2024 Outlook: An Inflection Point for Emerging Markets

How we view the world and how we are positioned to win

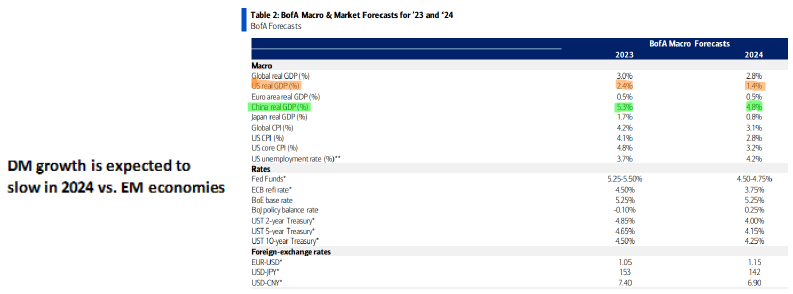

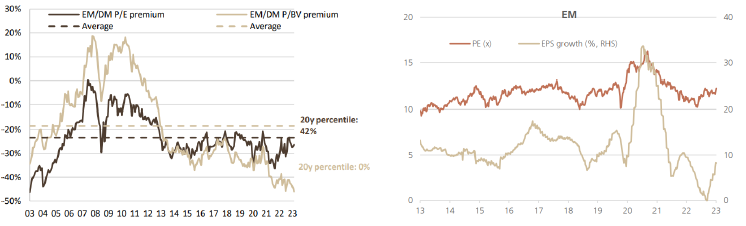

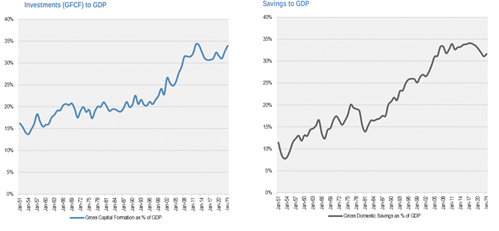

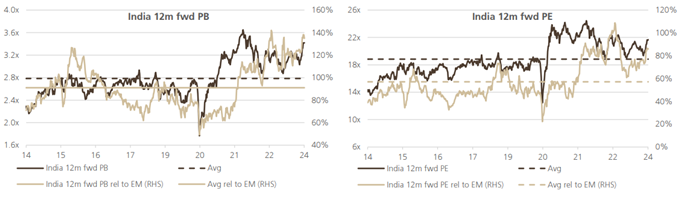

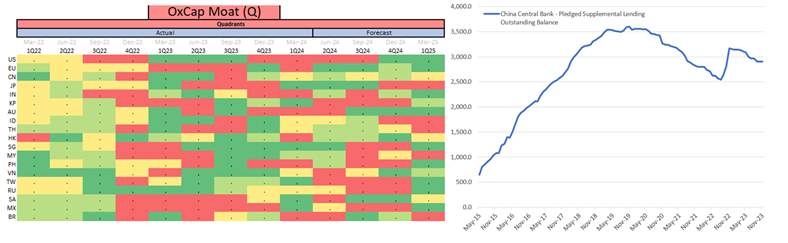

Welcome to 2024, the Year of the Dragon in the Chinese Zodiac. We believe the fundamentals are in place for emerging markets (EM) to outperform developed economies (DM) in the coming year. Many EM central banks, with a few exceptions, were first to react to combat inflation by shifting monetary policy and tighten financial conditions. As a result, many EMs were the first economies to loosen monetary policies in 2023 which will support growth in 2024. In contrast, growth outlooks for developed economies are expected to slow. US rates have peaked. We believe a slowdown in growth for the US is going to lead to interest rate cuts. Our proprietary quant model (the MOAT) is pointing to a mixed environment for many developed markets into 2024, versus an improving outlook for many EM countries. Moreover, emerging markets are at a multi-decade low in relative price to earnings and price to book valuations compared to developed markets, and earnings growth is likely to rebound. In this report, we outline our key expectations and themes across emerging markets in 2024 and how we are positioned.

Infection point on the horizon for Emerging Economies

Historically, the year of the dragon has been a momentous year for Asian equities performance and Asia constitutes the majority of the MSCI EM index. We are looking at an attractive entry point with forward price to earnings multiples at depressed levels for quality companies with sustainable long-term growth and a backdrop supportive of outperformance. Moreover, many EM economies are undergoing continued economic development and political reforms. We believe the fundamentals are in place for emerging markets to outperform developed economies in the coming year as we enter a positive backdrop in 2024. Inflation is trending lower in many EMs allowing for central banks to cut rates, such as in Vietnam and Brazil cutting interest rates multiple times in 2023.

