a) Summary

The Ox Capital Dynamic Asia Fund (the ‘Fund’) promotes environmental and social characteristics and limits investments to companies that follow good governance practices. It does not however have its objective as a sustainable investment fund.

The Fund integrates ESG factors (including the consideration of Sustainability Risks) into the investment decision-making process. Based on the assessment of the Investment Manager, the Investment Manager will exclude companies considered to have serious ESG violations or facing acute Sustainability Risks (outlined in further detail below in the section titled “The ESG Policy”). The Investment Manager also applies a positive screen to determine investments to be made by the Fund when seeking sustainable investment opportunities.

For non-English translations of this summary please click here

b) No sustainable investment objective

The Fund promotes environmental or social characteristics but does not have its objective as sustainable investment. While it does not have sustainable investment as its objective, it will have a minimum proportion of 50% of sustainable investments with an environmental or social objective in their economic activities.

Notwithstanding that, the Investment Manager integrates the consideration of Sustainability Risks into the investment decision-making process, the Investment Manager does not consider the Principal Adverse Impacts of its investment decisions on Sustainability Factors in respect of the Fund. The Investment Manager has opted against doing so, primarily because such information that would be necessary to enable the Investment Manager to make this assessment is not yet available for all the markets or companies in which the Fund may invest.

The Fund does not expect to make any Sustainable Investments however the Fund does consider some Sustainability Risks as set out below.

For the purpose of the Taxonomy Regulation, the Fund does not presently intend to be invested in investments that consider the EU criteria for environmentally sustainable economic activities. Therefore, 0% of the Fund’s investments will be invested in economic activities that qualify as environmentally sustainable under the Taxonomy Regulation.

The “do no significant harm” principle applies only to those investments underlying the Fund that consider the EU criteria for environmentally sustainable economic activities. The investments underlying the remaining portion of the Fund do not consider the EU criteria for environmentally sustainable economic activities.

c) Environmental or Social (“E/S”) characteristics of the financial product

The Fund promotes a range of environmental and social characteristics through some of the direct and indirect investments it makes. The Fund excludes companies that have serious environmental, social or governance violations. The Fund applies a screen that excludes companies that derive any revenue from the manufacturing of tobacco or controversial weapons. The Fund also applies a positive screen that assesses the investee companies credentials in this area. The Fund favours companies that are on a positive ESG trajectory.

Risks and factors considered by the Investment Manager include but are not limited to:

- Environmental factors such as pollution and contamination, land degradation, water use and water scarcity risks, carbon intensity and energy transition; and physical climate change risks;

- Social factors include respect for the rights of indigenous peoples, workforce diversity and the fair and equitable treatment of employees and stakeholders; development of deprived areas and the prevention of modern slavery or the use of child labour and positive engagement with and support of local communities; and

- Governance factors whereby the Investment Manager will seek to invest in companies that can demonstrate best practice in (i) corporate governance and risk management; (ii) financial governance, reporting and transparency; (iii) ESG implementation; (iv) board representation and diversity; (v) anti-money laundering; and (vi) anti-bribery.

The Fund’s process favours sustainable companies and those that are on a positive ESG trajectory. It aims to invest in companies with good governance that are well positioned to benefit from global ESG trends. The Investment Manager sees this as a significant opportunity in Asian and emerging market economies. The Investment Manager looks for companies that are preparing to transition their businesses to more sustainable practices and those that are contributing to the transition to a more sustainable economy.

The approach to ESG integration is therefore focused on identifying the direction the investee company is taking towards sustainability and the governance structures it has in place. The Investment Manager assesses material ESG risks and engages with investee companies to mitigate those risks. The Investment Manager will manage the Fund in accordance with its environmental social and governance policy (the “ESG Policy”) on a continuous basis. The Investment Manager has fully integrated the ESG Policy into the overall investment process.

The Investment Manager will invest in companies which follow good governance practices in their respective domiciles. The Investment Manager utilises an ESG scorecard as part of its investment process which focuses on ESG due diligence on governance factors including board effectiveness, internal controls, company ownership structure and corporate strategy. The Fund also engages with all investee companies to receive reporting on good governance practices of the investee companies and will assess any information as part of their ESG scorecard and engagement processes.

The ESG Policy consists of five parts which are i) the corporate mission, ii) overall approach to responsible investment, iii) governance structure, iv) ESG integration and the due diligence process including research, the Investment Manager’s ESG scorecard (further described below), exclusions, and engagement with investee companies, and v) monitoring of engagement outcomes and escalation strategies (as further described below).

