story of under allocation to private assets in Brazil by the pension funds and it has recently partnered with Ares. Valuation is very attractive, is expected to grow strongly, and half of its market value is cash/investments earning +8-9% yields.

Source: Vinci Partners & Brazil Central Bank

Hypera

Hypera is Brazil’s leading retail drug manufacturer. The pharmaceutical industry is a highly profitable one in Brazil in which the majority of drugs are generics. Barriers to entry is high as new drugs can take up to two years before approval is granted.

We believe Hypera has many competitive advantages as:

It is a consolidator of the industry in Brazil, buying up new drug brands.

•It is an extensive R&D pipeline of drugs to be the first to market.

•It has pricing power, regularly putting through price increases in line with inflation.

•It has the best-in-class pharmaceutical distribution network in Brazil

It is also diversifying from its retail root to the hospital channels. This new category makes up 20% of sales at the moment and will grow rapidly in the coming years.

Valuation is inexpensive, trading at 10-11X price to earnings multiple and is generating a 3% dividend yield. It is a powerful EM consumer play, capable of growing 10-15% a year through time.

At Ox, we are focussed on the quality companies with long term growth at inexpensive valuations. Current valuation is providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities.

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.