As pictured, the Dragon (China) is leading the way while pulling a cart of animals representing emerging markets in our portfolio, such as the Water Buffalo (Vietnam), Komodo Dragon (Indonesia), Jaguar (Brazil), Panda (Hong Kong), Eagle (Philippines), and Tiger (India). We believe this graphic illustrates expectations for EMs in our portfolio for exciting money-making opportunities across EMs now as headwinds are turning into tailwinds for many markets! We remain optimistic for companies and outlooks in 2024 as the dots are connecting for outperformance for emerging markets.

Theme 1: Slowing DM economic growth.

In 2024, growth in develop economies is expected to slow as rates have likely peaked. In contrast, despite recent economic challenges, the Chinese economy is expected to grow much faster than the US, Japan, and Euro Area. Although China’s growth is lower than in recent years, its economy is showing signs of bottoming, on the back of the Chinese authorities showing a willingness to stimulate and support the economy. Keep in mind interest rates in China are low with minimal inflation relative to the rest of the developed world. A positive set up for equities in the year ahead. Moreover, Emerging countries make up the bulk of global growth, contributing to ~60% of global GDP, but is under appreciated by global investors. Clearly, emerging markets are much more than just China, as it includes markets like India, Southeast Asia, South America etc.

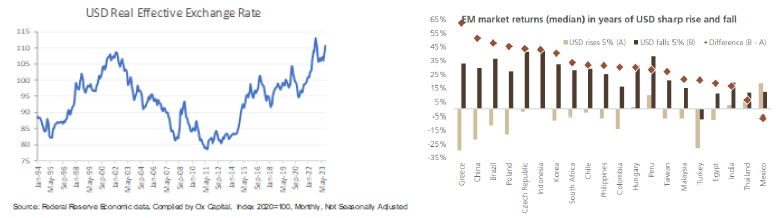

Theme 2: A weaker greenback (USD).

The US interest rate hikes by the central bank (Federal Reserve) has driven a stronger US Dollar. The recent strength of the “greenback” has been a headwind for emerging economies. This is logical as a stronger dollar can impact capital flows, trade, direct investment, and can impact credit growth. We believe a peaking USD will provide a tailwind for emerging market equities.

Theme 3: Thawing geopolitics.

There has been a ramp up in high-level dialogue between Beijing and senior officials from both the US and Australia, which we believe is a clear sign of thawing relations after more than three years of minimal contact. We believe the US-China relations is also in the process of thawing, especially post the recent meeting between Xi and Biden at the San Francisco APEC Meeting. The increase in dialogue from Beijing shows a willingness to mend ties, despite tension from both sides recently. Moreover, President Xi Jinping stated to a US Senator during a visit to China “a thousand reasons to make US-China relations better, and no reason to make them worse”. Indeed, the recent meetings provide the foundation for further optimism of ongoing dialogue. Nevertheless, it is likely that continued technological competition will remain. In our view, the recent meetings show an intention to restore bilateral relations and reduce near-term risk of escalatory confrontations. With the economy a top priority, China is adopting a pragmatic approach to dealing with geopolitical questions.

Theme 4: Supply chain reconfiguration.

A wave of current global supply chain reconfiguration, boosting some EMs GDP growth through foreign direct investments, propelling an increasingly urbanised society. Vietnam is a notable beneficiary of this trend. Greater foreign direct investment into an ever more open and market driven economy, with some of the most comprehensive free trade agreements in place globally, is providing strong employment opportunities for this young and vibrant country. In turn, consumers are demanding higher quality goods and services, in an increasingly modern setting as they also grow their purchasing power. As such, we believe this backdrop provides a foundation for alpha generating opportunities.

Theme 5: Sustainable growth at mouth-watering valuations

Emerging markets are at a multi-decade low in relative price to earnings and price to book valuations compared to developed markets, an important fact given EM equities has historically outperformed developed market over the long-term. The recent period of underperformance, largely over the last 10 years, is an outlier in our view. We believe the underperformance is largely due to over-indebtedness and high starting valuations over a decade ago in emerging markets. The picture at present is vastly different. Fiscal balances are healthy while debt to GDP ratios are at stable levels. Corporates are in a healthy position, with lower leverage and stronger balance sheets than many counterparts in developed economies.