The ESG Policy is implemented by:

a) an initial screen of investible universe for exclusion of companies which derive revenue from the manufacturing of tobacco or controversial weapons;

b) an in-depth qualitative research and risk assessment on each investee company on how they manage ESG risks. This includes a detailed review of its board and management, processes, procedures, policies and prior ESG related incidents it may have been involved in that indicate management of these issues is insufficient;

c) the Investment Manager’s ESG score is then applied to each company and companies with a low ESG score are excluded from the potential investment universe for the Fund;

d) on an ongoing basis, monitoring the ESG risks of the stocks currently held in the Fund;

e) selling out of a stock if the ESG risks rise to an unacceptable level;

f) actively voting proxies and actively engaging with investee companies on ESG issues. For the avoidance of doubt, the Investment Manager will ensure that the Fund does not acquire any shares carrying voting rights which would enable it to exercise considerable influence over the management of the investee company in accordance with Regulation 74 of the Regulations; and

g) being transparent with fund investors.

d) Investment strategy

The Fund aims to provide an absolute return and the capital growth above the Benchmark Index over the long term. The Fund seeks to achieve its investment objective by investing in a portfolio of high-quality undervalued companies primarily in Asia ex Japan. The Fund is actively managed and the Benchmark Index is used for reference and performance comparison purposes only.

The Fund will typically hold 30 – 50 stocks that are diversified across countries, sectors and thematic exposures related to the immense demographic, economic and technological changes taking place in Asia. The investments will primarily comprise of companies within listed markets in Asia ex Japan however the Fund may also invest in companies listed outside this region who generate more than 50% of their annual sales revenue from the Asia ex Japan region. The Fund may also invest up to 10% in companies that are not traded or listed in a regulated market. The Fund is permitted to hold up to 25% of the Portfolio’s Net Asset Value in securities outside of the Asia ex-Japan region including Emerging Market Countries. For the avoidance of doubt, this allows for exposure to frontier and developed markets.

The investment universe is comprised of equity and equity-related securities (including ordinary shares, depository receipts, preference shares, partly paid shares, convertible securities, equity-linked notes, warrants and rights) as well as Derivatives such as foreign currency forwards, futures, options, swaps, and participation notes (which gain exposure to the Asia ex-Japan region, primarily to access the Indian market).

Please see section j) below for details on the due diligence process.

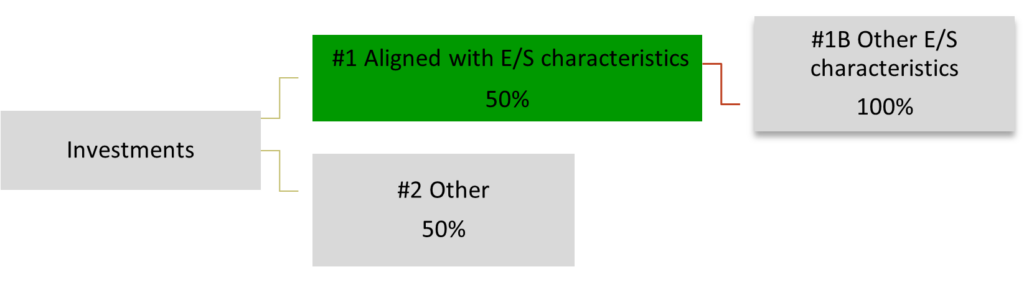

e) Proportion of investments used to meet E/S characteristics

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

The category #1 Aligned with E/S characteristics covers:

– The sub-category #1A Sustainable covers sustainable investments with environmental or social objectives.

– The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

f) Monitoring of E/S characteristics

Please see section b) and c) above for detail about the screens applied to the investment universe and section g below on the scoring methodology applied to the Fund. The Fund monitors the positive momentum indicator provided by its data provider for the portfolio and individual investee companies. The Fund also monitors the environmental and social characteristics as part of its ESG qualitative assessment of each company. Where there are specific points being monitored by the Analyst, as they improve, so can the ESG ranking of the investee company. These improvements are monitored through regular engagement as well as internal and external research resources, which allow for assessment of company progress on E/S fronts.

g) Methodologies

Please see section b) and c) above for details about the screens and risk management process for the Fund.

The binding elements of the investment strategy used to select investments to attain each of the environmental and social characteristics promoted by the Fund are:

- Initial Screen – negative screen: Investment Manager applies an initial screen of investible universe for exclusion of companies which derive any revenue from the manufacturing of tobacco or controversial weapons;

- Governance Screen: Investment Manager then reviews the company for its governance credentials. The Investment Manager utilises an ESG scorecard as part of its investment process which focuses on ESG due diligence on governance factors including board effectiveness, internal controls, company ownership structure and corporate strategy.

- Positive ESG Screen best in class: Once the Governance screen is applied; the Investment Manager applies a positive screen which looks at the best-in-class companies to be considered for inclusion to the portfolio on a sector basis for environmental and social characteristics. The Investment Manager scores the companies from an ESG risk perspective as noted above. Companies which receive a score of 1 will be automatically excluded from consideration by the Investment Manager. The Investment Manager then looks at the remainder of the scores and those companies scoring a 4 to 5 are upholding strong to best in class ESG practices and can be considered for best-in-class classification. Where the ESG score is 2 to 3, but there is evidence that the company is on a positive environmental and social trajectory, the Investment Manager will consider the company for investment, providing the company has an ESG development strategy which will allow them to perform more favourably in the future, or if there is room for company engagement to improve current approach to ESG adopted by the company.