Market Commentary: Some EMs more promising than others in 2024

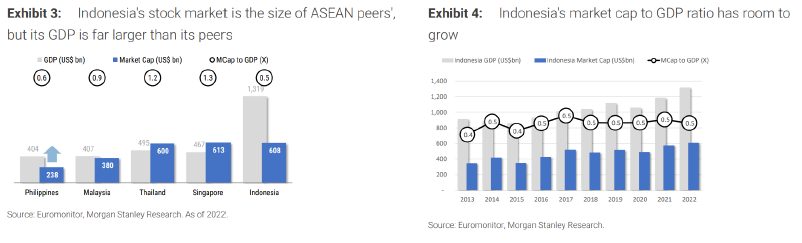

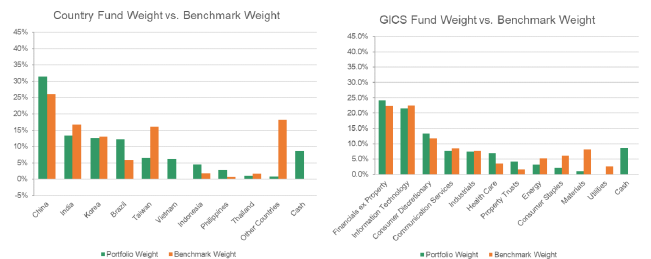

Emerging countries make up the bulk of global growth, contributing to 60% of global GDP, but is under appreciated by global investors. Ox Capital is currently over-weight China, Indonesia, Vietnam, and Brazil and underweight India, Taiwan, and Korea. We are predominantly focused on the bright spots in emerging markets where the environment is ripe for outperformance.

China (The Dragon) set to rebound; attractive entry point: The Chinese market has been on a multi-year transition from an investment led economy to one that is driven by high value industries and consumption. Despite a slowing economy coming out of COVID in 2022 and collapsing property sales, China’s GDP grew more than 5% in 2023. After a three-year bear market, Chinese equites are well-and-truly out of favour. However, we believe the various economic headwinds are well-understood and manageable. Many new policies and initiatives in China are being introduced to support and stimulate the economy and reducing its reliance on the property sector for growth. It also had to cope with heightened geopolitical pressure and has spent the last few years purposefully reforming the economy. While the Chinese economy is facing multiple headwinds, quality businesses will continue to grow and become champion businesses in coming years. Right now, it is an opportunity to invest and take advantage of the very attractive valuations. While the economy is growing slower than in prior years and facing some challenges, the overall economy is resilient and there are plenty of pockets of strength. Our view is the economy is bottoming and has the fundamentals to outperform:

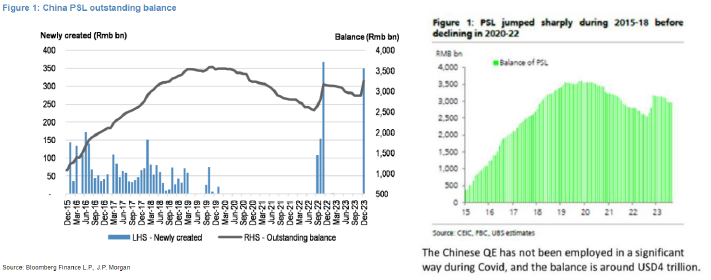

–Stimulating confidence: Our base case has always been the Chinese authorities would continue policy easing. On top of the loosening of policies in property market and expansion of the Central Government fiscal deficit, the Chinese Central Bank plans to provide at least RMB1 trillion of pledged supplemental lending (PSL, the Chinese version of QE) to better support and restore confidence in the economy. The sum is likely to be spent on urban renewal projects and affordable housing programs and infrastructure across the nation. This is positive to Chinese equities, as it signifies a willingness of the authorities to support economic growth if needed. In prior periods, when the PBoC intervened via PSL, it successfully restored confidence and revigorated the property market. PSL was gradually curtailed post 2017 during China’s deleveraging campaign.

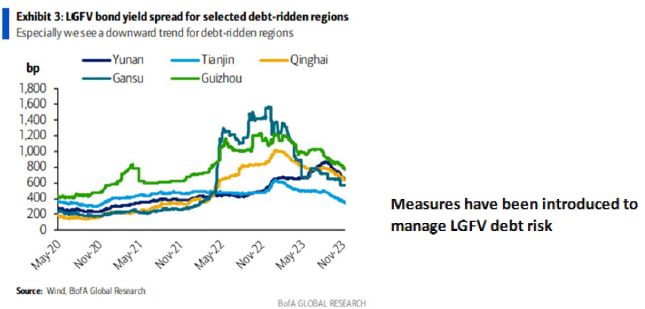

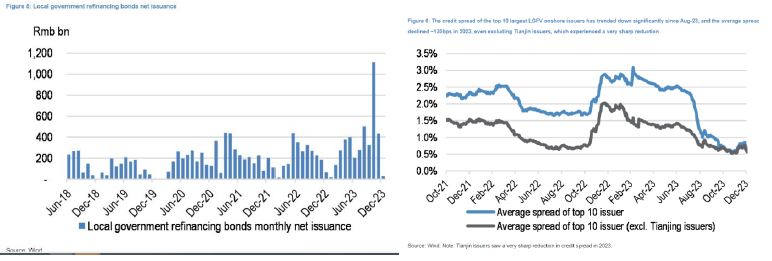

–The banking system remains well capitalized and resilient. The current situation in China is far from that of a crisis. The global financial crisis more than a decade ago in the developed economies involved gargantuan banking system losses and amplified by derivative instruments. The Chinese banking system remains solid and resilient despite controlled implosion of the property sector by the government. In addition, many measures (debt swap of as much as Rmb1.3trn, debt restructuring, and cap on new debt issuance) have been introduced to defuse local government financing vehicle (LGFV) risks. These measures are heading in the right direction. LGFV bond yield spread for several fiscally weaker regions are tightening. Further, as the vast majority of losses are denominated in RMB, the printing press can be readily cranked up if required (the PSL).

Although the “hidden debt” of the Local Government Funding Vehicles (LGFV) is a large sum totalling USD7 trillion, it is manageable, and the magnitude is well-understood by investors and regulators. The regulators are pursuing a combination of austerity, debt restructuring, assumption of debt by the central government and potentially money printing to tackle the problem. These initiatives should gradually work to reduce potential issues over time. LGFV relief programs have contributed to a decline in the LGFV bond credit spreads despite the potential liquidity risk from the real estate sector and rise in trust defaults.

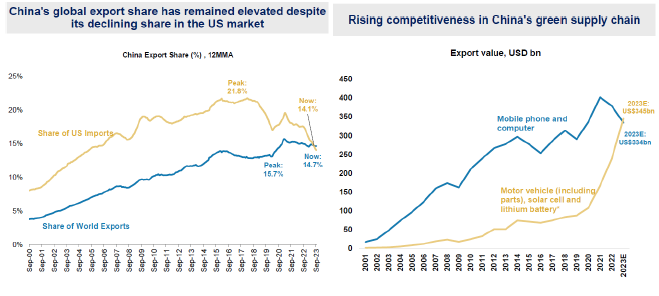

–A key player in global supply chains. China’s manufacturing base remains second-to-none and cost-competitive versus alternatives. China will remain a key part of the global supply chains, in our view. New industries such as electric vehicles, renewable energy and automobile have become new drivers for export. China is diversifying exports towards the BRICS countries of the global south and remains the biggest exporter in the world.

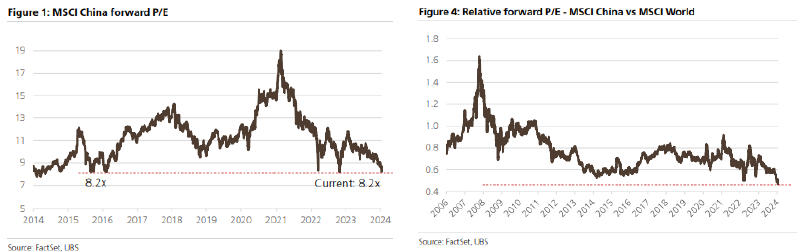

In 2024, GDP is expected to grow between 4.5% to low 5.0% range. Despite this, valuation for quality Chinese companies with sustainable growth are trading at mouth-watering, deeply discounted valuations. Chinese equities are trading near recent troughs in 2016 when there was enforcement to restrict the shadow banking industry as well as the recent sell off from ADR listing concerns in 2022. As such, relative forward price-to-earnings multiples are at historic lows vs. the rest of the world, even when comparing to emerging economies. We have seen this playbook post the GFC in USA and Europe in the past decade. In hindsight, it was a great time to own the quality growth businesses like Google and Amazon when the US market was valued at highly attractive valuations in 2009. We believe similar amazing opportunities are available in China right now!

In our view, the problems facing the Chinese economy are manageable. We believe long term investment opportunities for China are under appreciated and the market is underestimating the changes and transformation happening across the Chinese economy. The outlook is further supported by the rise of new industries and other EM regions. The breakneck pace of development and technological advancement at the company level will build many new champion businesses in China. China’s depressed equities valuations, and by implication its equity risk premium is already so high that risk reward remains attractive despite the economic adjustment the Chinese economy is undertaking.

Despite headwinds, the huge domestic market continues to grow. Importantly, real income for the consumers is growing, but with the weakness of consumer confidence has led to an excess in personal savings levels. Notably, confidence can quickly re-ignite consumer spending. In the meantime, we are focussed on strong businesses with solid positions within the country that are still enjoying long term growth. Businesses like Tencent, Tencent Music or Kuaishou, all of which have an abundance of levers to pull by virtue of its dominance in the to maintain decent growth rates even in a slower economy.