- Active Management: Investment Manager will sell out of a stock if the ESG risks rise to an unacceptable level.

Please see section g) below for detail on the due diligence process.

With reference to other binding commitments such as those highlighted on paragraph f) “Monitoring of environmental and social characteristics” the fund collects data related to controversies or breach of Standards using: external research on the compliance of companies with global norms and conventions, including the UN Global Compact, the OECD Guidelines for Multinational Enterprises, ILO Tripartite Declaration of Principles, UN Draft Human Rights Norms for Business, UN Guiding Principles on Business and Human Rights, and other sector specific standards.

h) Data sources and processing

Data sources used by the Investment Manager include:

- External research on the compliance of companies with global norms and conventions, including the UN Global Compact, the OECD Guidelines for Multinational Enterprises, ILO Tripartite Declaration of Principles, UN Draft Human Rights Norms for Business, UN Guiding Principles on Business and Human Rights, and other sector specific standards.

- MSCI ESG Manager

- Company documents and audited Annual Reports and investee Company reporting

- Local news agencies and media outlets

- Broker research from various international research providers

Data quality

- Data quality can be ascertained by the quality of the auditors who have conducted reviews of the respective investee companies reports and accounting standards adopted

- Information from media outlets is treated with a degree of scepticism, the Fund uses other sources such as company contacts and other forms of research to triangulate and cross-check such information for accuracy

How the data is processed

- Data is processed by each Analyst to inform their view on the ESG standing of the investee company. This data allows for assessment of a variety of criteria, beyond what is formally reported by the company, to form a more wholistic view of the companies ESG standing

- Where a breach in a company’s ESG philosophy identified, the Fund will engage the investee company to understand their approach to remedying the breach and will adjust their investment in the company according to the degree with which they are satisfied by the company’s response to such controversy

i) Limitations to methodologies and data

Environmental and social data availability in emerging markets is limited in many cases, particularly data relating to emissions and human rights sustainability risk factors.

Data for other environmental and social factors such as water use, biodiversity impacts and waste recycling are not yet reported on by all investee companies in the emerging markets. In such cases, the Fund looks to consider the overall level of E/S impacts the industry with which the company sits within to form a view on the relative level of E/S impact the company might have.

Data constraint is one of the biggest challenges when it comes to providing sustainability related information to end-investors, especially in the case of principal adverse impacts of investment decisions. There are also limitations on sustainability and ESG-related data provided by market participants on comparability. These disclosures may develop and be subject to change due to ongoing improvements in the data provided to and obtained from financial market participants in the emerging markets to achieve the objectives of SFDR to make sustainability-related information available.

j) Due diligence

Please see section c above for details on the ESG Policy.

The Investment Manager undertakes an extensive ESG due diligence process on every company considered for investment. ESG companies are assessed on several factors including, inter alia:

- Board effectiveness;

- Severities of controversies under current management;

- ESG internal controls and policies around material ESG exposure;

- Company strategy considers ESG trends; and

- ESG momentum.

Each criterion is given a score out of 5 with 5 indicating good management of the risk and 1 indicating that the risk is not being managed. An overall internal ESG score is then calculated on an equal weight basis for the stock. Companies which receive a score of 1 will be automatically excluded from consideration by the Investment Manager. Companies with a score of 2 or 3 will be considered if the Investment Manager identifies the possibility that through company engagement the value of the security might increase or if the value of the security is sufficiently discounted considering the low ESG score. Companies which score a 4 or a 5 on the ESG Scorecard will be prioritised by the Investment Manager.

The Investment Manager also conducts due diligence on an ongoing basis. The Fund’s portfolio of investee companies and prospective investee companies is reviewed annually or on an as needs basis as company circumstances change in accordance with the above. Any material deviations in ESG scoring or any of the above factors is considered as part of the portfolio review process. The Investment Manager obtains this information from a variety of sources as mentioned in section h) and engages with investee companies regarding any relevant issued raised by the ongoing due diligence.

k) Engagement policies

The Investment Manager engages with investee companies and as part of that engagement, the Investment Manager monitors the commitments made by investee companies and progress made in respect of such commitments. If a company does not honour its commitment or if a company’s response to an engagement activity does not satisfy the Investment Manager’s concerns regarding ESG and other material risks, this will trigger an escalation process and the Investment Manager may take any of the following actions:

- Seek to collaborate with other investors on this issue;

- Reduce the internal valuation of its investment; and

- Either reduce its position or exit its position in respect of the company.

i) Designated reference benchmark

A reference benchmark has not been designated for the purposes of attaining the environmental or social characteristics promoted by the Fund.