Brazil (The Jaguar): Set-up for a bountiful harvest: A wealth of promising opportunities. Brazil is a growing, vibrant, commodities rich country, with a vast population (~214mn) that are fairly well off from an economic perspective. Brazil has had a high interest rate of almost 14% until the recent cuts, and now stands at 11.75%. As global interest rates start to decline, the Brazilian economy stands to benefit from a recovery of commodities, as Brazil is a major exporter including soybean, oil, iron ore, and meat. Further, a rapid decline interest rates from a sky-high level will drive revaluation of equities which are trading on attractive valuations. The longer-term fundamentals of the Brazilian economy are robust:

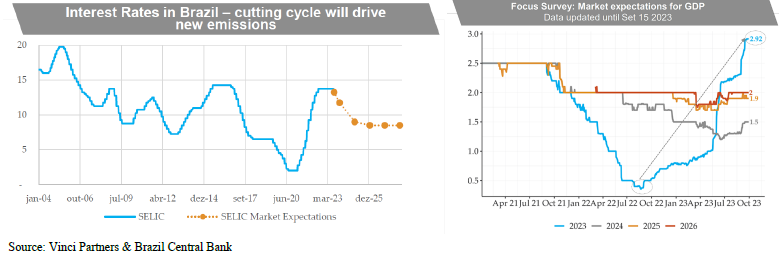

–Rate cuts to continue: Inflation in 2023 fell to within the central bank’s target for the year in a range between 1.72% to 4.75%. Notably, the official policy interest rate (SELIC) was cut four consecutive times from 12.25% to the current 11.75% and has fallen from its peak of almost 14%. The sensible fiscal and monetary policies supported the currency. Inflation has peaked and is expected to fall continuously through 2025. Given cooling inflation in the region, we expect interest rates to continue in 2024 to at least 9%. Please note there will be a change at the end of 2024 as the President of the Central Bank of Brazil (Campos Neto) will be replaced. Only two out of the Nine Monetary policy committee (Copom) members are from the pre-Lula administration which may result in changes to official policy if there is a political shift.

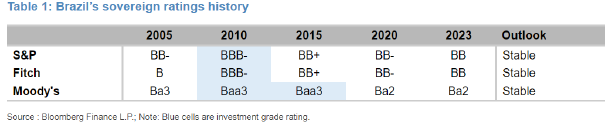

–Improving credit outlook: Recently, the S&P updated Brazil’s credit rating to BB from BB- and cited recent tax reforms as one of the main reasons for the upgrade. Although still below investment grade, it is a move in the right direction for the country’s outlook and its treasury has stated investment grade is the objective by the end of term for President Lula. While the country has been growing better than expected recently, the ratings agencies would like to see debt levels reduce. In time, if the government maintains its fiscal focus, Brazil may be upgraded back to investment grade. It is currently two notches below.

–The Lula government is fiscally responsible: The Lula government came into power in October 22. Contrary to initial fear, the new government has been sensible, and it is looking to balance the budget in 2024. Going forward, the government aims to restrict real growth in government expenditures to 70% of growth in tax revenues. In addition, the government is working on multiple tax reform plans to simplify the current complicated tax regime.

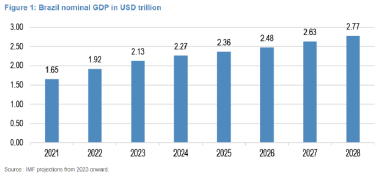

–GDP growth: Brazil’s growth has moderated since 2021 (5%) but is expected to be 1.5%-2% over the next few years with the IMF’s expectation on the lower end of that range. It is important to note the fact that the Brazil economy has surprised to the upside over the last three years and is one of the world’s top 10 biggest economies, surpassing Canada. In fact, the IMF believes Brazil’s economy (nominal GDP) can grow almost 70% in the next five years. That would put its economy only behind India (in USD) and would put it at roughly the eighth largest economy in the world. A very promising outlook if the scenario comes to fruition.

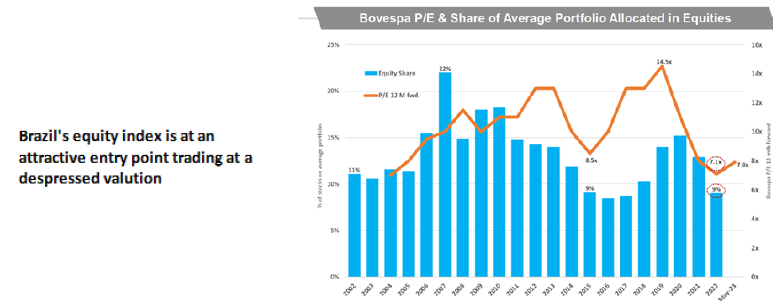

–On valuation, the Brazilian market (Bovespa) has sharply contracted. We are looking at a great entry point with forward price to earnings multiples at depressed levels

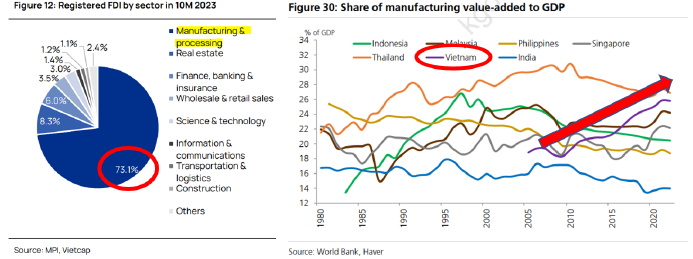

Vietnam (The Water Buffalo): A warehouse to the world. Vietnam is riding the wave of current global supply chain reconfiguration, boosting its GDP growth through wider manufacturing capacity and enhanced productivity, propelling an increasingly urbanised society. Greater foreign direct investment into an ever more open and market driven economy, with some of the most comprehensive free trade agreements in place globally, is providing strong employment opportunities for this young and vibrant country. In turn, consumers are demanding higher quality goods and services, in an increasingly modern setting as they also grow their purchasing power. With a population of just under 100M people, and a urbanisation rate of under 40%, Vietnam reminds us of China ~15-20 years ago. That is, there is substantial room for growth in its urban population, as foreign direct investment into the country continues, GDP per capita rises, and in turn consumption amongst its increasingly large middle-class population increases. As such, we believe this backdrop provides a foundation for alpha generating opportunities.

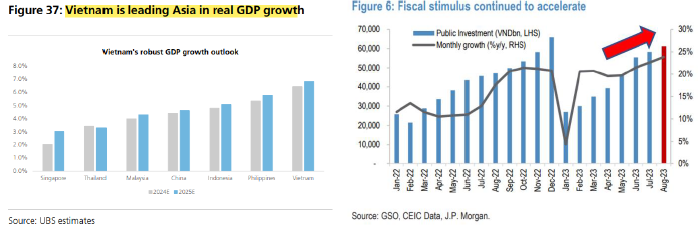

–Cutting rates: Unlike many counties around the world, Vietnam has been able to cut its policy rate four times in 2023, supported a strong current account surplus and continued FDI disbursement, and is expected to grow GDP at just under 5% in 2023, following growth of over 8% in 2022 and is expected to accelerate above 6% growth in 2024.

–Solid FDI growth: Vietnam has been successful in its ability to continue to attract a greater number and scale of foreign direct investment (FDI) into the country in 2023. Vietnam has attracted ~U$29B in FDI commitments in the first eleven months of 2023, representing strong growth of 15% from a year ago. Commitments have been seen across thousands of projects, of which ~25% are coming from new FDI projects into the nation. Recent strong FDI commitments will support Vietnam’s ability to continue this journey of industrialisation going forward, boosting exports, supporting capital expenditure by companies on the ground, whilst also creating new jobs.

–Manufacturing powerhouse to the world. Vietnam’s ability to continue to attract significant FDI flows, even amidst the current global environment, is proof of the increasing competitiveness of Vietnam’s manufacturing sector amongst global supply chains. Such support for the manufacturing sector, from which the majority of FDI is directed into, importantly provides further confirmation of investors’ confidence and expectation going forward, that Vietnam will remain a highly attractive and productive location for capital deployment. Notably, while FDI businesses make up just over 3% of all companies registered in Vietnam, they contribute nearly 19% of GDP and over 35% of jobs reflective of their outsized importance to Vietnams development.

–Increasing production demand. We have seen announcements from companies such as Apple, and its key component manufacturers such as Hon Hai, Foxconn, Luxshare and Goertek, who are moving manufacturing to Vietnam with increasing frequency. Key production of the AirPod and more complex products such as the Apple Watch and iPad are planned to be increasingly offshored to Vietnam over the next 3 years.

–Extensive Trade Agreements in place already. Vietnam’s obvious locational benefit, in close geographic proximity to China, continues to be enhanced by greater regional and country-based partnerships and free trade agreements (FTA). Vietnam has one of the most comprehensive sets of regional and country specific agreements. As exhibited below, comparing agreements in place across key Asian nations, Vietnam is one of the most inclusive trade partners in the region.

–Public Spending Accelerating. In addition to strong FDI growth in 2023, greater policy support from the Vietnamese government through accelerated public spending, extended tax cuts to VAT on goods and services into mid-2024, and meaningfully lower interest rates, will provide tailwinds to domestic driven demand into 2024. Public investment grew by 36% over a year ago to November 2023, accelerating in the last quarter of 2023, as is typical at year end for the Vietnamese government. Plans to accelerate public spending in 2024 further, including on transport and other public infrastructure, is supportive of 2024 GDP growth of over 6%.

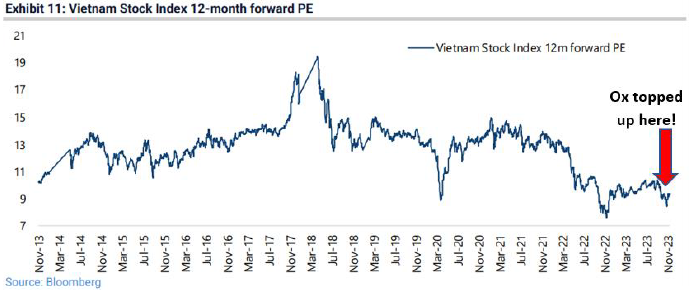

The Vietnam Stock Index trades on an attractive 12-month forward P/E below 10x

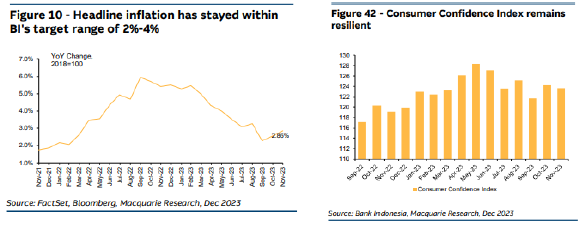

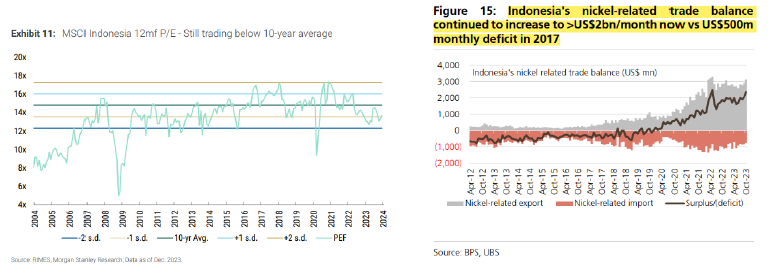

–Indonesia (the Komodo Dragon) Beneficiary of the EV boom! As the world’s fourth-most populous country, with a vast population (~280mn), Indonesia’s growing economy provides ample room for sector development, supporting still low incomes relative to more developed Asian economies. Indonesia’s economic development is improving after decades of underperformance as rising energy demand and commodity prices have boosted the country exports, improving its current account balance and domestic growth. Indonesia is a key exporter of commodities, such as Nickel, and we expect this will benefit Indonesia’s terms of trade, fuelling investment growth for years to come.

–Room for rates cuts in 2H. Indonesia’s inflation rate remains under control at sub 3%. Rice inflation remains a worry given low incomes, but government subsidies has mitigated some concerns. Combined with a more stable currency and FX reserves, we expect its central bank can start to cut rates in 2H24.

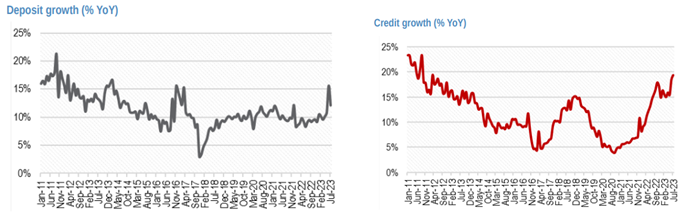

–Banking system strength. The bank of Indonesia expects loan growth 10-12% y/y in 2024, supporting consumption and domestic growth.

–Domestic consumption will remain resilient off the back of Indonesia’s upcoming elections and government led spending. Moreover, the government recently announced tax incentives to boost home purchases, direct cash payments for low-income households, and rice handout programs.

-EV battery maker of the world. Nickel production in the country makes up ~40% of global output. Mining companies extract nickel ore that resides on the surface and process it into battery grade nickel that is below current nickel prices. Indonesia is fast becoming the EV battery capital of the world. Moreover, trade surplus has improved, especially during President Jokowi’s second term in office, which has been boosted by down streaming minerals since 2020 and higher commodity prices. Moreover, since Jokowi took office, FDI has doubled.

–The outlook for 2024 remains robust as GDP growth is expected to be in a range of 4.7%-5.5% (Bank of Indonesia), with a fiscal deficit of <2.3% of GDP.

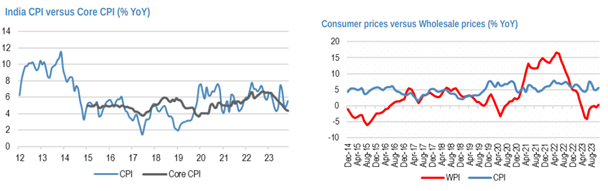

India (Tiger): Giant economy beginning to fulfill its potential. The economy in India has been going though economic reforms over the last decade and infrastructure investment and corporate incentives have underpinned the rise of its manufacturing sector, enabling growth in exports. India has a vast population with over 1.4bn people, but income levels are low. However, the economy is expected to see the largest growth in its middle-class cohort globally on the back years of economic reforms, driving domestic consumption. Economic reforms and political stability have reduced the risks of investing in India, and it remains predominantly a domestically focused economy that is well insulated from adverse global events.

–Rate hikes have paused as inflation has softened.

–Credit has been growing strongly as the combination of FDI and exports are driving growth in the banking sector credit.

–Stable political environment boost investor confidence. Election of the prime minister are set to take place in the first of 2024. Modi is the current prime minister of India and consensus expects Modi to winthe national election. Furthermore, the BJP has won three recent state elections and with the probability of the BJP retaining power and having more than 300 seats in congress. The political stability should spur increased government spending on infrastructure projects and capital investment.

–Capex cycle uptick. Post elections, assuming no political shifts, the expectation is the country is on the cusp of another investment cycle, including the power, railways and industrial capex.

-Strong GDP growth outlook, with growth expected to be at least 6.5% in FY24.

-The market remains expensive relative to other EMs on a forward multiple basis.

Top down + bottom-up analysis drives positioning

Our risk management framework at Ox Capital relies on both quantitative and fundamental, bottom-up analysis along with our experience to deliver actionable, alpha generating ideas.

The MOAT (Macro Overlay Aggregate Tracker): Our propriety quantitative model is pointing to a promising environment for EM growth in 2024 as inflation in many markets is stable to declining. We note:

- Overall credit withdrawal in the United States has slowed the economy and lowered inflation

- Many parts of emerging markets continue to grow rapidly with minimal inflationary pressure

- Of note, Brazil’s inflation rate has fallen from its peak of ~12% to low single digits and continues to trend lower.

Finally, China has entered a fiscal loosening cycle, which will fuel growth through credit expansion. Notably the PSL has restarted which should assist in improving confidence and boost economic growth.

Fund positioning: A bottom-up approach is vital when hunting for alpha. Ox Capital is overweight China, Brazil, Vietnam, and Indonesia. We look for businesses that have resilient and sustainable long-term growth in a volatile environment.

At Ox Capital, across EMs, we look for companies that meet the “QGV” test:

That is, quality companies with a strong, sustainable long-term growth outlook at inexpensive, attractive valuations. For a stock to make it in our portfolio, there is a high bar to clear. We need to be comfortable and confident on the political landscape, macro environment, industry dynamics, company competitiveness, catalysts, and ESG considerations.

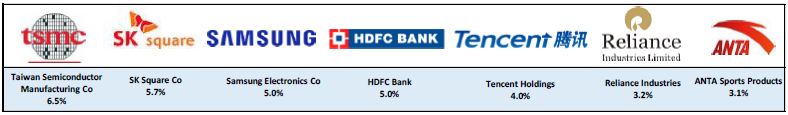

As seen in the image below, our top holdings are leaders in Emerging Market economies that exhibit long-term sustainable growth outlooks and are trading at discounted valuations. For example, Anta Sports, (ticker HK 2020), sits at 3% weighting in the OX Dynamic EM Fund, vs. the Benchmark of 0.2%, as of December 31, 2023. Anta is a leading quality multi-brand sportswear company in China. Noticeably, it has overtaken competitors Nike and Adidas as the top sportswear brand in China. Leveraging the playbook of the luxury goods maker like LVMH, Anta is building a platform of multiple high-end brands. FILA alone will be a Rmb50 business in the next 2-3 years. Descente in skiwear where a ski jacket can cost over $1000. Longer term, it will further develop other premium brands and athletic apparel such as Arcteryx, Salomon, Wilson, and Descente Golf in China. Notably, the company is positioned to deliver double digit per annum growth as it gains and sustains market share, driving brand synergies through its portfolio. Despite this backdrop and outlook, the shares at 15x P/E vs Nike (Ticker: NKE US) which trades at almost double the valuation 28x P/E.

The Dynamic Process will win!

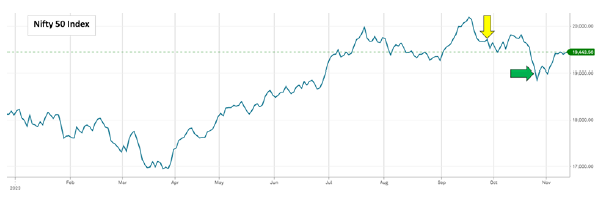

Ox Capital is positioned now to benefit by investing in quality companies with sustained growth at attractive valuations across EM countries. In a volatile environment such as the one we are in; it is important to try to hedge the volatility. Ox Capital has the capability to manage the portfolio dynamically that has reduced volatility in prior periods. For example, in late September, we shorted 8% of the portfolio against the Nifty 50 index (yellow arrow) and brought our net exposure in India to 3%. In late Oct (green arrow), the shorts were lifted and net exposure in India back to 11%. The shorts mitigated downside during the market sell off.

At Ox Capital, we are focussed on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.